In the US, refinancing a car loan requires taking out a new loan to pay off and replace your existing one. You start making payments on the new loan, which typically has a lower interest rate or a shorter repayment period. Completing an application for vehicle refinancing usually takes less than an hour, and many lenders in the United States provide a loan decision right away.

Refinancing a car loan can be done for a variety of reasons. If your credit has improved since you took out the original loan, or if a dealership charged you an excessively high interest rate, refinancing may reduce your rate and the overall amount of interest you pay. If you're having trouble making your monthly car loan payments, refinancing may help.

Here is how to refinance your car loan in United States

1. Examine your current car loan

Gather the following information from your current auto loan contract:

The current monthly payment amount.

Your current loan's APR.

The number of months remaining to repay your existing loan.

The payment amount and APR should be specified in your contract. The remaining loan months and payoff amount can be obtained from your lender's customer care department. This information is also available from some lenders when you log in to your online loan account.

2. Determine the value of your car

Unless you have excellent credit, refinancing a car loan with negative equity can be tough. If you owe more than your car is worth, you may not be able to refinance until you achieve positive equity. The simplest approach to accomplish this is to continue making on-time car payments and to pay extra — even if it's a small amount — each month. Simply ensure that any excess funds are applied to the principal of your loan rather than to interest.

3. Examine your credit score

If you've made all of your auto loan payments on time for the past six to twelve months and maintained all of your other credit accounts currently, your credit may have improved. If this is the case, you have a better chance of benefiting from refinancing your car loan to a cheaper interest rate.

4. Gather data for your application

The information required to refinance a car loan varies depending on the lender and the stage of the application process. The majority of lenders in the United States will ask for the following information at some point, so gather it all ahead of time.

Your driver license.

Registration of your car.

Insurance documentation.

Your vehicle's identification number, or VIN.

Pay stubs or proof of employment from your present employer.

Social Security number.

A loan payoff statement from your present lender.

5. Compare lenders and interest rates

A car loan refinance calculator can help you compare pre-qualified loan offers to your current loan. First, provide information about your current loan, such as the original loan amount, interest rate, and loan length in months. Then enter the amount you wish to refinance as well as the loan term and interest rate from your pre-qualified offers.

This will show you how much money you may potentially save on your monthly car payment and help you decide where to apply.

6. Apply for a loan refinance.

If you decide to move to the approval process with more than one lender to compare firm loan offers, you must do so within 14 days. During this time period, similar enquiries are often merged together and handled as one, reducing the influence on your credit score. Once you've decided on a lender and agreed to refinance your car, you'll be given new loan documentation to sign. When you refinance your car loan, the lender will construct a new loan with the new rate and term length you agreed on.

Your new lender will either pay off your previous loan or provide you with the means to do so. Keep an eye out for communication from your new lender regarding when and how to begin making payments on your vehicle refinance loan.

How to refinance your car loan in United States

From application to approval, the entire process of refinancing a car loan is quick in the United States. Here's how to refinance a car and perhaps save money in the process

Car model, calculator and coins on white table

Car model, calculator and coins on white table

- Previous Story

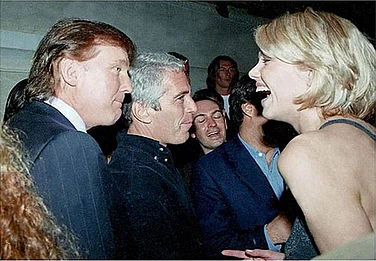

The Epstein Files: A Network of Criminal Socialites in a Rotten System Called Capitalism

The Epstein Files: A Network of Criminal Socialites in a Rotten System Called Capitalism - Next Story

WATCH

MORE FROM THE AUTHOR

×