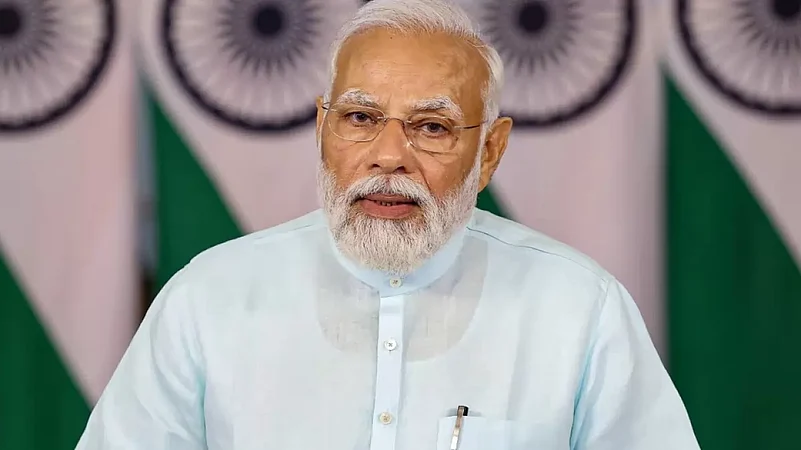

India has transformed under Prime Minister Narendra Modi believes Morgan Stanley.

In its report, Morgan Stanley has said the country has gained a position in the world order and also became a key driver for Asia and global growth.

According to the report published in NDTV, Morgan Stanley said significant scepticism about India, particularly with overseas investors, ignores the significant changes that have taken place in India, especially since 2014.

India of today, the report said, is different from what it was in 2013.

"This India is different from what it was in 2013. In a short span of 10 years, India has gained positions in the world order with significant positive consequences for the macro and market outlook," it said. "India has transformed in less than a decade,” it added.

“Listing the 10 big changes that have happened since Prime Minister Narendra Modi took office in 2014, the brokerage said bringing corporate tax at par with peers and infrastructure investment picking pace are one of the biggest supply-side policy reforms,” it mentioned.

“Also, the rising collection of GST -- the uniform tax that replaced more than a dozen different central and state taxes -- and the rising share of digital transactions as a percentage of GDP indicate the formalisation of the economy,” it said.

It added: “Transfer of subsidies to accounts of beneficiaries, insolvency and bankruptcy code, flexible inflation targeting, focus on FDI, government support for corporate profits, a new law for real estate sector and MNC sentiment at multi-year high were other significant changes.”

India, according to the report, "will emerge as a key driver for Asia and global growth."

“On the skepticism about India, particularly with overseas investors, who say India has not delivered its potential -- despite it being the second-fastest growing economy and among the top-performing stock markets over the past 25 years -- and that equity valuations are too rich, it said, such a view ignores the significant changes that have taken place in India, especially since 2014,” it said.

It added: “The report highlighted the 10 big changes, including supply-side policy reforms, formalisation of the economy, Direct Benefit Transfer, Insolvency and Bankruptcy Code, focus on FDI and flexible inflation targeting. These changes are because of India's policy choices, and their implications for its economy and market.”

“As a result, the report expects a new cycle in manufacturing and capex, as the share of both will rise in GDP. It also estimates that India's export market share will rise to 4.5 per cent by 2031, nearly 2 times from 2021 levels, with broadbased gains across goods and services exports and there would be a major shift in consumption basket,” it said.

"As India's per capita income increases from USD 2,200 currently to about USD 5,200 by F2032, this will have major implications for change in the consumption basket, with an impetus to discretionary consumption," it said.