Anil Ambani has been asked to depose at the ED headquarters in Delhi on August 5.

The action reportedly pertains to alleged financial irregularities and collective loan 'diversion' of more than 10,000 crore rupees.

The development came a week after ED raided multiple companies and executives of his business group last week.

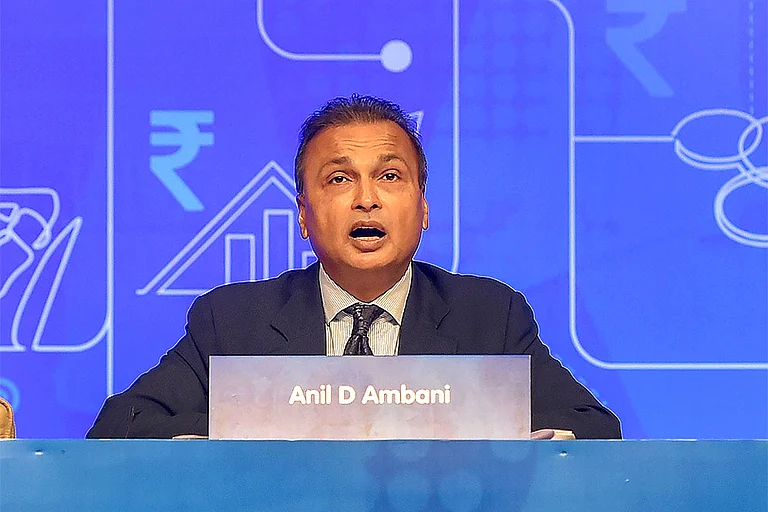

Reliance Group Chairman and Managing Director Anil Ambani has been summoned by the Enforcement Directorate (ED) on August 5 in connection with an ongoing investigation into an alleged loan fraud-linked money laundering case against his group companies, official sources said on Friday.

As per reports, the action pertains to alleged financial irregularities and collective loan 'diversion' of more than 10,000 crore rupees by multiple companies. However, ED sources had said the investigation primarily pertains to allegations of illegal loan diversion of around Rs 3,000 crore, given by the Yes Bank to the group companies of Ambani between 2017-2019.

Sources told PTI that Anil Ambani has been asked to depose at the ED headquarters in Delhi as the case has been registered there. It has been mentioned that the federal investigation agency will record his statement under the Prevention of Money Laundering Act (PMLA) once he deposes.

The development came a week after the federal agency raided multiple companies and executives of his business group last week.

The searches, launched on July 24, went on for three days across 35 premises in Mumbai, and they belonged to 50 companies and 25 people, including a number of executives of the Anil Ambani Group companies.

It has been reported that the probe agency identified 'gross violations' in Yes Bank loan approvals to Reliance Anil Ambani Group Companies. The loopholes include charges such as back-dated credit approval memoranda and investments proposed without any due diligence/credit analysis in violation of the bank's credit policy.

“Credit approval memorandums (CAMs) were back-dated, investments were proposed without any due diligence or credit analysis in violation of the bank’s credit policy,” the officer said, as per a report by Hindustan Times.

“In violation of the terms, these loans were diverted to many group companies and shell companies”, the official further added.

Reliance Power and Reliance Infrastructure, two companies of the group, had informed the stock exchanges saying while they acknowledge the action, the raids had "absolutely no impact" on their business operations, financial performance, shareholders, employees or any other stakeholders.

"The media reports appear to pertain to allegations concerning transactions of Reliance Communications Limited (RCOM) or Reliance Home Finance Limited (RHFL) which are over 10 years old," the companies had said.

The ED, the sources had said, has found that just before the loan was granted, Yes Bank promoters "received" money in their concerns.

The agency is investigating this nexus of "bribe" and the loan.