In a strategic move that could reshape the entertainment industry, Warner Bros. Discovery (WB Discovery) is planning to acquire Paramount Global. If the deal materializes, it would mark another significant mega-merger in Hollywood, following Disney's acquisition of 21st Century Fox in 2019 and the complex union of AT&T with Time Warner in 2018, culminating in the subsequent Discovery-WarnerMedia fusion in April 2022.

Caution reigns as industry insiders stress that discussions are in the embryonic stages, triggered by a recent lunch meeting between WB Discovery CEO David Zaslav and Paramount Global's Bob Bakish. The outcome remains uncertain, especially considering Paramount Global and its parent company, National Amusements Inc., were already subject to acquisition interest. However, if the parties commit to a union, overcoming a series of challenges, including potential regulatory and legal hurdles, will be the next phase before integration plans can unfold.

Why Pursue Paramount Global?

To echo media magnate Sumner Redstone, content reigns supreme. Paramount Global, while grappling with aging linear assets, possesses an extensive content library, including movies, TV shows, and other forms of media. This trove could substantially enhance WB Discovery's streaming platforms, leveraging the existing content for potential remakes, reboots, and reimaginings in today's content-driven market.

Why Now?

The decline in Paramount Global's stock price, coupled with David Ellison's endeavors, propelled the company into play last month. Reports surfaced that Skydance Media, led by Ellison, aimed to gain control of Paramount by acquiring preferred shares owned by National Amusements Inc. WB Discovery had to expedite its actions due to the escalating discussions involving Skydance.

What's the Value of Paramount Global?

As of Wednesday, Paramount Global's estimated value stood at $10.3 billion, a stark contrast to its $30 billion valuation after the 2019 re-merger with CBS. Paramount Global's stock struggles, with shares below $20 since May, closing at $15.50 on Wednesday. Both companies carry the weight of accumulated debt from the past decade, adding financial complexities to the deal.

Assessing the value of Paramount's linear cable networks, such as MTV, Nickelodeon, and Comedy Central, presents a significant challenge. The diminishing worth of these channels amid the shift to streaming may require strategic decisions, possibly leading to the merging of networks and the phasing out of certain cable brands.

Would Warner Bros. and Paramount Pictures Stay Separate or Combine?

While it's premature to definitively answer, the likely scenario involves maintaining both imprints – the WB shield and the Paramount mountain-and-stars logo. However, streamlining administrative and infrastructure operations could be a key objective.

CNN and CBS News Integration?

Though speculative at this point, if the merger progresses, combining CNN and CBS News appears plausible. Both entities have a history of intermittent courtships, with the synergy of CBS News' prestige and CNN's global distribution making a compelling case for integration.

Is There a Possibility of Other Suitors?

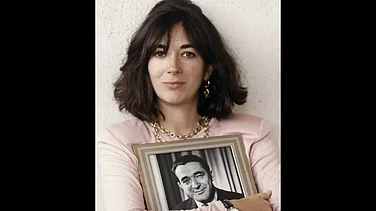

Paramount Global Chair Shari Redstone is optimistic about selling the company as a whole rather than in parts. The market dynamics in the coming weeks will determine the fate of the media conglomerate initiated by her father in the 1980s. The hope for multiple suitors vying for Paramount Global's attention aligns with Redstone's strategy to secure a deal on her terms. As 2024 unfolds, Hollywood is poised for potential seismic shifts, and the fate of Paramount Global hangs in the balance.