- SEBI has made IPO rating mandatory, but it’s unlikely to help small investors as issues with high rating and high issue price are still unattractive.

- SEBI hopes to have a price band for any IPO on its listing day, but most of the IPO-related manipulations are over a period of few months.

- It needs to take action against all violators, including MFs and FIIs.

- The regulator needs to take proactive action the growing nexus between institutional investors, promoters and brokers’ cartel.

***

Another failsafe ‘failure’ strategy—that’s widely-sought-after by retail investors—is to blindly put money in new issues, or IPOs (initial public offerings). In the past two years or so, stockmarket regulator SEBI has unearthed several IPO-related scams, including manipulations on the day the specific stocks are listed on the stock exchange. It has also doled out many interim orders pinpointing the guilty parties like a cartel of brokers and/or promoters.

SEBI seems to have woken up to the reality that in a bullish phase, there will be some black sheep who’ll take small investors for a ride. The regulator wishes to avoid this as scarred investors are extremely cagey about returning to the equity market. M. Damodaran, chairman, SEBI, has said in past interviews that India needs to woo "more investors" in the market and, therefore, the Indian regulator is responding more quickly than other regulators elsewhere against possible manipulations.

To curb IPO scams, SEBI has made IPO rating mandatory. Companies, tapping public money for the first time, will compulsorily have to get one—or opt for more—from either of the four credit rating agencies: Crisil, Care,ICRA and Fitch. The IPOs will be graded from 1 to 5 with the lower number representing weaker fundamentals. To control listing-day manipulations, the regulator is toying with several options like a price band within which the newly listed stock can move during its first trading day.

However, experts feel that SEBI is merely barking up the wrong tree(s). Damodaran himself has elaborated that grading will not indicate the investment-worthiness of an IPO and, hence, not really help small investors. For example, if an IPO is rated 5, it can still be a bad buy if the offer price per share is too high and has more than factored in the strong fundamentals of the company. Similarly, a firm with weak fundamentals may not always hurt investors if the issue price is kept low.

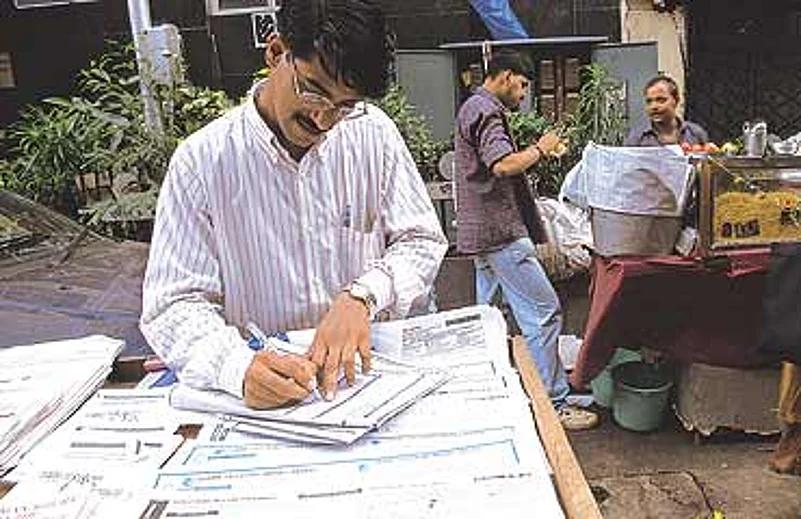

What is required is for the market watchdog to control the abuse in allotment of shares in IPOs, and the authenticity of disclosures in the prospectuses as well as post-IPO corporate announcements. Jayshree Dhabaria, a Mumbai-based retail investor, says that "allotment in fundamentally sound IPOs doesn’t really happen and one has to block huge sums in application money to get a small allotment".

Experts point out that SEBI hasn’t still framed final charges against over 110 operators who rigged 21 IPOs in 2005 to corner higher allotment through over 45,000 benami applications. Although it issued interim orders against depository participants and depositories last year, the lead managers to the IPOs have been let off even though they failed to weed out multiple applications, as required by SEBI’s IPO norms.

Thanks to such half-hearted measures, IPO-related scams continued in 2006. Among the worst is the case of Atlanta, which came out with an IPO of Rs 64.50 crore, and whose scrip price shot up from its September 2006 issue price of Rs 150—and the listing price of Rs 208—to Rs 1,446 by mid-January 2007. This was an almost tenfold rise, even as the Sensex was up by just 1.2 times during the same period. Like in other cases, the regulator failed to take action against all the culprits.

SEBI’s investigations indicated a well-coordinated operation to fool investors and it involved promoters and/or associates, operators,and mutual funds (MFs) and FIIs. First, MFs and FIIs were allotted 20.5 lakh shares, or almost half of the 43 lakh shares issued by Atlanta through its IPO. Within a week of listing, the institutional investors sold 19.4 lakh shares, or nearly their entire allotment.

While SEBI hasn’t revealed the names of the institutional sellers, one can get an idea from the bulk deals—or a sale of over 0.5 per cent of any company’s share capital by any investor—reported to the stock exchanges. Surprisingly, the sellers included fourFIIs—ABN Amro Bank N.V. London (1.96 lakh shares), Credit Suisse Singapore (1.61 lakh), Marshall Wace A/c Kuvera (1.31 lakh) and Somerset India Fund Rhode (1.31 lakh), and one domestic MF, Prudential ICICI (1.85 lakh). All five sold the shares on the listing day at prices varying between Rs 188 and Rs 202 per share.

Five groups of private investors cornered Atlanta’s shares between the listing day and end-December 2006, to push up the stock price. The largest of them was controlled by Manish Marwah and Dilip Nabera, who jacked up their combined holdings from 3.5 per cent on September 30 to 7.3 per cent on December 31. There was also a nexus between Marwah/Nabera and Atlanta’s promoters, who diverted Rs 20.9 crore to finance their purchase of convertible warrants, which would entitle them to 18 lakh fresh shares in Atlanta, in December 2006. In the same preferential issue, warrants (equivalent to 9 lakh shares) were issued to the Marwah/Nabera group.

The nexus was complete when Atlanta’s scrip price zoomed after it reported an unbelievable 139 per cent rise in sales and 1,788 per cent in net profits for the quarter ended December 31, 2006. SEBI suspected that these were rigged as they were not backed up by proper evidence of either revenue receipts or accounting records.

In its interim order, SEBI prohibited further dealings by Atlanta promoters, officials and associates, as also by Marwah/Nabera entities. Surprisingly, it did not comment on the motives of the FIIs and MFs, which sold 95 per cent of their allotment in the week after listing. Sources contend promoters enter into pre-IPO deals with institutional investors and promise them an exit price with a 20-100 per cent profit over the listing price on the first day itself.

What’s shocking is that SEBI didn’t even delve into heavy purchases of Atlanta shares by select FIIs in 2007. According to a Mumbai-based broker, "market operators who rig IPO prices are known to indirectly fund large purchases by FIIs to maintain price levels". Although SEBI’s interim order details out cornering of Atlanta shares by another group, headed by Atul Shah, there was no prohibition on it. On April 18, 2007, Shah’s Rajshah Enterprises sold 1.09 lakh shares at a price of Rs 395.

Sources say that there are at least 5-10 more IPOs where prices have moved like in the case of Atlanta and which involve the same operators. But SEBI hasn’t reportedly swung into action to investigate them. Concludes Dhabaria: "Using these revelations as a yardstick, I don’t think I will ever invest in an IPO. I will want to push the panic button."