Bitcoin is dominating crypto news today as U.S. spot Bitcoin ETFs record consecutive net outflows, raising fresh questions about near-term momentum. According to CoinMarketCap, Bitcoin is trading around $88,269 with a market capitalization close to $1.76 trillion, maintaining its position as the largest cryptocurrency by market value. These developments shape the current Bitcoin price prediction debate and highlight why investors are reassessing upside potential across the market.

As that reassessment unfolds, attention is also drifting toward early stage opportunities like Pepeto ($PEPETO), where presale positioning and a smaller valuation profile offer a very different risk reward dynamic compared with large cap assets such as Bitcoin.

Bitcoin Market Snapshot and ETF Pressure

Recent Bitcoin news today has focused heavily on ETF flow data. Multi-day outflows have introduced the temporary pressure to price action, but they are not an indication of structural breakdown. In the past, selling under ETF was usually a rebalancing exercise as opposed to a lack of long-term conviction.

Bitcoin's scale is both its strength and limitation. Stability is supported by deep liquidity, but it is a fact that, at present, the structure of creating huge multiples involves colossal amounts of capital injections during a particular cycle, something akin to and constrained by explosive increases as compared to past cycles.

Bitcoin Price Prediction Outlook 2025-2026

Most analysts frame the Bitcoin price prediction within realistic valuation bands. The most conservative case would yield BTC of between $75,000 and $90,000 in case the volatility of the ETFs continues. It is a base case that presupposes the stabilization and gradual recovery to reach the level of $95,000 to $105,000 once liquidity conditions are improved.

The bullish forecasts of more than $120,000 normally depend on new world relaxation, continued systematized gathering, and a well-organized macroeconomic climate. Although these might occur, they indicate that the grind may not be fast and definitely not an exponential gain.

Why Capital Turns After the ETF Volatility

The volatility of ETFs due to periods has always been a time of transition, but never a period of market tops. With this reduction in uncertainty, capital tends to shift out of major cap assets and toward opportunities at earlier stages, which contain greater asymmetry. This pattern has repeated across past cycles, where Bitcoin consolidates while new narratives emerge elsewhere in the market.

Pepeto Emerges as the High-Upside Alternative

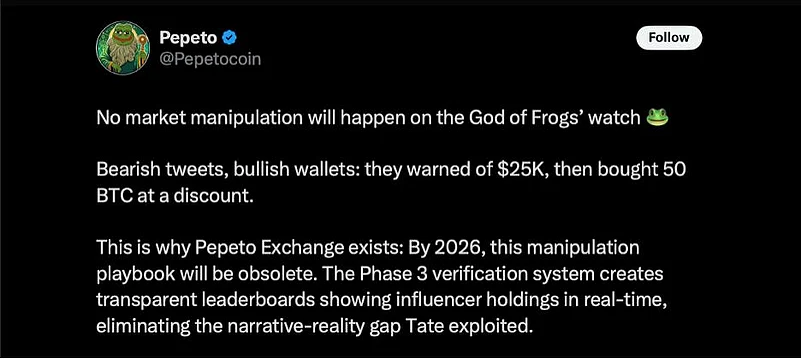

Pepeto ($PEPETO) is quickly emerging as one of the presales many believe could define the next wave of outsized crypto returns. Often described as the God of Frogs, Pepeto was created by a PEPE cofounder who learned the hard lesson of the last cycle, memes alone can explode, but without real utility, they struggle to sustain momentum. Pepeto is the answer to that gap. It keeps what worked, the viral frog identity and culture, and upgrades it with the one thing PEPE never had: infrastructure designed to support long-term value.

Entering the market at a moment when capital is rotating toward early, asymmetric opportunities, Pepeto has no public market cap yet, putting it squarely in the high-risk, high-reward zone where low to high outcomes are historically born. The presale price sits around $0.000000172, with a fixed 420 trillion supply, and more than $7.1 million already raised, a clear sign that experienced investors are positioning early, not waiting for listings. This is the stage where the biggest gains are made, before exposure, exchanges, and the wider market catch on.

How Pepeto Price Targets Are Modeled

Pepeto price prediction models differ fundamentally from those used for Bitcoin. Rather than relying on macro inflows alone, Pepeto's framework is built around usage-driven demand.

PepetoSwap introduces zero-fee meme trading, Pepeto Bridge enables cross-chain routing, and the upcoming Pepeto Exchange focuses on verified meme tokens. Every transaction within this ecosystem routes through the $PEPETO token, creating a demand loop tied directly to activity.

Pepeto Price Prediction Scenarios 2025-2030

In a conservative case, limited adoption and early listings could already generate returns that outperform Bitcoin's realistic upside over the same period. A base case assumes broader meme-season participation on Ethereum, while bullish scenarios factor in full ecosystem rollout and sustained trading volume.

Even the lower-end projections position Pepeto as a next huge meme coin candidate relative to its presale valuation, a dynamic no longer available to trillion-dollar assets.

Bitcoin Versus Pepeto: Risk and Reward

Bitcoin remains essential for portfolio stability and long-term crypto exposure. It is, however, inherently short-term, constrained by its size at the moment. Pepeto represents the opposite end of the spectrum. It is riskier, although it includes the sort of asymmetry that characterized early DOGE, SHIB, and PEPE investors.

Overall Conclusion: Stability and Asymmetry

Bitcoin's ETF-driven volatility reinforces its role as a mature asset with steady but slower growth potential. Pepeto offers what Bitcoin no longer can: an early entry, micro pricing, audited contracts, real utility, and exposure to the next meme cycle before it becomes obvious. Investors who seek the most profitable crypto to purchase at this point with actual upside asymmetry can expect this presale to go down the drain before the expected time.

How to Buy Pepeto Safely

Pepeto can be purchased exclusively through the official website, Pepeto.io. Buyers match a compatible wallet, execute the transaction, and can stake tokens at once with an approximate APY of minor to major percent. It should be used only on the official site in order to avoid the fake presale sites.

Official Pepeto Channels:

Website: https://pepeto.io/

X (Twitter): https://x.com/Pepetocoin

Telegram: https://t.me/pepeto_channel

Instagram: https://www.instagram.com/pepetocoin/

Disclaimer : Cryptocurrency investments are risky and highly volatile. This is not financial advice; always do your research. Our editors are not involved, and we do not take responsibility for any losses.