India posts 7.8% GDP growth in Q1 FY2025-26, the fastest in five quarters, driven by robust domestic demand.

Trump’s 50% tariffs on Indian exports threaten key sectors like textiles, leather, and engineering goods, risking job losses.

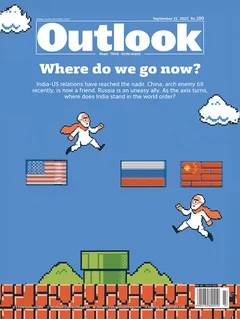

India pursues strategic autonomy, diversifying trade with EU, UK, ASEAN, and boosting self-reliant manufacturing to offset US pressures.

According to the latest estimates from the Union Ministry of Statistics and Programme Implementation, India’s economy surged ahead with a remarkable 7.8 per cent growth in the April-June quarter of FY2025-26, its fastest expansion in five quarters. This figure not only signals robust economic momentum, but also exceeded market expectations, which had pegged growth between 6.5 per cent and 7 per cent. The performance stands out all the more given the backdrop of intensifying global uncertainties and geopolitical headwinds.

The National Statistics Office (NSO) attributes this resilience to strong domestic demand and stable macroeconomic fundamentals, a view echoed by the finance ministry and the Reserve Bank of India in their recent assessments. Reinforcing investor confidence, Standard and Poor (S&P) Global Ratings upgraded India’s sovereign rating in August, marking its first such revision in 18 years. The agency cited India’s sound policy framework and enduring economic stability as key drivers behind the upgrade.

Geopolitical Headwinds

Yet, the road ahead is fraught with challenges. US President Donald Trump’s dramatic tariff escalation—whereby he has imposed a punitive 25 per cent tariff on Indian goods over continued purchases of Russian oil, on top of an earlier 25 per cent duty, raising total export tariffs to 50 per cent for key sectors such as textiles, leather, engineering goods, and chemicals—threatens to shave 0.2-0.4 percentage points off India’s GDP growth, potentially dragging it below the 6 per cent threshold.

Following a pointed remark on social media characterising India as a ‘dead economy’, Trump intensified his criticism of the bilateral trade relationship, describing it as a “one-sided disaster”. He accused India of flooding the US market with “massive amounts of goods” while offering minimal reciprocal imports. Further, he condemned India’s continued reliance on Russian oil and defense equipment, asserting that purchases from American suppliers remain disproportionately low.

The tariffs, among the steepest imposed by the current US administration, have strained bilateral ties between two democracies that had evolved into strategic partners over recent decades. Nearly 55 per cent of Indian exports to the US—valued at approximately $48 billion—now face a competitive disadvantage compared to goods from Vietnam, China, and Bangladesh.

As exports falter, cracks are beginning to show in India’s resilient growth narrative. In just three trading sessions, foreign investors have pulled $2.4 billion from Indian equities, signalling growing apprehension about the country’s external trade outlook. At the macro level, the widening trade deficit is stoking concerns over economic stability, while at the ground level, even as industries such as pharmaceuticals, smartphones, and oil and gas remain exempt, the impact is most acute in labour-intensive industries, raising fears of significant job losses despite their modest share in India’s $4 trillion economy.

New Delhi is increasingly compelled to pursue a foreign policy rooted in strategic autonomy and diversified engagement.

Manufacturers, grappling with eroding cost competitiveness, are sounding the alarm. In its latest annual report, Reliance Industries warned that the ongoing geopolitical and tariff-related uncertainties could disrupt trade flows and destabilise the delicate demand-supply equilibrium.

The situation is particularly dire for exporters who now face steep barriers in the US market, India’s largest trading partner. Global Trade Research Initiative (GTRI) warns that if corrective measures are not swiftly implemented, India’s exports to the US could plummet by 43 per cent, falling to $49.6 billion in FY26. This would affect nearly 66 per cent of the country’s $86.5 billion export basket. If the punitive tariffs remain in place throughout the fiscal year, the direct hit to GDP could range between 0.5 per cent and 1 per cent, potentially undermining the broader growth momentum that India has worked hard to sustain.

Trade negotiations between India and the US have hit an impasse after five rounds of dialogue, with key sticking points emerging around the opening of India’s farm and dairy sectors and its continued imports of Russian oil. The government is pushing to resolve the 25 per cent additional US tariffs before a trade deal. Efforts are underway to reschedule the talks soon. Acknowledging that “a little bit” of geopolitical turbulence had overshadowed trade deliberations, Commerce and Industry Minister Piyush Goyal recently affirmed that discussions with Washington continue, expressing optimism that a bilateral trade agreement could be finalised by November.

The economic strain is already manifesting in currency markets. On September 1, the Indian rupee plunged to a record low of Rs 88.33 against the US dollar, breaching its previous lifetime low. “Unless we see some improvement in trade relations between India and the US, we cannot expect any stability in the rupee,” noted V. R. C. Reddy, treasury head at the Karur Vysya Bank.

Strategic Defiance and Domestic Realignment

In his first public response to Trump’s sweeping 50 per cent tariff on Indian goods, Prime Minister Narendra Modi adopted a resolute stance, declaring that India would not compromise the interests of its farmers, dairy producers, or fishermen. “For us, our farmers’ welfare is supreme,” Modi affirmed at a New Delhi event. “India will never compromise on the wellbeing of its farmers, dairy sector, and fishermen. And I know personally I will have to pay a heavy price for it.” In a bid to boost indigenous manufacturing, reduce import dependency, and rally citizens around the vision of a self-reliant India, Modi is urging citizens to embrace locally-made products. “Say with pride, this is Swadeshi,” he repeated emphatically. “One mantra—Vocal for Local; one path—Atmanirbhar Bharat; one goal—Developed India.” His remarks come amid mounting criticism from the Congress Party, which has accused the government of failing to respond decisively to the steep US tariffs.

The most consequential response has come in the energy domain, where India has reaffirmed its strategic autonomy, underscoring that its energy choices will be governed solely by national interest.

Perhaps the most consequential response has come in the energy domain, where India has emphatically reaffirmed its strategic autonomy, underscoring that its energy choices will be governed solely by national interest. Crude imports from Russia have surged from under 1 per cent of India’s total supply before the Ukraine conflict to nearly 40 per cent today, as Indian refiners capitalise on discounted rates left by Western buyers. It has been widely pointed out that while India faces steep tariffs, the US has not imposed similar measures on China, despite it being the largest buyer of Russian oil. It is likely because China’s dominance in rare earth minerals affords it strategic leverage that India currently lacks, deepening the asymmetry in trade treatment. On September 5, Finance Minister Nirmala Sitharaman made it clear that India will continue purchasing Russian oil, guided solely by national interest. “Where we buy our oil from, especially it being a big-ticket foreign exchange item, is a call we will take based on what suits us best,” Sitharaman stated. “So, we will undoubtedly be buying Russian oil.”

To cushion vulnerable industries, Sitharaman has pledged comprehensive support to sectors most affected by the tariffs. Recent reductions in the Goods and Services Tax (GST) rates may offer some relief to the Indian economy, partially neutralising the tariff hit. The GST Council has approved a streamlined two-tier rate structure, introducing lower tax rates for several essential products, set to take effect from September 22. The rate rationalisation is projected to enhance export competitiveness, spur consumption, and reinforce the broader economic recovery. However, caution remains. Jahangir Aziz, Head of Emerging Market Economics Research at J P Morgan, warned against conflating temporary trade shocks with permanent tax reforms, “If you are going to say that a GST cut is a response to it, then you shouldn’t really use permanent cuts to do something that we think is temporary.”

Modi’s SCO Presence as Calculated Diplomacy

American tariffs have inadvertently positioned India and China on the same side of trade pressure, forging an unlikely convergence of interests. Against this backdrop, the Shanghai Cooperation Organisation (SCO) Summit in Tianjin, China, offered a moment of pragmatic diplomacy, opening the door to a cautious thaw in India—China relations.

Flanked by the host President Xi Jinping and President Vladimir Putin, Modi’s appearance at Tianjin was less a pivot and more a calculated manoeuvre in response to the deepening dissonance between New Delhi and Washington. The moment was hailed as a masterstroke of statesmanship and a symbolic rebuke to US trade aggression.

India’s past participation in SCO summits has been marked by pointed critiques of China and Pakistan, particularly on issues such as cross-border terrorism and the strategic risks posed by connectivity initiatives. New Delhi’s 2023 SCO presidency was reduced to a brief virtual engagement, underscoring the strain in Sino-Indian relations following the Galwan clashes. In 2024, Modi opted to skip the summit in Kazakhstan altogether, delegating External Affairs Minister S. Jaishankar to represent India.

From a posture once firmly anchored in western alliances, like the QUAD and leadership roles in the G20, Modi’s personal engagement at the SCO where he described India and China as “partners, not rivals” signalled a nuanced tactical recalibration, one aimed at diversifying its diplomatic channels without compromising its strategic autonomy.

This emerging détente is already producing tangible outcomes—the resumption of the Mansarovar Yatra, easing of visa restrictions, and plans to resume direct air connectivity between New Delhi and Beijing later this year. More significantly, shipments of light rare earths (LRE) have begun clearing customs, indicating a gradual easing of supply chain disruptions and a broader economic re-engagement. In parallel, New Delhi is exploring the relaxation of foreign investment norms for Chinese investors in non-strategic sectors.

Trump’s reaction to the summit was swift and pointed. In a Truth Social post on September 5, he shared an image of Modi, Putin, and Xi standing together, remarking: “Looks like we’ve lost India and Russia to deepest, darkest China. May they have a long and prosperous future together!” The comment, laced with sarcasm and strategic concern, reflects Washington’s unease over the strengthening trilateral optics showcased at Tianjin.

Despite recent diplomatic overtures, experts caution that India’s trade prospects with China remain constrained due to overlapping export profiles. While bilateral trade between the two nations surpassed $100 billion for the third consecutive year, reaching $118.4 billion in FY24, the imbalance is glaring. India’s exports to China fell by 14.5 per cent, while imports rose by 11.5 per cent, widening the trade deficit to a staggering $99.2 billion. The challenge for New Delhi is to ensure that its engagement with Beijing moves beyond reactive diplomacy and evolves into a deliberate recalibration of foreign policy priorities. The US remains India’s top export destination, with shipments reaching $33.53 billion during April-July FY25, compared to just $5.76 billion to China.

Despite recent diplomatic overtures, experts caution that India’s trade prospects with China remain constrained due to overlapping export profiles.

Even though India’s relationship with China remains constrained not the least because of trade disparities, but by unresolved border disputes and geopolitical mistrust, the American partnership has already revealed its own fragilities.

Shortly after his earlier post, Trump sought to downplay tensions, by describing India and the US as having a “special relationship” and assuring that the two nations “just have moments on occasion”. Yet, such conciliatory remarks stand in stark contrast to his administration’s erratic policy signals, particularly the conditioning of tariff relief on India’s stance toward Russian oil imports.

Singling out India in the tariff escalation, at the same time positioning Pakistan as an alternative trade partner for oil exploration, coupled with Trump’s vacillating statements, have cast doubt on the reliability of the US as a strategic partner, at least under the current US dispensation. His advisers, including Peter Navarro, have openly called for punitive measures, while threatening to restrict H-1B and student visas, both heavily utilised by Indian nationals. These actions—perceived by many in India as vindictive—risk souring the relationship beyond trade and into the realm of people-to-people ties.

Mitigating Tariff Fallout Through Diversified Trade Channels

In this context, New Delhi is increasingly compelled to pursue a foreign policy rooted in strategic autonomy and diversified engagement. Negotiations with the European Union (EU) for an early-harvest deal are being fast-tracked, with both sides aiming to finalise a comprehensive Free Trade Agreement (FTA) by the end of 2025. The EU, now India’s largest trading partner, accounts for 12.2 per cent of its total trade, surpassing both the US and China. India is seeking a three-year moratorium on the EU’s Carbon Border Adjustment Mechanism (CBAM) to shield its MSMEs, while the EU is pushing for greater access to its premium exports such as whisky, wine, and automobiles.

The first “new generation” agreement with a major economy, the India-UK FTA includes deep tariff cuts, even in traditionally sensitive sectors like automobiles. The deal also introduces binding commitments in labour and environmental standards, signalling a structural transformation in India’s approach to trade governance. With 99 per cent of Indian exports to Britain set to benefit from zero duties and reciprocal reductions on 90 per cent of UK tariff lines, the agreement is expected to serve as a blueprint for future FTAs, including the one with the EU.

Parallel efforts with ASEAN are also underway. A review of the existing trade pact is scheduled for October in Indonesia, aimed at correcting the imbalance that has seen imports triple in the last decade.

India’s recent FTAs with the UK, UAE, and Australia offer a critical buffer. Collectively, India’s FTA partners have the capacity to absorb redirected trade flows, mitigating the impact of sudden shocks. Moreover, India holds dominant market share in several categories, making substitution difficult for American buyers. Nearly one-third of India’s trade with the US is already shielded, and exemptions in sectors like smartphones and pharmaceuticals further reduce exposure.

Yet, to truly capitalise on these buffers, India must pursue bold reforms. Improving the ease and cost of doing business, phasing out industrial cross-subsidies in power tariffs, and offering targeted credit support to sectors most exposed to US tariffs are essential. Simultaneously, India must invest in emerging industries such as artificial intelligence, green energy, and advanced manufacturing. A coordinated effort between industry, academia, and government is needed to address talent shortages and build high-quality growth clusters. In semiconductors, batteries, and advanced materials, building resilient domestic supply chains will be key to reducing import dependence. A sovereign technology fund can play a catalytic role by backing high-risk, high-reward R&D with clear paths to commercialisation. Despite being the world’s fifth-largest economy, India still trails behind over 100 countries in per capita GDP, a more telling measure of inclusive progress. With the right mix of foresight, reform, and innovation, India can transform external pressures into long-term opportunity and chart a course toward sustainable, inclusive growth.

(Views expressed are personal)

MORE FROM THIS ISSUE

Vaishali Basu Sharma is a security and economic affairs analyst.