CII Partnership Summit resulted in 613 memoranda of understanding, with companies committing an estimated Rs13.25 lakh crore in investments

Chandrababu Naidu government present these developments as evidence of Andhra Pradesh’s renewed economic momentum

Critics argue that the model prioritises headline-grabbing private capital over long-term structural needs, institutional safeguards, and equitable growth

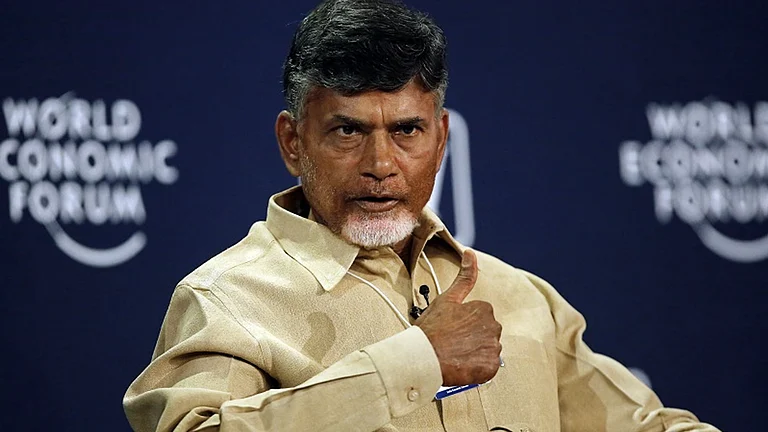

Chandrababu Naidu, long known for his assertive investment-driven governance model, appears to be pushing harder than ever after returning to power following a politically bruising five-year hiatus. Yet, even as his administration releases an expanding roster of big-ticket investment proposals, a parallel churn of controversies has begun to surface. With the opposition alleging procedural lapses and favouritism, and competition intensifying among southern states—particularly Tamil Nadu and Karnataka—the debate over how Andhra Pradesh is securing these projects and at what cost has taken centre stage in the state’s political discourse.

Surge in investment proposals

According to Andhra Pradesh government officials, the recently concluded CII Partnership Summit resulted in 613 memoranda of understanding, with companies committing an estimated Rs13.25 lakh crore in investments. This follows Google’s headline-making announcement of a Rs15-billion hyperscale AI data centre in Visakhapatnam. Soon after, South Korean footwear major Hwaseung confirmed plans to set up a non-leather footwear manufacturing unit in Kuppam, Chittoor district, with an investment of about Rs 900 crore.However, the political reverberations have been as significant as the investment claims themselves. Supporters of the Chandrababu Naidu government present these developments as evidence of Andhra Pradesh’s renewed economic momentum. But the announcements have also triggered a widening arc of political contestation.

Within the state, the NDA—of which the TDP is a key component—has used the investment narrative to target the opposition YSRCP. Outside Andhra Pradesh, the BJP in Tamil Nadu has seized on these numbers to portray the DMK government as falling behind in the regional investment race. The competition has extended to Karnataka as well. Google’s choice of Visakhapatnam, in particular, set off speculative commentary that Bengaluru had lost the project due to persistent infrastructure bottlenecks. Taken together, these claims reflect a broader political dynamic: the scramble for investments in the South is no longer just an economic pursuit but a rhetorical battleground, with NDA-ruled Andhra Pradesh positioning itself against opposition-governed Tamil Nadu and Karnataka to claim the mantle of the region’s most attractive investment destination.

Fresh investments or Rebranding?

The opposition’s pushback reflects a deeper contest over the state’s development narrative. While the government has framed the surge in investment announcements as evidence of renewed investor confidence, critics argue that the model prioritises headline-grabbing private capital over long-term structural needs, institutional safeguards, and equitable growth.

The YSRCP has used the moment to mount a pointed counter-narrative. Karthik Yellapragada, the party’s national spokesperson, contends that much of what the government now showcases as fresh investment inflows is essentially a rebranding of projects set in motion during the previous administration. He notes that at the 2023 Global Investors Summit alone, the YSRCP government had signed 352 MoUs worth ₹13 lakh crore, with a projected 6 lakh direct and indirect jobs, and that at least 39 companies began operations that same year. He also highlights the construction of four ports under the Jagan Mohan Reddy government.

According to him, the emerging pattern under the TDP-led government signals a shift from attracting private investment to subsidising it. “Instead of companies investing in the state, the state appears to be investing for the benefit of corporates,” he alleges. The accusations point to a broader concern: that land allocations and incentives may be structured in a way that disproportionately favours select investors, raising questions about transparency and governance.He alleged that a company with just one crore in capital, which claims to invest 22976 crores, was given high-value 150 acres of land at just 10 Lakhs/ acre. There were even instances of giving away land worth 50 crores per acre for just 1 paisa per acre, damaging the state's exchequer.

Earlier, the Chandrababu Naidu government drew criticism for allotting 1,200 acres of land to a company linked to film producer T.G. Viswaprasad. Opposition parties and trade unions alleged that the allotment was made at a significantly subsidised rate because of Viswaprasad’s proximity to Deputy Chief Minister Pawan Kalyan. According to reports, the land was allotted at Rs15–16 lakh per acre, far below the estimated market value of around Rs 80 lakh per acre.Viswaprasad’s firm, People Tech Enterprises, had signed an MoU with the Andhra Pradesh government to develop what is being billed as India’s first private Electric Vehicle Park—the Orvakal Mobility Valley—in Kurnool. Critics argue that while the project has been showcased as a major industrial initiative, the steep discount on land raises larger questions about transparency, valuation norms and whether the state is overextending itself to court select investors.

Taken together, the YSRCP’s critique seeks to flip the government’s investment narrative on its head: not only challenging the originality of the current administration’s achievements but also suggesting that the present model, despite its high-voltage messaging, may compromise fiscal prudence, regulatory norms and the state’s bargaining power with private capital.

More Land for Amaravati

The Chandrababu Naidu government has sought to dispel what it calls the confusion created by the previous Y.S. Jagan Mohan Reddy administration over Amaravati’s status as the permanent capital. But its renewed push to accelerate the capital project has revived contentious debates over land acquisition. Last week, the state announced its decision to acquire nearly 17,000 acres for the second phase of land pooling—on top of the 34,000 acres already taken in 2015—to develop Amaravati as a “world-class capital.

”The capital project had been halted during Jagan Mohan Reddy’s tenure, when he abandoned the Amaravati model and proposed a three-capital framework. Naidu’s return to power reversed that decision, and the revival gained further momentum when Prime Minister Narendra Modi launched projects worth Rs 58,000 crore in the state, including the resumption of construction on the greenfield capital.

However, opposition parties argue that expanding land acquisition without utilising land already pooled raises serious concerns about whose interests are being served. They allege that the new push will disproportionately benefit real estate interests. PCC president Y.S. Sharmila criticised the proposed acquisition of another 20,000 acres in Phase 2 as “unjust” and “coercive” towards farmers.Left parties have been equally sharp in their criticism. “In the name of development, thousands of acres of land are being acquired, which is against the interest of the common man,” said CPI(M) state secretary K. Srinivasa Rao. Questioning the government’s claims around marquee investments, he pointed to the state’s earlier allotment of 400 acres to the Adani Group for a data centre. “Now they are giving 500 acres to Google. But Adani and Google have entered into a joint venture. People are being misled, and farmers’ lands are being taken indiscriminately,” he alleged.

Naidu's Development Model

Naidu’s governance model has historically been anchored in aggressive investment promotion. During his earlier tenure in undivided Andhra Pradesh (1995–2004), he earned both acclaim and criticism for positioning himself as a corporate-friendly administrator—the “CEO of Andhra Pradesh.” While that period saw Hyderabad emerge as a major IT hub, severe agrarian distress contributed to his defeat in 2004.In the truncated post-bifurcation Andhra Pradesh, his government is once again attempting to revive that developmental template—this time to “regain the lost glory” of the undivided state, but without Hyderabad’s economic engine.

Despite mounting criticism, the TDP remains firm in its defence. “For us, governance is for the betterment of the people, and we do not view investment through political lenses,” said TDP spokesperson Jyotsna Thirunagari. She insisted that the current investment announcements reflect Naidu’s credibility among investors. “It is rubbish to say these investments are merely a continuation of the previous government’s MoUs. Even if some older proposals are moving forward now, that only shows this government’s commitment. We respect investors and continuously engage with every company that wants to operate in AP.

"As Andhra Pradesh doubles down on capital construction and aggressively courts private capital, the political battle lines over land, transparency, and governance models are sharpening. How the government responds to questions raised by opposition parties, farmers’ groups, and civil society organisations will play a crucial role in determining whether this renewed developmental push avoids the pitfalls that once cost Naidu his political foothold.