Netflix's deal is valued at $27.75 per WBD share, with a total enterprise value of approximately $82.7 billion.

Challenging the bid is Paramount's offer of a $30-all-cash per share deal equating to an enterprise value of $108.4 billion.

Guilds, creative forces and political faces have voiced grave concerns.

In a recent development in the Warner Bros. Discovery (WBD) takeover saga, Paramount Skydance has made a hostile bid to buy WBD, trumping Netflix’s bid to buy the legendary media corporation’s studio and streaming networks.

On Friday, the news of Netflix’s acquisition of the Warner Bros’ Hollywood movie studio, and the HBO cable network, valued at $82.7 billion followed after a long bidding war with Comcast, and Paramount Skydance. Netflix’s acquisition did not include WBD’s traditional television assets, including the news network CNN and the Discovery channel.

Paramount Skydance, headed by David Ellison, had previously tried to buy the entirety of Warner Bros., including its cable networks. This was rejected by Warner Bros before putting itself up for sale.

“The cash and stock transaction is valued at $27.75 per WBD share, with a total enterprise value of approximately $82.7 billion (equity value of $72.0 billion). The transaction is expected to close after the previously announced separation of WBD’s Global Networks division, Discovery Global, into a new publicly-traded company, which is now expected to be completed in Q3 2026,” a Netflix press release read.

On Monday, Paramount, backed by the billionaire Ellison family, announced that it was making a direct offer to shareholders of a $30-all-cash per share against Netflix’s $27.75 to acquire Warner Bros, including its traditional television networks, which equates to an enterprise value of $108.4 billion.

Following Netflix's announcement, US President Donald Trump had expressed concern over the deal. Addressing it at the John F Kennedy Center in the US Capital on Sunday, he hinted at Netflix’s "big market share" and that the combined size of Netflix and WBD "could be a problem".

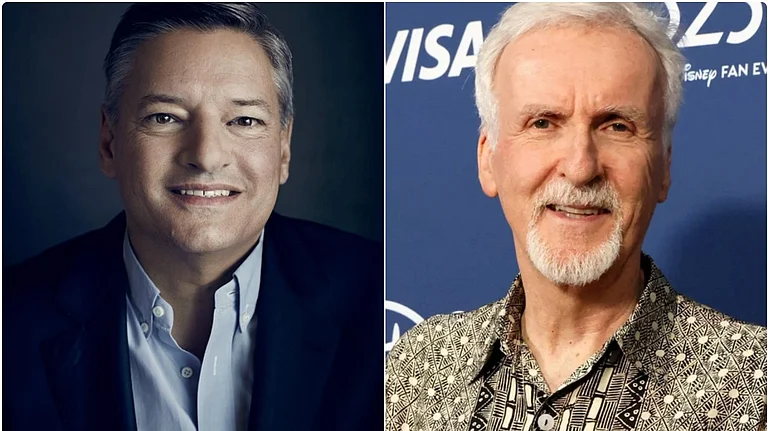

Trump’s personal involvement by taking a call on the approval could jolt the entire agreement in place. While flagging the concerns, he also said that Netflix's co-CEO Ted Sarandos recently visited the Oval Office and praised him for his work at the company, saying, "He's done one of the greatest jobs in the history of movies."

On the other hand, Paramount’s David Ellison's father, Larry Ellison, is a close ally of Trump. According to The Guardian, a regulatory filing on Monday revealed that the Ellisons’ bid was backed by outside funders including Affinity Partners, an investment fund founded by Trump’s son-in-law Jared Kushner; Saudi Arabia’s Public Investment Fund; and the Qatar Investment Authority.

Sarandos had earlier mentioned that Netflix would speed closer to WBD’s space in entertainment before WBD could come to Netflix. Recently, he acknowledged that the agreement may have surprised investors but said it was a chance to position Netflix for success in the "decades to come".

In a Paramount Skydance Corporation press release, David Ellison, Chairman and CEO, said: "WBD shareholders deserve an opportunity to consider our superior all-cash offer for their shares in the entire company. Our public offer, which is on the same terms we provided to the Warner Bros. Discovery Board of Directors in private, provides superior value, and a more certain and quicker path to completion.”

He further added that they believe WBD Board of Directors was “pursuing an inferior proposal which exposes shareholders to a mix of cash and stock, an uncertain future trading value of the Global Networks linear cable business and a challenging regulatory approval process”.

According to Reuters, if the deal falls through, Netflix could have to pay a $5.8 billion penalty, which stands at 8 per cent of the deal equity value, while if Warner Bros. accepts Paramount's offer, it will have to pay Netflix a $2.8 billion breakup fee. Following Paramount’s hostile bid, shares of Paramount were up 7.3% on Monday; WBD rose by 5.3%, while Netflix shares fell by 4%.

The Writers Guild of America, among other guilds and creative forces, have voiced strong concerns against Netflix’s takeover. In a strongly worded statement, they flagged how antitrust laws were designed to prevent deals of this sort where the world’s largest streaming company swallows one of its biggest competitors.

The statement further mentioned, “The outcome would eliminate jobs, push down wages, worsen conditions for all entertainment workers, raise prices for consumers, and reduce the volume and diversity of content for all viewers. Industry workers along with the public are already impacted by only a few powerful companies maintaining tight control over what consumers can watch on television, on streaming, and in theaters. This merger must be blocked.”

US Senator Bernie Sanders pointing out how a select few oligarchs controlling the entirety of the media poses a huge threat to democracy, said, "Now, Netflix is swallowing Warner Bros. Discovery. This is not just another corporate merger. This is about the growing, out-of-control concentration of ownership over the media. At a time when six major conglomerates control what 90% of Americans see, hear, and read, oligarch control is getting."