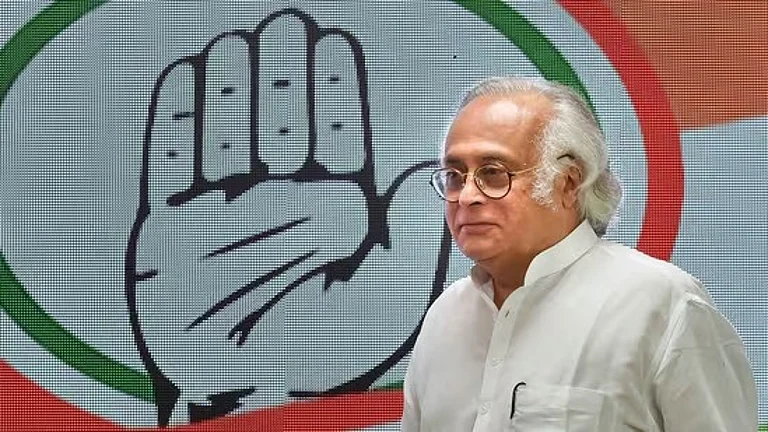

The Income Tax department stated in the Supreme Court on Monday that it will not use any 'coercive action' against the Congress party in relation to the tax payment notices amounting to around Rs 3,500 crore, considering the upcoming Lok Sabha elections.

The Supreme Court bench posted the Congress' plea against the tax demand notices for July.

The statement of Solicitor General Tushar Mehta, who is representing the I-T department, was recorded by a panel of judges consisting of Justice B V Nagarathna and Justice Augustine George Masih.

Mehta assured that no hasty action will be taken in the current situation until the matter is finally resolved.

At the outset, Mehta said, "I want to make a statement in this matter. The Congress is a political party and since elections are going on, we are not going to take any coercive action against the party."

He reportedly said, the department will not express any opinion on the validity of the issue, and it is advised to 'keep all rights and arguments unresolved'.

Senior advocate Abhishek Singhvi, appearing for the Congress appreciated the gesture, terming it "gracious", and said all demand notices were issued in March and before for different years totalling approximately Rs 3,500 crore.

The Congress party announced on Sunday that it has recently received new notifications from the Income Tax department, which have resulted in a tax bill of Rs 1,745 crore for the assessment years 2014-15 to 2016-17.

The total amount demanded from the party by the Income Tax department now stands at Rs 3,567 crore, including this latest notice.

On Friday the party said it received notices from the I-T department, asking it to pay around Rs 1,823 crore. The tax authorities have already withdrawn Rs 135 crore from the party's accounts for a tax demand relating to previous years.