On November 8, 2016, in a televised address at 8 pm, Prime Minister Narendra Modi declared that currency notes of Rs 500 and Rs 1,000 would cease to be legal tender. The disruption that the announcement caused to people’s daily lives and livelihoods and the Indian economy is still fresh in many people’s memories, as the Reserve Bank of India (RBI) announced a halt on circulation of Rs 2,000 notes on Friday.

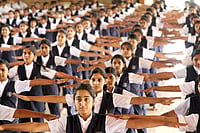

The announcement in 2016, which came late in the evening, resulted in large queues outside ATMs and banks across the country for several weeks. In his address, Modi had said that all banks would be closed the next day to prepare for the changes brought by the demonetisation announcement.

“It will cause some hardship to you... Let us ignore these hardship...In a country’s history, there come some moments when every person feels he too should be a part of it,” Modi had said.

Hardship was an understatement. What ensued saw millions of people trying to exchange notes and queues of angry, frustrated and panicking customers from all walks of life outside banks and post offices across India with no signs of immediate relief. Some were reportedly denied their salaries due to the chaos. Brawls were also reported from all over the country, indicating that authorities were probably caught unawares.

Those who suffered the most were the poor. Overnight, several small businesses —local street vendors selling snacks, ice cream, tea—disappeared. People with unaccounted money were exploring every avenue and loophole to legalise their stash.

In January 2023, when the Supreme Court agreed to review the 2016 demonetisaton, it brought back memories of that sudden announcement, sheer helplessness, and panic for many. Eventually, the Supreme Court rejected the 58 petitions challenging the demonetisation drive.

Since 2016, Congress has alleged that demonetisation was the “greatest organised loot” in independent India and has demanded a white paper on it from the Modi government. After the Apex Court’s verdict, the Bharatiya Janata Party (BJP) slammed the Opposition’s campaign and hailed the judgment as ‘historic’.

The RBI started printing Rs 2,000 notes in November 2016 after the demonetisation exercise. The central bank on Friday said it will withdraw these Rs 2,000 notes from circulation and people can exchange or deposit them in their bank accounts by September 30.

In 2016, Outlook looked at how the currency crunch from the demonetisation exercise worked to the detriment of traders, particularly those engaged in small and solely cash-based businesses.

Outlook also looked at how the Modi government’s demonetisation drive seemed to have blurred the great divide between the haves and the have-nots, the commoners and the powers-that-be, with even MPs rubbing shoulders with Class IV employees of Parliament House to get their notes exchanged or withdraw money.

Former Economic Affairs Secretary and anti-corruption activist E.A.S. Sarma had told Outlook that mall people at the receiving end in almost every sector of the economy were the ones who found themselves squeezed in the demonetisation drive, while the “big fish had enough cushion, innovative capacity and political patronage to absorb the shock”.

In light of RBI’s latest announcement, we revisit some stories from the issue ‘A Nightmare On Bank Street’.