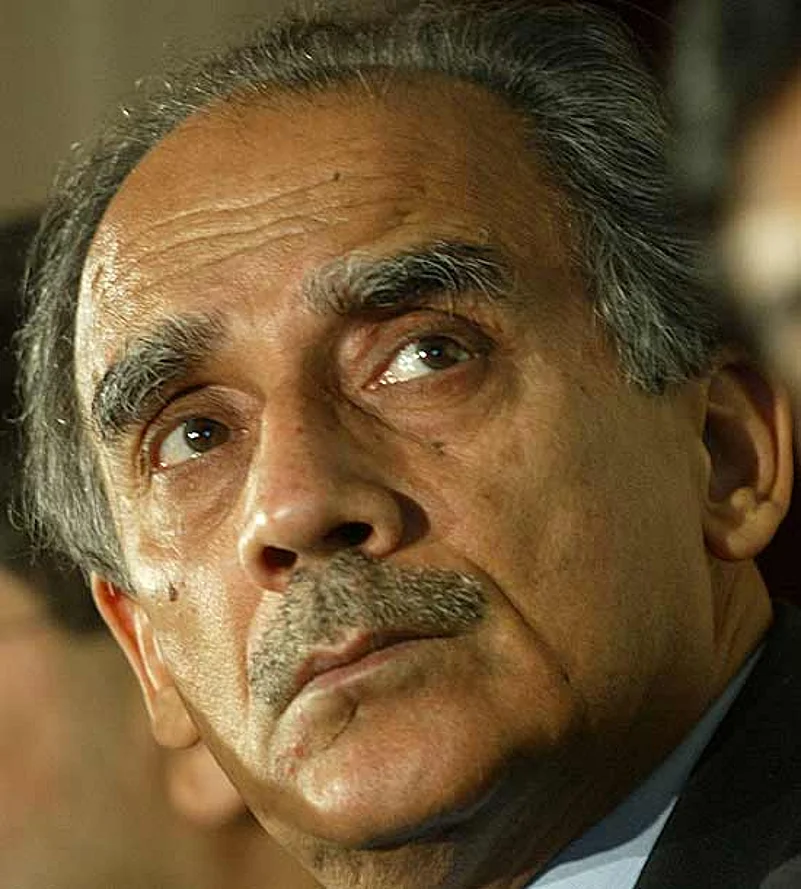

Sent a detailed questionnaire, former disinvestment and telecom minister Arun Shourie responded in an equally detailed manner, debunking all of Outlook's accusations. But the documents accessed by the magazine and the CAG report do point to huge irregularities and several favours shown to bidders.

Following is the full text of Mr Shourie's response to our queries — excerpts from which appear in print — which was prefaced with what he called some general facts:

Someone has fed you fabrications and half-truths.

i) All the processes involved scrutiny by Bankers, Law firms and were then vetted by Ministry for Law, the Inter-ministerial Group (including Finance Ministry representative), the Committee of Secretaries (headed by the Cabinet Secretary), which included Ministry of Finance, and finally by the Cabinet Committee on Economic Affairs.

ii) A bidding procedure was followed that gave equal opportunity to all bidders. Reliance was one of the bidders who lost in the price bid and one other bidder did not, I think, finally submit a price bid.

iii) VSNL was a listed company. It was listed both in Bombay and in New York. Therefore everything done was done and had to be within the regulatory framework of SEBI and the US regulator. Any unilateral or unfair decision would have immediately given ground to any and every shareholder—bidders apart—for bringing the entire process to a halt through litigation.

iv) The price we got was far above the market price. When you include the Special Dividend to which I shall refer in a moment, and which your informers seem to have kept hidden from you, the P/E ratio turned out to be 11. At 11, the P/E was excellent: it compared to the pre-disinvestment P/E ratio of just 6.

v) GOI took out excess cash through a Special Dividend; it settled a contingent liability on a tax matter that had been a cause of contention between two wings of Government for years; furthermore, contrary to what you have been led to believe, Government provided for hiving off the surplus land with no share going to TATAs in the hived off land company. In a word, the 700-odd acres you talk of were hived off, and TATAs could get no part of the proceeds were the land to be sold in the future.

During the disinvestment of VSNL in your tenure, the cash reserve of the company was in the range of Rs 6000 crore. Was the cash reserves held by the PSU considered a factor while determining the price?

Facts: First, please check the facts. As far as I am able to ascertain, The cash reserves in VSNL on March 31, 2001 were about Rs 4840 crore; on March 31, 2002 (about 2 months after the disinvestment) they were about Rs 2535 crores. I am not clear where the figure of Rs. 6,000 crore comes from.

The second fact is far more important. So that the bidder would not get this cash, a Special Dividend was announced by Government to withdraw the cash. Prior to the disinvestment, in 2001-02, at the insistence of the Government, VSNL announced a Special Interim Dividend of 750%, i.e. Rs 2137.5 crores to reduce the cash balance in the company. Compared to this drastic withdrawal, in the previous year, 2000-01, VSNL had declared a total dividend (regular plus special) of Rs 1425 crores.

In accordance with its shareholding in the company, GOI got 52.97% of this. The rest was distributed among other shareholders as a Special Dividend. The cash reserve that remained was factored in while valuation was done.

It is stated that the Tatas used the cash reserves of VSNL within three months of its disinvestment to expand Tata Teleservices. Your comments?

Facts: The cash was withdrawn from the company and distributed as a Special Dividend. TATAs as the Strategic Partner did not get it. I think a small portion was left in VSNL as a company cannot be left without a cash reserve. This amount was assessed by the Company management in the light of its requirements, and then left. But the bulk was distributed, as I have indicated above. Even for the cash that was left behind the Strategic Partner, that is TATAs, acquired access to only 25% in accordance with their shareholding, GOI 27.97% and 47.03% was owned by public shareholders.

As for subsequent decisions of VSNL, the company must have proceeded by its commercial judgement. On my information, its decision turned out to be a very sound one.

- VSNL decided to make an equity investment in Tata Teleservices and a proposal was presented to the Board.

- After several rounds of discussions, and after approval by the Government and its nominee Directors on the Board, VSNL agreed to make an investment of Rs 836 crores over a period of three years upto 2005-06.

- That investment has grown in value over time as can be gauged from the fact that VSNL (now Tata Communications) sold a part of its shares in Tata Teleservices to NTT DoCoMo in 2009 for Rs 424 crores, at a profit of Rs 346 crores.

The surplus land, in the region of 773.13 acres and held by VSNL at the time of disinvestment was to be de-merged and put into a Special Purpose Vehicle. Was this done before the disinvestment of VSNL? Why was there a differential built in the agreement that favoured the Strategic Partner in earnings if the government failed to set up the SPV and de-merge the surplus land?

Facts: A very stringent clause was built into the agreement regarding this surplus land. The land had been acquired earlier for expansion. But over the years, technology had changed in the telecom sector and large areas were no longer required to set up telecom facilities. The bidder was unlikely to bid for the full value of this land. On the other hand, Government was likely to be heavily criticized for leaving such large chunks of land with the private company. Therefore, the decision was taken to hive off the land through demerger.

Whoever won the bid for VSNL would not have any right to dispose off the land and pocket the profits. Clauses were added that ensured that even if the demerger did not take place and Government permitted sale of any portion of the land, the Strategic Partner would not get a share from the proceeds of sale on the 25% equity holding it had acquired in VSNL. It would have to pass the proceeds on to the Government. Needless to say, the Ministry of Law had vetted all these agreements. As to why the demerger did not take place, you would like to ascertain the reasons from the Department of Telecommunications.

A comparison of what the winning bidder paid with what the prevailing market price of VSNL shares was shows how perverse the insinuation behind the question is.

- The equity value of the company as per the winning bid (Rs 202 per share) was Rs 5757 crores. This valuation did not include the Surplus Land.

- The market price of VSNL, on Feb 1, 2002, the day of the bids, was about Rs 155 per share, and this share price included the Surplus Land.

Furthermore, I understand that in August, 2006 the DoT informed the Company that the Government was considering all important issues on the subject and that the Government decision shall be communicated to the Company, as and when taken. As far as I can ascertain, no further communication has been issued by DoT to the Company on this subject till date.

DoT, however, has come out recently with ‘Request for Expression of Interest’ to appoint consultant to advise Dot on the issue. So, you would want to pursue the issue with them.

VSNL continued to enjoy a monopoly on all ILD (International Long Distance) calls even after being disinvested. Three tenders floated by BSNL for ILD calls was not allowed to go through or delayed. Why was this allowed?

Facts: The facts are the complete opposite of what you have been led to believe. The government had allowed monopoly in ILD for a period of time when VSNL was a government company. This monopoly was to expire in 2004. As the company was going to be disinvested, Government rightly decided that this monopoly should not be allowed to continue. Hence, the date of expiry was brought forward—the monopoly was to end in 2002 instead of 2004. Hence, the Strategic Partner was put to a loss rather than being shown a favour as your question insinuates. And do remember that when Government took a unilateral decision to cut short the monopoly of VSNL, it risked being taken to court by shareholders in the US and India.

In accordance with the decision to curtail the monopoly of VSNL in this regard, the ILD sector was in fact opened up to competition on April 1, 2002.

Did this monopoly in ILD traffic for VSNL cause any loss to BSNL and MTNL as well as the exchequer? After VSNL's monopoly ended partly, it was allowed to continue with a monopoly on all outgoing ILD traffic being generated by BSNL and MTNL? Why was this allowed and did it cause a further loss to the PSUs and the exchequer?

Officers and others who were running the Department of Telecommunications at the time are the ones you would want to ask—especially in view of how it has allowed these to fall behind private operators. But a few facts speak for themselves:

- As I have mentioned earlier, originally, the Government had promised VSNL and its shareholders, including Indian and international public shareholders, that VSNL’s monopoly in ILD would continue till 2004. In fact, this was even stated in the NTP ‘99.

- In September 2000, the Government decided to end the monopoly prematurely in 2002, two years ahead of schedule. In order to compensate the company and its shareholders for the loss of two years of monopoly, the Government announced a package for VSNL.

- One of the elements that was included in the Compensation Package was an assurance that the ILD traffic of BSNL and MTNL would be routed through VSNL, on a most favoured customer basis, at market rates.

- Therefore, VSNL had to match any market price that its competitors offered. It is incorrect to say that BSNL or MTNL suffered any loss due to this.

Is it a fact that only payments were due from other ILD operators for terminating ILD Calls and there was no adjustment possible for outgoing ILD Calls? Did this make MTNL and BSNL vulnerable to defaulting in payments to private ILD Operators?

Your question is not clear. Perhaps you would like to know what the position in regard to payments on to and from traffic was. Access providers like BSNL & MTNL would pay the ILDO a charge for carrying their outgoing ILD traffic. They also charged a termination fee for incoming ILD calls. Usually, the industry practice (at that time) was to net-off the receivables and payables between two parties every quarter or so. Since the volume of incoming traffic was many times that of outgoing traffic, usually, the ILDOs would have to make the net payment to BSNL/MTNL.

Why was VSNL given a license for National Long Distance (NLD) without any Entry Fee?

- VSNL got NLD license to offset the fact that its monopoly was being ended sooner than the year that had been indicated to shareholders. The monopoly which was to end in 2004 was now being curtailed to 2002. As the company was listed in both the US and India, had such a step not been taken, there was every danger that the Government would be sued, and the entire process brought to a halt. The alternative would have been to let the monopoly to continue till 2004. That would have prevented competition, and thus harmed the consumers.

You would want to note two additional facts in this regard.

- The Compensation Package was announced prior to disinvestment of VSNL, and

- In fact, VSNL and its Board had protested at that time that the package was not adequate compensation for the premature termination of the monopoly.

It has been argued that had the tenders floated by BSNL for ILD been allowed to go through, it would have led to significant reductions in the tariff for making and receiving international calls and also encouraged healthy competition among the private telecom players. Why was this not allowed to happen?

- Even in 2002-03, during the two year period of Most Favoured Customer, BSNL was carrying incoming ILD traffic from other ILD operators. In fact, VSNL had written to DoT that BSNL working with other ILD operators on incoming traffic caused almost Rs 1800 crores of loss to VSNL.

- Since BSNL was able to work with other ILD operators for incoming traffic and also got market price for outgoing traffic, BSNL got full benefit of the competition amongst the private players.

- Within a year of the end of VSNL’s monopoly, ILD tariffs in India had fallen by 50%, from about Rs 48 per minute to Rs 24 per minute, and they continued to reduce thereafter, thus benefiting the Indian customers.

Why was the earnest money from the bidders of Rs 500 crore in cash diluted to a Rs 100 crore irrevocable bank guarantee during the disinvestment of VSNL?

Facts: I do not recall the exact sequence. In all probability, the original amount may have been fixed keeping in mind the cash reserves that VSNL originally had, and when the cash was withdrawn through a Special Dividend as I have explained above, the amount was reduced. In fact, I recall that one potential bidder went to the Delhi High Court arguing that, since cash has been withdrawn, the net worth criteria should be reduced and fresh bids invited. The Court dismissed the petition, and upheld what Government had decided. In a word, apart from other things, the transaction withstood judicial scrutiny.

A contingent liability of Rs 1,402 crore against VSNL was withdrawn but not communicated to the bidders till a day before the bids were opened. Had this been communicated to the bidders earlier, it would have fetched a much higher price. Your comments on the same

Facts: You are being fed falsehoods. Due diligence does not help the bidders alone to understand a company better. Interaction with them also helps the Government understand where exactly lie the value depletors. This is made evident by the very falsehood you have been fed. During the months in which the disinvestment of VSNL was going on, in the bidders meeting towards almost the end of the process, it was pointed out by them that the VSNL balance sheet showed a contingent liability on some tax matter of about Rs. 2000 crores. This case had been pending with the tax department for years. It became manifest that unless this issue was resolved, there was no point calling for price bids, as the bidders would discount the whole amount! Therefore, special efforts were made to get this matter finally disposed of and Ministry of Disinvestment succeeded in doing that. All such information was communicated to all the bidders well in advance.