In an era where attention spans vanish faster than passwords expire and digital experiences are judged in milliseconds, a quiet transformation is underway, one click at a time. There are no blaring headlines, no influencer campaigns, and no media fanfare. Instead, it’s a silent revolution, anchored not in what you see, but in what you don't, powered by innovations like e-sign and e-KYC that streamline trust, speed, and security in the digital world.

At the center of this shift is Nextbigbox, a new-age tech partner powering digital transformation for fintechs, NBFCs, and digital lenders across India. Their approach doesn't hinge on visibility, it’s about invisible infrastructure. Infrastructure that redefines how financial trust is established, scaled, and secured.

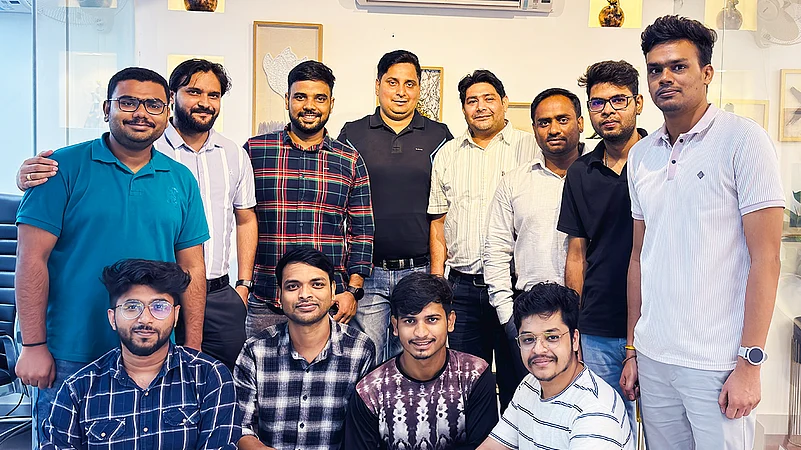

“We are not just building KYC flows; we are building credibility frameworks that scale with ambition,” says Shiv Kumar Gupta, Chief Technology Officer, NextBigBox. Under his leadership, the team NextBigBox has built a modular, API-first KYC stack that integrates real-time video verification, OCR-driven document reading, facial recognition, and geo-tagged validation. The system doesn’t just meet compliance benchmarks — it anticipates them. The result? A plug-and-play identity engine that reduces onboarding time from days to seconds, and operational friction from high to invisible.

What makes this architecture powerful isn’t just the front-end. It’s the orchestration beneath, the encrypted backbones, the fault-tolerant infrastructure, and the API interconnectivity that makes seamless trust possible. That’s where Hitesh Kumar Rajput, Chief Information Officer, steps in. If trust has a technical blueprint, he’s the architect engineering its hidden pathways. His work doesn’t make headlines, it prevents them. From encrypted data flows to layered infrastructure resiliency, he ensures the system is as secure as it is scalable.

But trust in fintech doesn’t stop at code. It breathes through execution — that delicate balance of compliance, user experience, and operational agility.

The NextBigBox team, including its esteemed team members Ankit Kumar, Ankush Ansh and Abidi Yusha Yusuf, has simultaneously ensured the silent stewards of uptime, precision, and scale. In a sector where compliance is non-negotiable and customer onboarding is a battleground, this team ensures that what users experience is not just functionality, but fluidity.

Their collective vision is clear, that is to redefine what it means to “know your customer” — not by collecting more data, but by interpreting smarter, silent signals. Behavioural cues, biometric trails, AI-augmented pattern recognition — these aren’t just features; they are digital trust-building mechanisms that operate at the speed of thought and the scale of ambition.

This is not about digitization. It’s about humanized automation — tech that doesn’t feel like tech. Systems that don’t scream “security,” but quietly deliver it. Frameworks that don’t ask for trust, they earn it.

The impact is already visible — even if its creators are not. Every time a loan is approved without paperwork, a policy is issued without delay, or a customer is onboarded without friction, it’s a subtle nod to the future being built by teams like NextBigBox. A future where compliance becomes intuitive, identity becomes fluid, and trust becomes ambient.

In a market flooded with attention-grabbing innovation, their work stands out by not trying to. It simply delivers Quietly, Reliably, Elegantly.

Because behind every frictionless click, there’s a team that understands:

The future of trust won’t be loud, but it will be unforgettable.

Disclaimer: This is a sponsored article. All possible measures have been taken to ensure accuracy, reliability, timeliness and authenticity of the information; however Outlookindia.com does not take any liability for the same. Using of any information provided in the article is solely at the viewers’ discretion.