Taxes are not determined based on people’s age in the United States. There is no age at which they are exempted from paying taxes. If a person is 65 years of age or older, they are required to file a tax return if their gross income reaches or exceeds $14,700. For those who are married and filing jointly, if both spouses are 65 or older, the threshold is $28,700. However, if only one spouse is 65 or older in a joint filing, the threshold is $27,300.

However, there is one scenario in which one can eliminate their tax obligations. If their sole source of income is social security payments, they will not owe any taxes, and it is highly likely that they won't need to file a tax return.

How to reduce tax burden as a senior?

Even though seniors cannot entirely avoid paying taxes, there are a number of ways to reduce this burden after they reach a certain age. Here are a few ideas:

Apply for the elderly tax credit:

The credit for the elderly and disabled provides a tax benefit between $3,750 and $7,500. Using the IRS's online tool, seniors may establish their eligibility and the potential credit amount. Normally, they have to be 65 or older and make less than $17,500 per year as a single filer or head of household.

Maximize your standard deduction:

If a person is 65 years of age or older and decides not to itemize their deductions, they are entitled to a greater standard deduction. The additional deduction for a single person over 65 is $1,750, and for a married couple filing jointly, the additional deduction for each spouse who is 65 or older is $1,400. Therefore, the additional deduction is $1,400 if just one spouse is 65 or older, but it is $2,800 if both are.

Seek help:

Seniors don't have to handle it alone if they find it difficult managing tax credits. Benefit from the free IRS tax assistance programme is offered to people who are 60 and over. Alternatively, if a person is 50 or older and make a low to moderate income, they might want to use the free AARP tax aid programme. These resources can offer helpful advice for efficiently handling their taxes.

Do you have to pay income tax after the age of 70 in America

Retirement income taxation varies depending on a number of variables, such as your individual financial situation, the source of your income, and other tax rules

Income tax after the age of 70?

Income tax after the age of 70?

- Previous Story

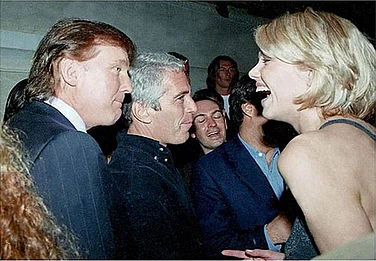

The Epstein Files: A Network of Criminal Socialites in a Rotten System Called Capitalism

The Epstein Files: A Network of Criminal Socialites in a Rotten System Called Capitalism - Next Story

WATCH

MORE FROM THE AUTHOR

PHOTOS

×