- Travel, shopping abroad cheaper as you spend less rupees for same dollars

- But if you take today's exchange rate to book in the near future, hotels and airlines may change fares and rates as they are applicable for a limited period

- Retail speculators are hoarding dollars hoping the rupee may weaken against it; so they feel they can buy dollars cheap and sell at a higher price later

- Studying abroad has become cheaper; send your kids for higher education

- Maybe it is time to buy that dream house in New York or San Francisco

- Gold imports less expensive; so you should insist on that new necklace

- The RBI has to keep a close watch to counter the adverse impact of a stronger rupee

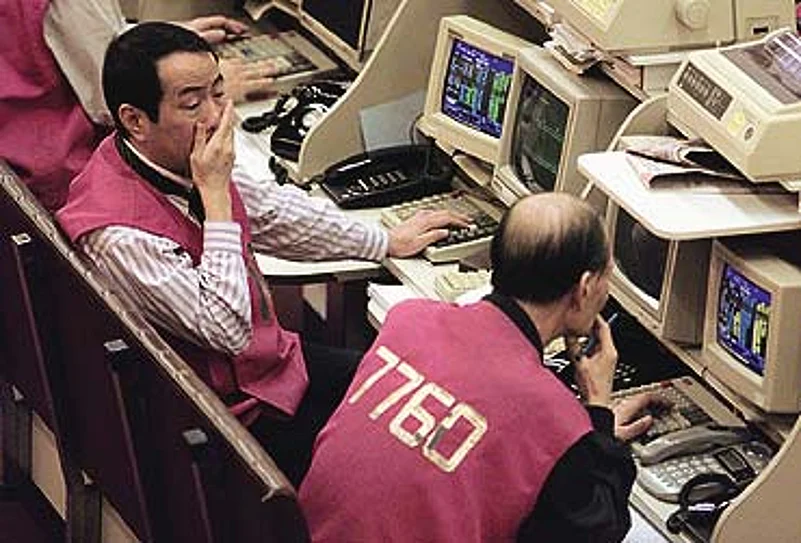

Huge foreign inflows have led to a weak dollar as well as phenomenal rise in prices in several asset categories like real estate and equities; the central bank has had to hike interest rates to curb speculation in assets - A weak dollar can rein in inflation due to cheaper imports of basic items

- If the rupee becomes too strong, it can hurt demand and, hence, GDP growth; so the RBI is easing controls on forex spending by Indian corporates and citizens

- Importers benefit as they spend less rupees to buy goods priced in dollars; it also reduces costs for corporates who import raw materials and intermediates

- Exporters lose, especially in sectors like textiles where they face intense competition from Pakistan, Bangladesh and China

- High interest rates increase finance costs, and curb demand in critical sectors like real estate, automobile and white goods

- If growth peters out, it may spell the end of the quarterly growth story and the amazing price-earning valuations in stockmarkets