Summary of this article

The bill modernises insurance laws, encourages foreign investment, and enables new products and distribution models to expand coverage and industry growth.

Insurers and executives view higher FDI and regulatory flexibility as drivers of innovation, efficiency, and deeper market penetration.

However, core consumer concerns - mis-selling, unresolved grievances, ethical lapses, and delayed claims, remain inadequately addressed, threatening customer trust.

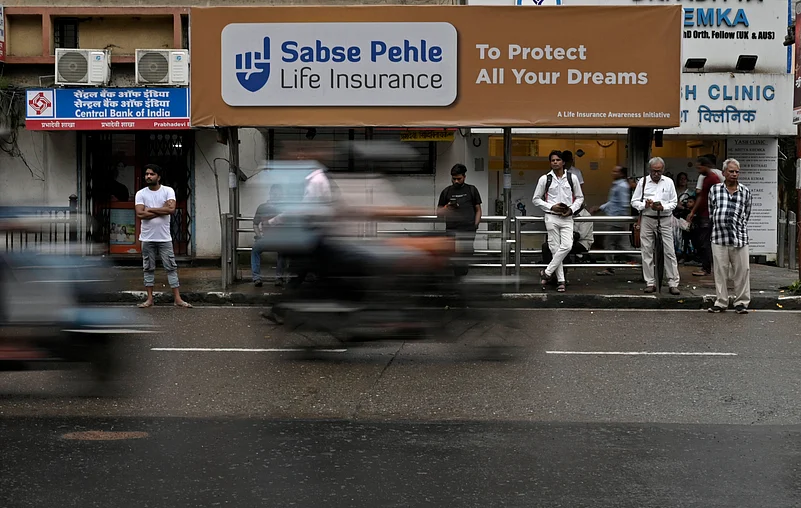

When the Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill was introduced in Parliament, it was presented as a reform for the insurance sector of India.

But beneath the bill which favours inclusion, protection and introduction of new entities in the industry lies a more complicated reality.

Firstly, What Is The Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill?

The Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill aims at updating the existing insurance law framework. The bill seeks to expand insurance coverage and improve regulatory flexibility in the sector and proposes changes to rules governing insurers, intermediaries, and distribution channels to support wider access to insurance products.

Key provisions in the bill include allowing greater participation of private and foreign entities in insurance companies, subject to regulatory oversight. The bill also aims to simplify licensing norms, enable composite licences for insurers, and permit new capital-raising options. It introduces provisions to support digital distribution and alternative insurance products, including micro-insurance and parametric insurance.

In addition, the bill seeks to strengthen the role of the Insurance Regulatory and Development Authority of India (IRDAI) by granting it more powers to frame regulations.

How It Will Affect The Insurance Sector And Companies?

The increase in the foreign direct investment (FDI) limit is widely viewed as a positive development for insurance companies as corporate entities. Higher foreign ownership is expected to bring in fresh capital, advanced technology, global expertise, and greater product innovation. Well-capitalised insurers are better positioned to scale up operations, absorb losses over longer periods, and invest in digital distribution and sophisticated underwriting tools. The market reaction reflected this optimism: on December 17, shares of some of the country’s largest insurance companies were trading in the green after the Lok Sabha approved the bill.

Industry leaders believe the move will also help expand insurance coverage and bring more individuals under the protection of the insurance safety net. Alok Kumar Agarwal, MD & CEO of Zurich Kotak General Insurance, highlighted that allowing 100 percent FDI would attract deeper global participation and expertise. “By enabling 100 percent FDI, the sector will witness increased global expertise and deeper participation, while introducing modern intermediaries like Managing General Agents will drive operational efficiency, specialised underwriting, and deeper penetration into underserved geographies,” Agarwal said.

From a consumer perspective, the reforms are expected to translate into more advanced offerings and improved service standards. Rakesh Jain, CEO of IndusInd General Insurance, said customers would benefit from more sophisticated products and faster, more efficient claims processes. Echoing this view, Parag Raja, MD & CEO of Bharti AXA Life Insurance, said: “For customers, it means more options, better protection, and an insurance industry better equipped to serve the evolving needs of a growing and diverse nation.”

The bill’s emphasis on strengthening regulatory oversight and enhancing customer protection has also been welcomed by industry executives. Mayank Bathwal, CEO of Aditya Birla Health Insurance, noted that these measures would help build a stronger and more transparent sector. “Stronger regulatory oversight and a sharper focus on policyholder protection together create the conditions for a more resilient, transparent, and innovation-led industry,” Bathwal said.

Customers Left In The Dark

Pending claims, questionable ethical practices, and an ineffective grievance redressal mechanism remain some of the biggest pain points plaguing India’s insurance sector. On a daily basis, thousands of policyholders take to social media platforms, consumer forums, and helplines to raise complaints related to claim rejections, delayed settlements, misleading policy terms, and agent misconduct. More often than not, these grievances are met with templated responses asking customers to shift the conversation to direct messages, or they result in hours spent navigating call centres where the redressal process remains sluggish and inconclusive.

While the new bill seeks to strengthen certain regulatory aspects of the insurance ecosystem, it fails to address these core structural issues. Instead, the proposed increase in the foreign direct investment (FDI) limit risks exacerbating existing problems, particularly on the customer protection and ethical conduct fronts. Greater capital inflows may encourage expansion and competition, but without parallel reforms in accountability and oversight, the benefits are unlikely to trickle down to policyholders.

A former chief executive of a public sector insurance company, speaking on condition of anonymity, pointed out that one of the most pressing challenges in the insurance space is the lack of a robust and time-bound customer grievance redressal mechanism and the bill ignores that. “Customers frequently complain that their issues are left unresolved for months. In many cases, the complexity of processes only adds to their distress. As more insurance companies enter the underpenetrated Indian market, their primary focus will be on scaling business and maximising profits. Customer redressal, unfortunately, continues to be treated as a secondary concern,” the executive said.

Another deeply entrenched issue is the rampant mis-selling of insurance products, which has emerged as a major trust deficit for the sector. Insurance policies are often sold as investment instruments with assured or inflated returns, while critical details such as lock-in periods, exclusions, charges, and claim conditions are either downplayed or not disclosed at all. In many cases, agents and intermediaries push unsuitable products to customers, particularly senior citizens, first-time buyers, and those in semi-urban and rural areas, to meet aggressive sales targets and earn higher commissions.

Mis-selling frequently comes to light only at the time of claim or policy maturity, when customers realise that the coverage does not meet their expectations or financial needs. This not only leads to disputes and grievances but also erodes long-term trust in insurance as a risk-mitigation tool. Despite regulatory guidelines issued by the Insurance Regulatory and Development Authority of India (IRDAI), enforcement remains inconsistent, and penalties often fail to act as a meaningful deterrent.