While India faces a particularly harsh summer, one of its most flamboyant—and most tainted—businessmen might just manage a reprieve from the heat in his prison accommodation. As the Supreme Court goes on its summer vacation, there is a strong indication that Subrata Roy will finally get the break he has been looking forward to for the past 26 months.

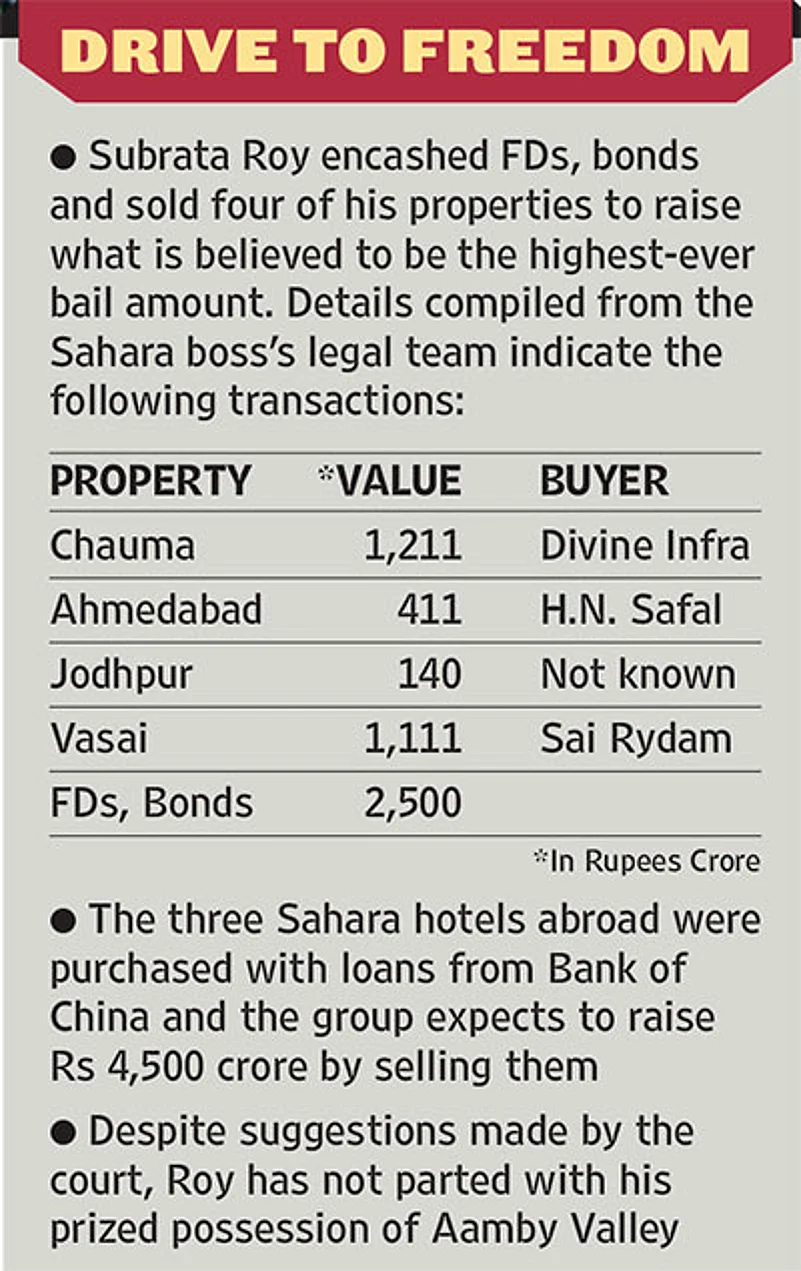

In judicial custody for the last two years, the self-styled Saharasri’s lawyers told a Supreme Court bench led by the Chief Justice of India that Roy has paid Rs 200 crore short of the Rs 5,000-crore cash component required for the bail as per the apex court’s order. The money has been paid into the SEBI-Sahara repayment account.

The second condition set by the SC was that Roy arrange for a bank guarantee for the same amount. Roy has failed to obtain that despite owning prime real estate around the world. Eventually, the Securities and Exchange Board of India has engaged two agencies (SBI Caps and HDFC Realty) to conduct e-auctions for 60 properties. The transactions are to be completed in the next four months.

On April 27, Rajeev Dhavan, Roy’s lawyer, asked the apex court to at least grant Roy parole for 180 days or alternately place him under house arrest, since the two agencies were now auctioning the properties and that made the bank guarantee exercise redundant. The SC bench seemed receptive, but has also sought a complete list of Sahara’s properties, indicating that now the court could direct SEBI to liquidate as many of them as required to recover the debt.

Never before has any Indian been asked to pay up so much upfront to regain his personal liberty. But even if Roy walks out of Tihar, his troubles are far from over. The apex court expects him to arrange an additional Rs 25,000 crore according to a schedule, failing which he could find himself back in jail. Those close to Roy say that he has been trying to liquidate Sahara Group’s properties almost all by himself from his Tihar jail office.

“At one time, stars, politicians and businessmen would be with him and he bestowed them with favours. Now, almost every powerful person he knew has cast him aside,” says Keshav Mohan, one of Roy’s lawyers. The bitterness is evident as organising the ‘bail amount’ has been long-drawn and tortuous.

In August 2014, the apex court had got the government to notify a reasonably spacious outhouse in the Tihar complex as a ‘jail’ so that Roy could run his office from there. While he was trying to sell local properties to raise Rs 5,000 crore in cash, he was also trying to sell off two hotels in New York (The Plaza and The Dreams) and the iconic Grosvenor House Hotel in London to get the Rs 5,000-crore bank guarantee.

Subrata Roy with Anil Ambani, Big B at his son’s wedding

Roy’s troubles began in June 2011, when SEBI ruled that two of his group companies, SHICL and SIRECL, had together collected Rs 22,000 crore from small investors through illegal bonds in 2008-2009. Sahara was directed to pay back the deposits, which have swelled to Rs 35,000 crore with interest. SEBI also questioned the authenticity of the depositors, leading to public speculation that the transactions were camouflaged to launder black money.

In August 2012, the court directed Roy to cough up the money under the supervision of retired SC judge B.N. Agrawal into a special SEBI-Sahara Repayment account. All expenses incurred by SEBI and others related to the Sahara case is paid out of this account. Justice Agarwal himself was to be paid Rs 5 lakh every month for his trouble, besides other expenses.

A recent bill submitted by SEBI to the Supreme Court was for Rs 42 crore, incurred to store documents related to the 3.7-crore investors, sent by Sahara to Mumbai on 127 trucks. Sahara has asked that the documents be returned, since they have been recorded electronically. Sahara claims that a bulk of these documents prove that it has paid back most depositors.

Sahara’s attempts to sell its three hotels abroad generated global interest and brought in several bids. Indian tycoon Cyrus Poonawalla, the sultan of Brunei and the royal family of Qatar were the first bidders. The sultan eventually won the bid, but it could not go through because of protests in London against Brunei’s harsh Sharia laws. The hotels were then mortgaged to Bank of China. Roy tried to get the bank to give the bank guarantee required for his bail, but the RBI ruled it out, as the transaction would violate Foreign Exchange Management Act regulations. The court wanted an Indian bank to provide the bank guarantee.

A US-based entrepreneur of Indian origin then offered to buy the three properties through a company called Mirach Capital and provided a comfort letter from the Bank of America. It offered Rs 7,000 crore, out of which Sahara would get about Rs 4,300 crore. It almost solved everyone’s problems, because Roy’s prolonged incarceration for contempt of court was not helping anyone. But, when Roy’s lawyers in London travelled to the US to confirm with the American bank, it turned out that the letter had been forged.

Later, British billionaires the Reuben Brothers bought out the Bank of China loan, thus indirectly controlling the fate of the iconic London hotel and the two New York hotels. In September 2015, Switzerland-based Helvetia Group offered $5 billion (about Rs 33,000 crore) for Roy’s bail. That would almost entirely wipe out Roy’s debt, but they wanted the three hotels and other properties in return. The group is apparently run by a London-based family from Qatar, which ties in with the bid for Grosvenor House made by the Qatari royals.

Aamby Valley, Sahara’s largest piece of real estate

Significantly, several properties were sold at close to the market value and at rates higher than the circle rates. One property located in Ahmedabad was sold for around Rs 500 crore, at three times its circle rate. The 106-acre Versova plot, worth around Rs 19,000 crore, also turned out to be controversial. Around a third of the property was in violation of the Coastal Regulation Zone norms, which scared off investors, till the court stepped in.

There were similar problems with Divine Infra’s purchase of a 185-acre property in Chauma, Haryana, and Sai Rydam Realty’s purchase of a 270-acre plot in Vasai, Mumbai. In both cases, the firms defaulted on payments. When the company’s officials did not turn up, the judges tersely told their lawyers that if their clients don’t complete the transaction, they could find themselves with Roy. On April 27, the SC again warned Divine Infra’s lawyer reminding him about incomplete payments.

Aamby Valley is the largest piece of the real estate owned by the Sahara Group. In March 2015, a Calcutta-based middleman, Karan Judge, turned up as a representative of a Hong Kong-based company, Nouam Capital, promising to raise money. They offered to raise nearly 1 billion Euros (Rs 7,500 crore) through the Spanish bank BBVA, whose comfort letter was found to be genuine. The bank even claimed that the source of the money was ‘clean and untainted’. The SC allowed Sahara to sell up to 600 acres of land in Aamby Valley at Rs 6.55 crore per acre—again, much higher than the prevailing circle rate.

On several occasions, both SEBI and the court have asked why Roy wasn’t selling off Aamby Valley. On one occasion, Kapil Sibal, appearing for Roy, said that it was his client’s choice what to sell. The bench retorted, “Your choice is to remain in prison”.

Rumours abound that many real estate firms, interested in buying out and developing Aamby Valley, have indicated as much to Sahara. But Roy seems to want to hold on to it and prefers that only a part of Aamby Valley be used as collateral for the bank guarantee required for his bail.

On one occasion, the apex court turned into an auction hall to dispose a 45-acre plot in Gorakhpur. Samriddhi developers had put up Rs 64 crore for the plot. Another company called Gorakhpur Real Estate Pvt Ltd turned up and said that the property was worth at least Rs 190 crore and offered Rs 110 crore. The bidding continued in court till the Gorakhpur company went up to Rs 152 crore.

Sahara claims it has paid back around Rs 16,000 crore to nearly 90 per cent of its investors. In February 2015, a lawyer for the RBI told the court that a Sahara group company, Sahara India Financial Corporation, had diverted around Rs 500 crore to a Sahara India partnership firm. Sahara’s lawyers claimed that these were used to pay back depositors.

The same SC order which had asked Roy to pay back depositors had also directed SEBI to verify the investment applications as well as the repayments. If Sahara has truly paid off investors, then keeping Roy any longer may be futile. But, if he hasn’t, then who pocketed the cash? During these two years of Roy’s imprisonment, SEBI had ample opportunity to probe these payments and either authenticate them or expose Sahara’s claims as fraudulent.

In each major order, the court has mentioned that the depositors are people from economically weaker sections. On the other hand, it seems to accept SEBI’s position that the depositors were not genuine and do not exist, though, it seems, SEBI did find a few genuine depositors (nearly 3,000 applications).

Once out of jail, will Roy regain his patrician airs, a neo noblesse oblige all lit up by dazzle and flash? It depends on whether he can charm the rich and powerful with the dregs of his once-large fortune.