In the ever-evolving world of mutual funds, Multicap funds stand out for their ability to offer broad market exposure through a single scheme. These funds strategically invest in large cap, mid cap, and small cap stocks seeking to blend stability, growth potential, and agility within one portfolio.

Unlike schemes that focus on just one segment of the market, Multicap funds aim to strike a balanced risk return profile by diversifying across company sizes. This built in diversification helps reduce overexposure to any one segment and can work well for long term investors.

In this guide, we simplify everything you need to know covering how Multicap funds operate, the advantages of their structure, and how schemes like the Kotak Multicap Fund allocate across market caps.

Key Takeaways

Multicap funds invest in large cap, mid cap, and small cap stocks offering automatic diversification through one scheme.

SEBI rules ensure that at least 25% is invested in each cap segment, making the allocation more disciplined and structured.

The remaining 25% gives fund managers the flexibility to respond to market conditions.

This mix aims to balance stability (from large caps) with growth potential (from mid and small caps).

Funds like the Kotak Multicap Fund follow this approach and can adjust tactically without compromising on core diversification.

If you are looking for a long-term investment and want to avoid tracking multiple funds, Multicap funds can be a smart core option in your portfolio.

What Is a Multicap Fund

A Multicap fund is an open-ended equity mutual fund that invests in companies across all market capitalisations large cap, mid cap, and small cap.

As mandated by SEBI, the fund must allocate at least:

25% to large-cap stocks

25% to mid-cap stocks

25% to small-cap stocks

The remaining 25% is flexible, allowing the fund manager to adjust based on market outlook.

This structure ensures diversified equity exposure and disciplined risk management unlike flexicap funds, which have no fixed cap wise allocation.

Key Benefits of the Multicap Structure

Multicap funds offer a compelling structure for investors looking for simplicity, diversification, and long-term growth all within a single scheme.

Invests a minimum 25% each in large cap, mid cap, and small cap stocks ensuring mandated diversification as per SEBI guidelines.

Large cap stocks provide portfolio stability, steady returns, and lower volatility.

Mid cap companies add growth potential with manageable risk levels.

Small cap exposure introduces high return opportunities through agile, emerging businesses.

Reduces concentration risk by spreading investment across various market segments.

Helps generate long term alpha during bull markets while cushioning downside in volatile phases.

Simplifies investment by offering broad equity exposure in one scheme no need for multiple cap-based funds.

Fund manager handles asset allocation and rebalancing, reducing the burden of market timing for the investor.

Works well as a core holding in a mutual fund portfolio, especially for moderate risk investors.

How Kotak Multicap Fund Allocates Across Caps

The Kotak Multicap Fund follows SEBI’s 25:25:25 allocation rule, with flexibility to deploy the remaining 25% dynamically based on market conditions and opportunities.

Market Cap Segment | Minimum |

Large Cap | 25% |

Mid Cap | 25% |

Small Cap | 25% |

Flexible Portion | 25% |

Fund managers may shift the remaining 25% into large caps during volatile times or lean into mid/small caps when sentiment is bullish.

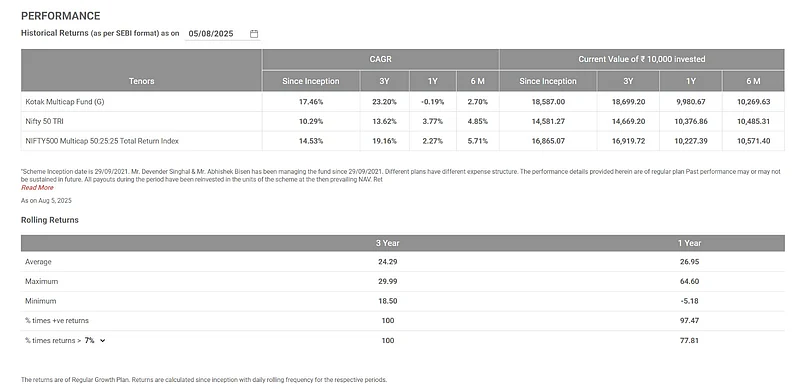

Past performance may or may not be sustained in the future.

When Does a Multicap Fund Make Sense

A Multicap fund is a good choice if you are looking for a simple way to invest in the stock market with built in diversification. You can consider investing in a Multicap fund if

You want to invest in large cap, mid cap, and small cap companies through one fund.

You prefer a fund with fixed rules (as per SEBI guidelines) rather than changing allocations.

You plan to stay invested for at least 3 years.

You don’t have the time or interest to decide which market cap segment to invest in

You want a mix of safety (from large caps) and high return potential (from mid and small caps)

In short, a Multicap fund suits investors who want long term growth with reasonable risk and don’t want to manage multiple funds separately.

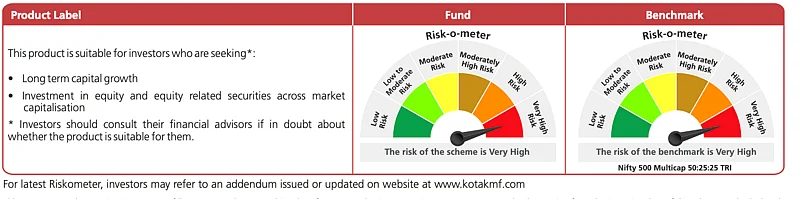

Risk-o-meter

The risk of the fund scheme is Very High. The risk of the benchmark is Very High.

AMC Details:

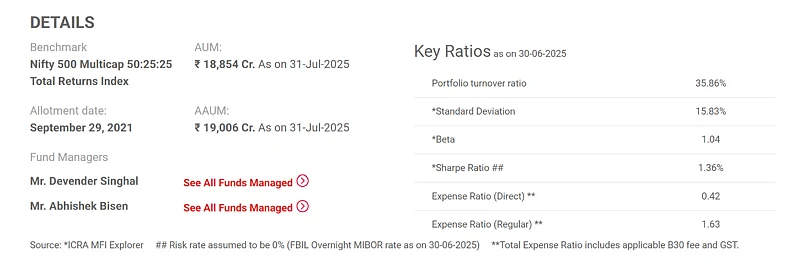

The Kotak Multicap Fund is managed by Kotak Mahindra Asset Management Company Limited.

Registered Office - 27BKC, C-27, G Block, Bandra Kurla Complex, Bandra (East), Mumbai, Maharashtra - 400051, India.

Incorporated under CIN U65991MH1994PLC080009.

The distributor for the fund is Kotak Mahindra Bank Limited, an AMFI-registered mutual fund distributor with ARN 1390.

Conclusion

If you are someone who wants to invest in equities but does not want to worry about choosing between large, mid, or small cap funds a Multicap fund could be the right fit.

Thanks to SEBI’s clear allocation rules, Multicap funds offer a structured way to stay diversified while still giving fund managers some room to act on market opportunities. This makes them suitable for long term investors who want both peace of mind and potential growth.

Whether you are just starting out or refining your mutual fund portfolio, a Multicap fund like Kotak Multicap Fund can be a simple yet effective addition. Just make sure your goals, time frame, and comfort with market ups and downs align with what the fund offers.

FAQs on Multicap Funds

Q1. What is a Multicap fund, and how is it different from other equity funds?

A Multicap fund invests in large cap, mid cap, and small cap stocks, with at least 25% in each, as per SEBI rules. Unlike flexicap funds, it follows a fixed allocation across segments, offering structured diversification.

Q2. Who should consider investing in a Multicap fund?

Investors looking for diversified equity exposure, with a moderate risk profile and a long-term horizon (3+ years), may consider Multicap funds. Suitability depends on individual goals.

Q3. Can I invest in a Multicap fund through SIP?

Yes, Multicap funds offer SIP options, allowing regular investing and cost averaging. SIPs help build long term wealth gradually.

Q4. What are the main risks in Multicap funds?

Multicap funds are exposed to market risk, especially from mid and small cap stocks. Short term volatility is possible. Investors should be aware of these risks and invest accordingly.

Q5. Do Multicap funds have an exit load?

Many Multicap funds charge an exit load of up to 1% if you redeem within one year. Check the fund’s Scheme Information Document (SID) for details.

Disclaimers

Investors may consult their Financial Advisors and/or Tax advisors before making any investment decision.

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, PLEASE READ THE SCHEME INFORMATION DOCUMENT (SID) AND KEY INFORMATION MEMORANDUM (KIM) CAREFULLY BEFORE INVESTING.

Disclaimer: This is a sponsored article. All possible measures have been taken to ensure accuracy, reliability, timeliness and authenticity of the information; however Outlookindia.com does not take any liability for the same. Using of any information provided in the article is solely at the viewers’ discretion.