After a long period of cooling down, decentralized finance is showing signs of its return to momentum. Total value locked in DeFi protocols has been stable and started increasing again based on the data from DeFiLlama, which is holding above the $90 billion level. Although this is still below previous cycle highs, the direction is what is important.

Yield-focused capital typically has a return first and then speculative capital. Investors seeking yield - come in early, seeking to profit while waiting for broad market upside. This sort of behavior has been repeated over past cycles as well and often marks the beginnings of a greater expansion of a given market.

Why Yield Narratives Return Before Full Bull Momentum

In previous bull markets, yield has been a bridge between bear periods and speculative mania. Reporting from The Block and other crypto research outlets sees experienced investors often rotate into yield-bearing strategies in the time leading up retail interest returns.

A disciplined approach reflects on discipline and not excitement. When capital needs to remain productive through uncertain phases, yield enables this to happen without the price action looking muted and it is why oftentimes DeFi activity increases silently while the price action still appears muted.

Staking and Yield Become A Magnet For Smart Capital

Yield strategies are attractive to risk-adjusted return-oriented investors. So instead of focusing on short-term pumps, they focus on permanent exposure plus income. When DeFi yields start to attract attention again, it generally means that confidence is restoring in the underworld.

This is the environment where good staking opportunities are conspicuous. Investors seek investments with both good yields and well-grounded structure as opposed to isolated farming schemes.

Pepeto Staking Enters The Yield Conversation

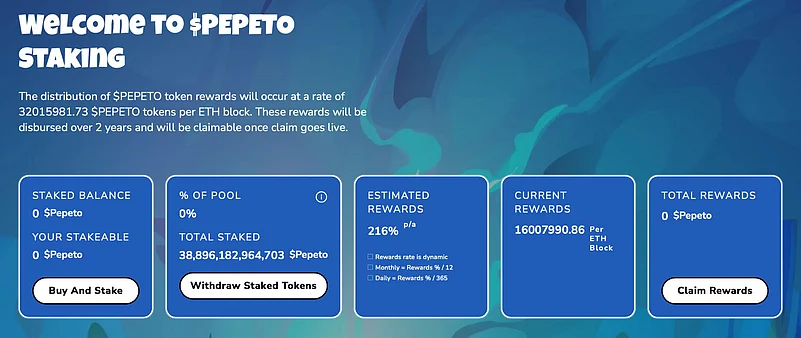

Pepeto ($PEPETO) comes into this new yield environment with one of the most aggressive presale staking offers out there. The project offers staking rewards that are above high APY, which is making it possible for these early participants to expand their allocation of tokens even before the major listings. One of the best ways experienced investors choose to turn red days into yield.

Unlike many other yield options, Pepeto puts staking into a wider ecosystem. The staking model is intended to support a growing platform instead of being a temporary incentive.

Utility-Backed Yield With Audits and Structure Sets Pepeto Apart

What sets Pepeto apart from other yield tokens is the infrastructure that supports the yield. Pepeto is built on Ethereum mainnet and features zero-fee PepetoSwap; a planned cross-chain Pepeto Bridge, and a Pepeto Exchange centered around verified meme utility tokens.

Every swap, trade, and future listing happening in the ecosystem passes through PEPETO token. This design is used to link the yield to actual activity to generate a demand that goes beyond short-term returns.

Experienced investors know that just because an APY is high, it is wise. It's important to have security and transparency. Pepeto's smart contracts have been audited by SolidProof and Coinsult, two reputable blockchain security companies. This layer of audit reduces the risk that is usually involved with aggressive yield offers. In a market where many yield schemes disappear once incentives subside, audited structure is an important differentiator.

Presale Metrics Strengthen The Yield Thesis

Pepeto has already raised over $7.1 million in its presale indicating meaningful confidence from early participants. The current presale cost is around $0.000000171, so the cost of entry remains incredibly low compared to potential upside.

The overall total supply of 420 trillion tokens follows a similar PEPE-style structure known to those familiar with meme trading, but adds staking, audits, and actual utility to provide a better role for the long-term future, making Pepeto one of the best crypto to buy now.

Why Early Stakers Capture The Best Opportunity, Yet The Window Will Not Stay Open

Yield opportunities are squished as awareness is built. The best APYs are almost always available to early, rather than to late participants - and not after listings and volume arrive. Once the demand rises, the yields usually decrease.

Pepeto staking provides an incredibly rare opportunity to lock in both elevated yield and early price simultaneously. For seasoned investors, this combination is tantamount to a high conviction opportunity ahead of broader market attention.

As DeFi activity keeps rebounding, the competition for quality yield goes on. The projects that give the best combination of good returns and credible structure get noticed in a short amount of time.

For informed investors of the DeFi cycles, the message is obvious. Where the best yield opportunities are found, early, before narratives take headlines. Pepeto's staking model would put it dead center in that early time frame, giving experienced investors an opportunity to get in front of the herd.

DeFi TVL Trends Hint At A Broader Recovery

Looking at historical DeFi data to put the current recovery in more context. In past bull cycles, the total value locked in DeFi started increasing months before altcoins as meme coins started gaining mainstream attention. This early TVL expansion reflected the movement of disciplined capital back into the market on the quiet, well in advance of the resurgence of retail enthusiasm. As protocols stabilized and yields became attractive again, confidence followed setting the stage for broader market participation.

Why Yield-First Investors Often Win Cycles

Yield-focused investors often do better since they are in it when others are out. Instead of trying to get bottoms in perfect time, they earn yield in phases of consolidation. This way, opportunity cost is reduced and capital is allowed to compound before price-driven narratives take command. When markets finally pick up, these investors are already in larger positions that were accumulated in a disciplined manner.

Pepeto is unique in this space because it has a combination of both things that experienced investors tend to look for. The project provides aggressive staking yields complemented with a poignant narrative connected with meme culture and innovative infrastructure. By combining both, investors can receive income while positioning for upside, instead of having to choose between income and growth. As the confidence in the market grows, projects that combine yield and story tend to receive disproportionate attention.

As presale stages progress and Tier-1 listings approach, Pepeto ($PEPETO) represents the rational investor’s answer to 2025’s meme-driven volatility, a project where fun meets function, and staking meets scale.

Official Links

Website: https://pepeto.io

Telegram: https://t.me/pepeto_channel

X (Twitter): https://x.com/Pepetocoin

Disclaimer : Cryptocurrency investments are risky and highly volatile. This is not financial advice; always do your research. Our editors are not involved, and we do not take responsibility for any losses.