- Residential: Speculators exit, builders offering freebies to lure serious customers

- Commercial: Oversupply and IT slowdown hurts rates. Prime properties vacant

- Luxury: Has few takers, builders look at mid- to low-income housing

- Retail: Impact most severe. Many builders converting retail space into commercial property

***

You know something’s not quite right when real estate brokers start sounding like seasoned diplomats. Take Praleen Chopra, who "by the grace of God" has 13 residential construction projects in South Delhi. When asked how business is going, words like ‘correction’, ‘stabilisation’and ‘cooling’ roll off the tongue. "By the grace of God, prices will start rising in six months to a year," he affirms. More circumspect is a sales officer of Oberoi Construction, a Mumbai-based real estate company that pegs its classy complex for possession in 2010, "Earlier, we wouldn’t entertain anyone with a budget of less than Rs 90 lakh; now we are taking enquiries for lower budgets." He quickly adds, "Our rates are the same."

Even though the real estate sector loathes admitting it, a slowdown is evident. After years of a dream run in property prices—which zoomed in the metros, big cities and Tier-II and Tier-III sites by anything between 100 and 300 per cent—the mood is sombre across India’s prime real estate markets. Builders are paring down residential projects and throwing freebies like confetti, speculative investment has all but dried up, and massive commercial projects that dot urban landscapes are finding no buyers. In a market where sentiment is everything, discounts are not advertised or openly discussed. Quoted rates are still what they used to be six months back. But the word is out: serious buyers can negotiate a bargain today.

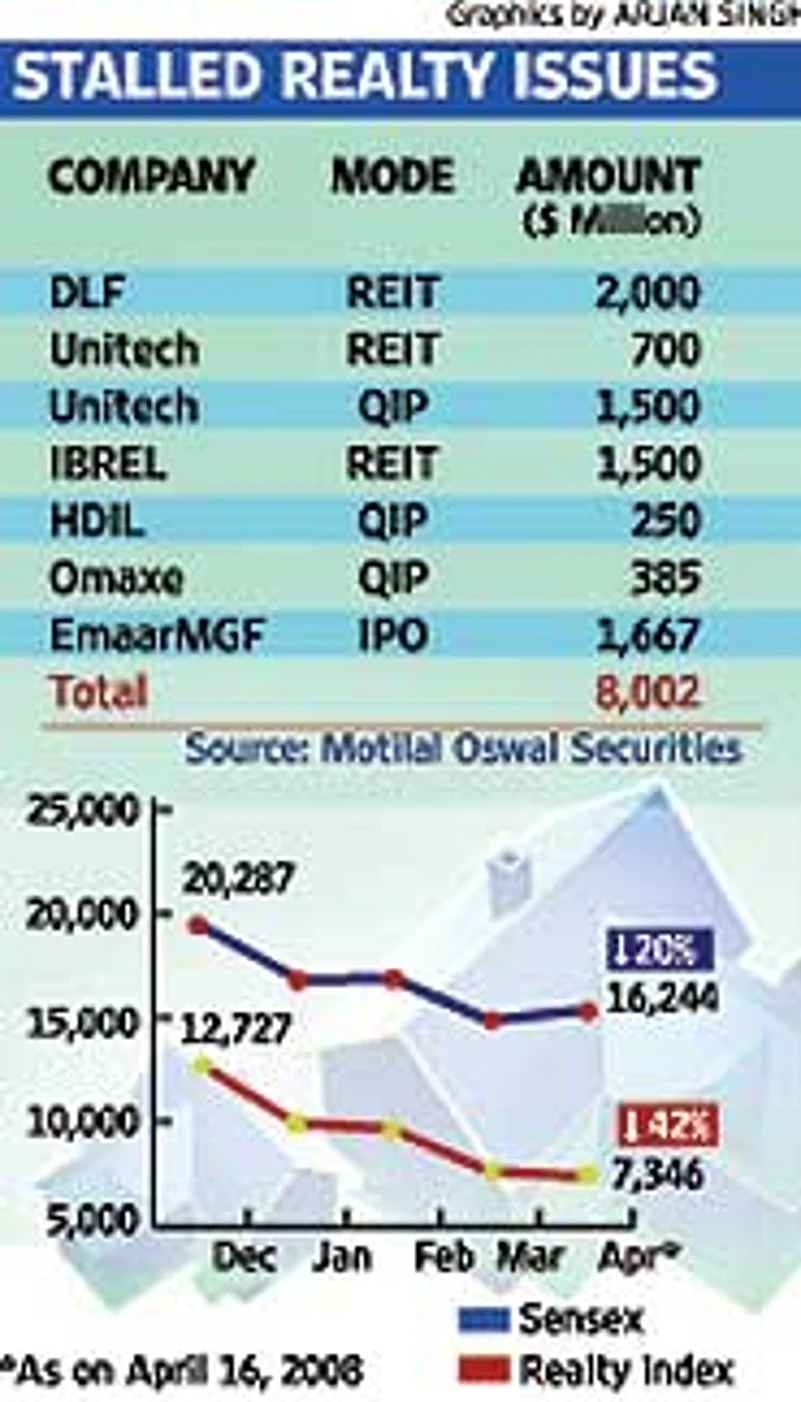

In India’s data-deficient realty market, it’s difficult to put numbers to the slowdown. But the fact is that the stock market has been punishing real estate stocks—the BSE Realty Index is down 42 per cent since December 2007, compared to a 20 per cent fall in the Sensex. Real estate firms have put off fund-raising plans. Leading tile-makers and sanitary equipment suppliers are also reporting lower orders. With speculators out of the realty market—the stock market crash hasn’t helped matters—developers are adopting a wait-and-watch strategy. And, sensing blood, consumers are bargaining hard, and even postponing purchase decisions.

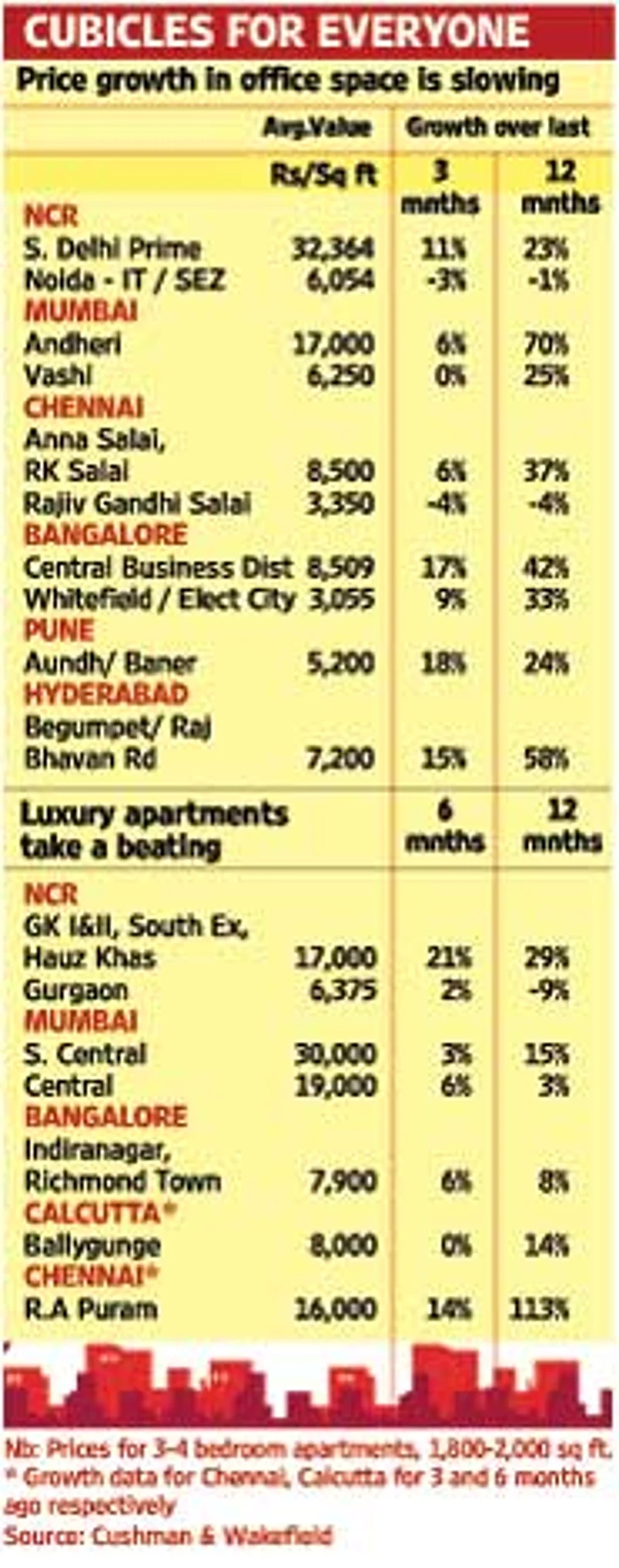

Examples of the slowdown are found across the country. In Mumbai, two prime plots at the Bandra Kurla Complex—billed as the next hot destination for companies after Nariman Point—barely fetched the reserve price at an auction in March. Barely three months back, the going rate was Rs 46,000 per sq ft; the March auction fetched Rs 32,000 per sq ft. Sources say all auctions of plots for the next few months have been postponed. Then, in Delhi’s upmarket suburb Gurgaon, home to the who’s who of corporate India, property prices in certain pockets have fallen by 40-50 per cent in the space of about six months.

Or look at Chennai, which woke up to the real estate boom later than the other metros. A piece of prime commercial land in Annanagar has not found any takers for several months. Worse, about three million square feet of IT space is going abegging. Even Hyderabad’s high-profile ‘Singapore’ and ‘Malaysian’ townships—dubbed the den of the nouveau riche—has about 400 apartments vacant with flagging demand from IT sector employees. The latest India Strategy Report from Motilal Oswal Securities warns: "Developers who are desperate for a pick-up in volumes...could resort to moderation of prices in the near term. This could negatively impact all players, especially those who have higher exposure to the middle income residential segment."

Analysts and realty consultants say the slowdown in the suburbs will be more than in bigger cities, both in residential and commercial property markets. That could also be because these areas witnessed abnormal growth in recent years. In Navi Mumbai areas like Kharghar and Nerul, for instance, where several high-end townships have come up, prices are expected to fall from the present Rs 5,000 per sq ft to around Rs 3,500 in the next few months. Chandrakant Kankaria, director of Chennai’s Olympia Tech Park, adds: "There is over-capacity in the IT, non-SEZ segment. Even in the residential segment, the buoyancy has come down. The market is in correction mode." And if Calcutta is an aberration, points out K.S. Bagchi of Bengal Peerless Housing, it’s because an overwhelming majority of buyers are the end-users.

The slump is also visible in non-metros and smaller Tier-II cities. In Bhopal and Indore, for instance, prices of land and built-up units have come down by almost 20 per cent and 30 per cent respectively since January. Around 25 per cent of the dwellings in the huge ‘Sahara Township’ have not found buyers even three years after its completion. "Given the uncertainties in the real estate business, builders rarely seek institutional finance; they depend on private moneylenders. And the moneylenders have tightened their purse-strings. The inflow of money into the business has dried up," says Brij Tripathi, joint director, town and country planning, of the Madhya Pradesh government.

Indeed, analysts agree that the problem is compounded by curtailed access to institutional finance thanks to hardening interest rates, the turmoil in global financial markets and negative outlook on the housing sector. Rising inflation isn’t helping matters. nri Narayan Reddy, who is a partner in Hyderabad’s Lumbini Constructions and a director in V3 Infra Constructions, says the steep rise in prices of cement, steel and land have made it unviable for builders to supply at the prices buyers are seeking. Developers are no longer confident that they can sell and local builders and developers with smaller stakes are fading out. Only big developers with private equity players are taking positions.

While the big players agree there’s a fall in prices, they dub it as a correction, around 10 to 15 per cent, and feel everything will be back to normal in a year’s time. Says Shravan Kumar, managing director, Emaar MGF: "The industry has witnessed corrections in certain pockets only. While speculative demand is at a low, consumer demand has been encouragingly stable. In relative terms, the industry might be experiencing a temporary slowdown." Big Mumbai realtors also agree that some correction was expected after the overheating of the market over the past three years. They add that the slowdown is more pronounced in some pockets of north India, Gujarat and Kerala, and especially in the residential segment where prices had moved up too high, too fast because of speculative buying.

But even those who point to a much-needed correction, stress the bottom hasn’t been hit. Anil Kumar, deputy MD and CEO, Ansal API, says: "There has been a correction of about 10-15 per cent in real estate prices and this could go to about 15-20 per cent in the next few months." Analysts agree that prices will remain weak for some time. Says Sanjay Verma, executive MD, South Asia, Cushman & Wakefield, "There are more sellers in the market than buyers, so prices will continue to soften although no big crash is likely."

Sure, according to the Reserve Bank, housing loans recorded a year-on-year growth of 15.1 per cent till December 2007. In fact, S. Sridhar, cmd, National Housing Bank, strongly rebuts any slowdown in the real estate sector, considering that "there is no slowdown in NHB refinancing activities. In fact, there is a normal growth of 20-25 per cent." That may well be, but everyone from developers to analysts to consumers agree that speculative buying has been snuffed out. Subir Gokarn, chief economist with Standard & Poor’s, points out, "The trend of people buying property to maximise gains is probably going down as reflected by the slower numbers in disbursements. On the other hand, interest-bearing assets are attracting more investments, as validated by the rise in number of term deposits."

For now, builders who had gone overboard with multi-storeyed residential apartments and retail mall spaces are trying to woo customers with freebies. In Mumbai, prices are being lowered for residential and commercial property on a case-to-case basis for the serious buyer. Prices in such cases are cut by at least 12 to 15 per cent, even 20 per cent in some cases, with builders willing to throw in a stilt garage (usually priced at Rs 2-5 lakh in suburban residential complexes) or club house membership fee (Rs 2-4 lakh). But these are not advertised or discussed up front.

Moreover, as Motilal Oswal’s report says, over the past few months, there have been new launches in the mid-income housing segment across the country. The response has been "encouraging", as they have been at a 20-25 per cent discount to the prevailing market rate. DLF, which has traditionally been in high-end and luxury projects, has entered mid-income housing with projects in Gurgaon, Calcutta, Indore and Kochi. Unitech too has launched similar projects in Greater Noida near Delhi. Says Pradip Jain, chairman, Parsvanath Builders, "This slowdown will lead to realistic prices; since this is a end-users market, it’s good for the industry."

While everyone focuses on the slowdown in the residential segment, the story for the commercial and retail sector is equally dismal, with demand stagnating on account of high cost and rentals. The most worrying aspect is the high vacancy rates. Reports by property consultants put the ‘vacancy indicator’ at 23 per cent higher than last year, with a steep 12 per cent rise in vacancies in the last quarter. With a number of projects expected to be complete in 2008, landlords will be at the mercy of those wanting to rent. At the height of the retail boom, 600 retail and mall complexes had received approvals from Mumbai authorities. This has been scaled down to less than half.

High vacancies in the retail market, coupled with a continuous and rising demand for commercial and office space, has led to a shift in strategies by developers. In Mumbai, for instance, developers like Indiabulls, DLF, Peninsula and retail giant Future group are converting retail space to office space. Before the slowdown, office rentals increased 30 per cent in Nariman Point and about 20 per cent in Lower Parel over a year. But rentals for retail went up just 10 per cent, according to a jllm report.

So, Indiabulls Real Estate planned to construct 1.2 million sq feet of corporate space and 4,00,000 sq feet of high-end retail at Elphinstone Mills in Lower Parel, but is now redrawing plans for a commercial complex. Future Group—buyer of Piramal’s Crossroads Mall—has reportedly changed its plans and will convert the property into an office-cum-mall complex. DLF, which bought Mumbai Textile Mills land at Lower Parel for Rs 720 crore, is also planning just a commercial complex instead of the earlier retail-cum-commercial complex.

While developers chop and change strategies, one thing is clear. With inflation and interest rates expected to stay firm, prices are not likely to increase over the next year or so. Call it a correction or slowdown or cooling, that’s good news for those in the market for property.

By Arindam Mukherjee & Smruti Koppikar with Madhavi Tata in Hyderabad, Pushpa Iyengar in Chennai, Lola Nayar in New Delhi, K. S. Shaini in Bhopal and Jaideep Mazumdar in Calcutta