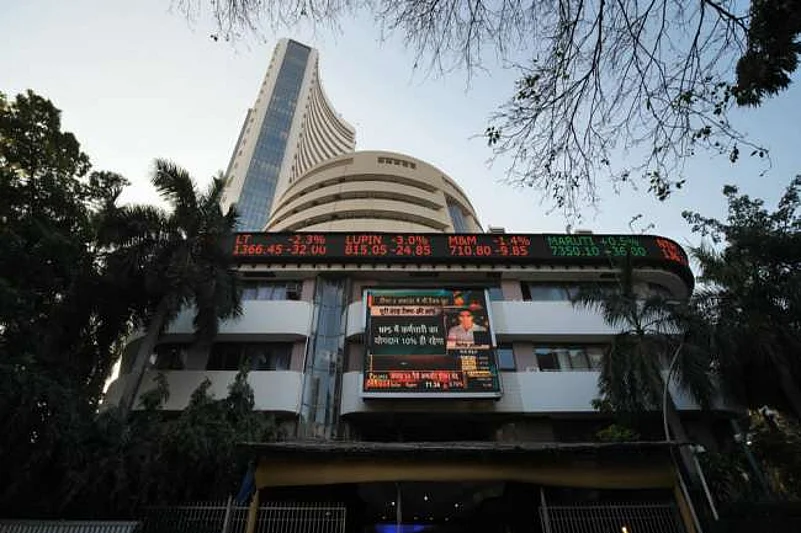

Equity benchmark Sensex closed lower for the third consecutive day on Tuesday as unenthusiastic inflation numbers and concerns about the Omicron variant weighed on investor sentiments on Tuesday. Index heavyweights too closed in the red.

Sensex closed 166.33 points or 0.29 per cent lower at 58,1117.09 on Tuesday whilst the Nifty closed 43.35 points or 0.25 per cent lower at 17,324.90.

ITC was the major loser on the Sensex pack. It lost as much as 2.73 per cent. Bajaj Finance, Kotak Bank, Bharti Airtel, Reliance Industries and Mahindra & Mahindra were the other prominent stocks that closed in the red.

PowerGrid was the top gainer in the Sensex pack. It closed 3.84 per cent higher than its previous close. Dr Reddy's Labratories, Nestle, Axis Bank and ICICI Bank closed in the green.

On the Nifty 50, ITC emerged as the biggest loser - closing 2.73 per cent lower than its previous close. Bajaj Finance, Tata Consumer and Kotak Bank too closed in the red.

PowerGrid was the top gainer on Nifty - closing 3.86 per cent higher than its previous close. Divislab, Axis Bank and Nestle were the other stocks that closed in the green.

Financial services provider Anand Rathi Wealth debuted at a 9 per cent premium, over its issue price, on Dalal Street today. It opened at approx 9.5 per cent premium at Rs 602.05 on the BSE. On the NSE, it opened at approx 9.1 per cent premium at Rs 600.

It closed 6.09 per cent above its issue price at Rs 583.50 on the BSE. On the NSE, it closed 6.36 per cent above its issue price at Rs 585.00

Foreign institutional investors remained net sellers in the capital market on Monday, offloading shares worth Rs 2,743.44 crore, according to exchange data.

In a separate development on Tuesday, WPI inflation spiked to a 12-year high of 14.23 per cent in November. It stood at 12.54 per cent in October. The wholesale price-based inflation scaled its highest level since April 2005.

Retail inflation too continued on a rising trajectory for the second consecutive month, spiking to 4.91 per cent in November 2021, as per government data revealed on Monday.

Asian markets reeled after China reported its first case of the Omicron coronavirus variant amid rising COVID-19 cases in multiple countries.

Bourses in Shanghai, Tokyo, Seoul and Hong Kong ended with losses. Stock exchanges in Europe were, however, trading on a positive note in mid-session deals.

Meanwhile, international oil benchmark Brent crude slipped 0.26 per cent to USD 74.20 per barrel.

The rupee on Tuesday declined by 10 paise to 75.88 against the US dollar as muted domestic equities and persistent foreign fund outflows weighed on the local unit.

On Tuesday, the rupee declined by 10 paise to close at 75.88 against the U.S. dollar owing to muted domestic equities and persistent foreign fund outflows.

The local currency witnessed an intra-day low of 75.95 against the dollar and rose to an intra-day high of 75.83 before settling 10 paise below its previous close.

Brent crude futures rose 0.35 per cent to $74.13 per barrel.

(With inputs from PTI)