They’re cool, look good, are feature-packed, and priced incredibly low. After grabbing an instant following in rural India, desi mobile handset brands—names unheard of elsewhere—are seeking to capture a slice of the lucrative urban and semi-urban markets of India’s ever-growing telecom pie. The big global players have reason to be worried: this is one MNC onslaught that is being matched (at unbelievable price points and with unique, if not quirky, features) by Indian wannabes.

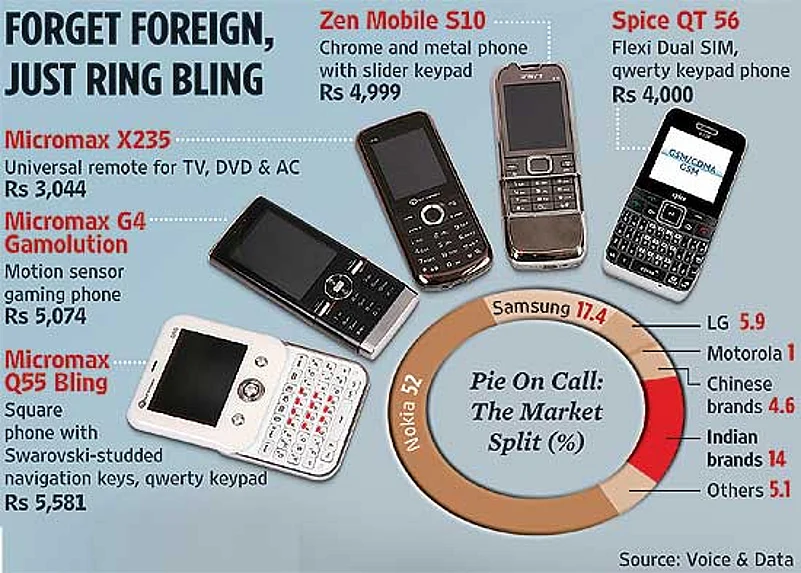

In the past 18 months, over 10 new homegrown brands—most of them led by first-generation entrepreneurs—have garnered a market share of about 14 per cent, up from just 4 per cent in 2008-09. Micromax, the leader among Indian brands, claims sales of over 10 lakh handsets every month. Another player, Spice, from the B.K. Modi stable, sells about 5-7 lakh handsets a month. Karbonn, Lava, Lemon, Zen...the list is growing rather rapidly.

The absence of entry barriers has obviously helped. Handsets are sourced from China without any investment in manufacturing and R&D. According to sources, there are currently 262 registered handset importers in India, while the applications of 30 others are under consideration. As a result, a new brand of mobile phones is coming up almost every two months.

The result is not surprising. Market leader Nokia has lost almost 12 per cent market share since last year. Another player, Sony Ericsson, has thrown in the towel by vacating the low-end handset market. The attack is forcing MNCs to change their strategies. After losing the game in the low-cost basic phones segment, they are now offering mid-level handsets—aimed at urban youth and executives—at very attractive prices. Some of them have even launched new ranges to retain customers.

That’s also because the Indian companies have taken a lead in innovation, something that’s crucial for urban markets. So get ready for a mobile phone that doubles up as a universal remote to run your LCD TV, DVD player, even the AC. Or one that can mimic motion sensor games like the energetic Nintendo Wii. Or an all-weather phone that produces an ultrasonic humming to drive away mosquitoes. All these handsets are priced under Rs 6,000.

“The present options for urban audiences are expensive. We will launch our products at more reasonable price points,” says Naveen Paul, national marketing head for Spice Mobility Ltd. New players are even pre-empting concepts the big boys are yet to launch. Micromax’s Bling, which comes in a square-and-slider keyboard format, comes dangerously close to Nokia’s X5 01 and Motorola’s Android 2.1 phone Flipout in terms of design concept. Micromax is also talking to operators for bundling its 3G handsets.

| Decoding Desi Sets | |

| Strengths | Weaknesses |

|

|

Then, Spice is preparing to launch its Android phone in India after its Malaysia launch. In the recent past, all Indian brands have started selling qwerty keypad phones—a status symbol thanks to global brands like Blackberry and Nokia. “Our urban strategy started with a big campaign centred on a qwerty phone, which is an aspirational product and positioned as an expensive buy,” says Vikas Jain, promoter and director, Micromax. Although none of the Indian brands have pushed mail—the main utility of a qwerty keypad—their phones, priced at under Rs 5,000, are seeing brisk sales.

But will all this be enough to take on MNCs in their own turf? Obviously not, and that’s why companies are spending big money to make their products visible to urban, brand-savvy users. Romal Shetty, analyst with KPMG, says: “To succeed in the urban market, a strong branding is required.”

So, in the IPL earlier this year, the biggest ad campaigns were from Karbonn and Max Mobile. Micromax’s current campaign for its solitaire-encrusted Bling is clearly targeted at urban women. Even smaller brand Zen Mobiles is mounting a Rs 25-crore campaign for urban markets. The company, which started last October, already claims to have monthly sales figures of about 2 lakh handsets. Zen ceo Vaibhav Shashtri says: “If your product has a recall and is visible, it will be successful.” To live up to this principle, Zen has signed up Amitabh Bachchan as brand ambassador.

How do the global leaders react to all this? Market leader Nokia dropped the prices of a large number of its feature phones and has launched a range of feature-packed phones in the Rs 5,000-8,000 category. It has also launched a number of models targeted at the fast-moving sub-Rs 3,000 category, where the churn is the maximum. Even in the smartphone category, it will soon bring out its low-cost qwerty phone C3, which is likely to be priced around

Rs 5,000-6,000. Soon, Nokia will also launch two dual sim phones, a category Indian brands have excelled in.

Nokia is obviously extolling the virtues of quality and reliability. “Some of these (homegrown) phones do not meet the quality and technology standards that are required...in the long run, phones with dubious quality standards and which use hazardous materials will not succeed,” says Ambrish Bakaya, director, corporate affairs, Nokia. Indeed, that’s where smaller firms may lose out. The government is finalising a set of benchmarks for materials (the plastic, metals and key components) used in cellphones to ensure they are non-toxic and hazard-free. This is a move to rein in unbridled imports and dumping from China. Adherence to these rules will add to the costs of the Indian companies. With wages rising across China, their cost advantage could erode too.

“These Indian brands have proved that it is possible to dent the market share of international brands. But the new entrants are also employing a very expensive strategy. Whether it will yield results in the long term is yet to be seen,” says Future Brands’s Santosh Desai. But then, Indian companies have always found a way out. This is not likely to be an exception. More importantly, consumers are lapping up all offerings with gusto.