- Stay liquid as the market will remain volatile for some time to come

- Steer clear of derivatives segment, which has seen really heavy losses

- Cut losses in mid- and small-cap stocks; look for value in the large-cap space

- Don't bet on the index, company fundamentals and performance are supreme

- Stop thinking short-term, invest with a long-term horizon of at least 3 years

- Don't put all investments into equity, spread your risk

***

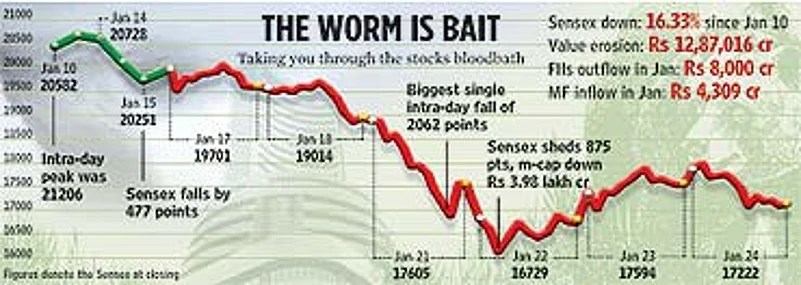

It was a rude shock for the millions who had invested in a stockmarket that seemed headed one way: upwards. While the big fall over January 21 and January 22 shaved off a quarter of the total market value—Rs 10.6 lakh crore—there was a smart recovery the next day thanks to a cut in interest rates by the US Federal Reserve. On Thursday evening, as the markets closed down yet again, reality set in. This was not a one-off correction that was going to be magically restored soon. This was the real thing, and there could be a lot more unpleasant surprises ahead for Indian investors. Particularly as many of them were still taking baby steps into the market, impressed by the phenomenal annual returns of over 50 per cent in the last two years.

The Indian stockmarket had continued rising even as markets across the globe stumbled over the last few months. Investors bid for over $190 billion of shares in the Reliance Power IPO in early January, equivalent to over a quarter of the Sensex market value. On January 10, when the Sensex reached its all-time high of 21206, the index's price-earnings multiple was an expensive 29 times. Amazed at the dramatic turnabout in a market driven by hype, dazed investors asked the usual questions: why had sentiment changed so quickly? Would the market recover as fast as it had fallen? More importantly, with the US economic recession inevitable, would the Indian growth story remain insulated from global tremors?

While finance minister P. Chidambaram sent out a strong signal to calm investors, there are no easy answers—just as there are never complete U-turns in the market, particularly for investors whose portfolios have been wiped out. While a correction was anticipated, the magnitude took everyone by surprise. Says Ashok K. Lahiri, executive director, ADB: "With Indian stocks appreciating by 50 per cent in a year, even without the current sub-prime turmoil in the US, some market correction was expected. Such a correction is a healthy thing. But the present, steep drop is a global phenomenon, much more than just profit- taking." Adds Dhirendra Kumar, CEO, Value Research: "We had taken stocks to a level that was not defendable by fundamentals. In this market, people were buying garbage at obscene prices."

The main trigger for the fall is quite apparent. Fears of a recession in the US boiled over across the world, with most global markets falling sharply. The Indian market just couldn't beat the trend any more. Also, FIIs who have been instrumental in pushing the markets to such unprecedented levels, have pulled out over Rs 8,000 crore worth of investments (according to SEBI) from the Indian markets in January alone. While the amount wasn't of significant proportions, the market clearly took note. Analysts say this created the volatility. Says Manish Shah, head of equities and derivatives at Motilal Oswal Securities: "The problem was that the savviest investors, the FIIs, were getting out, finding the valuations too high, and novices, mostly retail investors, having a short-term view and looking at quick gains, were getting in."

The high market valuations could also have pushed the FIIs, who were looking at booking profits to alleviate their sub-prime losses in the US. That's why there was a market buzz that a number of huge US institutional investors were cashing out. Says Mihir Vohra, India head (equities), HSBC Investments: "Yes, Monday and Tuesday were very tough days. Now that the over-valuation froth has been wiped out from the market, there exists a brilliant entry opportunity, especially in large caps. We have, in fact, been buying considerably in the infrastructure, telecom and banking space."

Other reasons being touted for the fall are of a technical nature. Analysts and market players feel there was a sudden liquidity shortage because of the frenzy over the Reliance Power IPO. Says Naresh Kothari, president, institutional equities, Edelweiss Capital: "The markets tanked largely because of the liquidity crisis induced by large IPOs that had confined a lot of cash. As brokers had fairly large retail portfolios, they panicked." According to market estimates, about Rs 50,000 crore was locked into the Reliance Power IPO as part of application money from qualified institutional buyers (QIBS). To this, add another Rs 10,000 crore as application money from retail investors.

All gore: Retail investors were all set to destroy the bronze bull at the BSE

But not all players are buying the theory that liquidity was tight. Say Prithvi Haldea of Prime Database, which tracks the primary market space, "I don't agree, not even marginally. This assumes that the money available in the capital markets is constant." Still, there's no doubt there were liquidity problems, particularly for investors in the derivatives (or futures and options) segment. Investors take future positions on a stock by depositing only a margin—typically 20-25 per cent—of the contract. In other words, they own the underlying shares by just depositing a fraction of its value. Many retail investors were playing in this segment, and rampant speculation was taking many stock prices—with no justifiable underlying value—to alarming levels. Most investors were in a "long" position, which anticipates a price rise in the derivative.

It is here that investors were completely caught by surprise. As prices crashed, brokers immediately asked investors to square up positions. As the fall was so dramatic—across all stocks, but particularly for mid- and small-cap shares—investors were in no position to do so. Brokers then sold the remaining part of the investors' portfolios to square the deal. And that caused large-scale panic. Stressing that 70 per cent of the daily market turnover was in intra-day trades (where no delivery is made), Haldea says: "It had reached a stage where it could have been yellow, white or green. You can't keep beating the casino all the time."

So what happens now? Will the market get back on its high growth trajectory soon? Analysts feel it will take a while before the retail crowd comes back, if at all. Badly hit by the sharp fall, the retail investor typically wakes up last. By the time he decides to sell his shares at a loss, it's already too late. The volatility in the market is expected to continue as traders complete their futures market positions. This could slow down further growth even as the market recovers from its current state. Analysts also expect a new set of mid-caps and small-caps to surface as the existing ones, having taken a beating, will take a long time to recover. "There is a chance that we have not seen the market touch its lowest depth just yet. Typically, in current situations, fluctuations occur in the range of 200-500 points for at least 2-3 months before the panic abates and some stability is reached," says Sanjay Waghle, technical analyst, Angel Broking.

The next few days could see some measured movement on the Sensex thanks to investments by state-controlled companies to lift sentiments. According to SEBI, mutual funds have pumped in close to Rs 4,600 crore into the market since the fall. Says S. Sarkar, executive director (investments), LIC of India: "We have made substantial investments as we saw value and opportunity to buy stocks, all top category stocks, which were 15-25 per cent lower. The trend for medium- to long-term is very positive."

The next big signal for the market would be the possibility of the Reserve Bank cutting interest rates when it meets on January 29. With the US Fed rate cut giving a cue, there are strong expectations in India as well. But analysts and experts are divided on whether rbi governor Y.V. Reddy will oblige. Says Subir Gokarn, Standard & Poor's chief economist, Asia-Pacific: "It's the right time for an interest rate cut, but I am not certain it will happen. There is not enough strong argument for a cut if you only look at traditional indicators. But given the overlaying market situation, there are chances." However, if that does not happen, expect some more turbulence.

And there will be challenging times ahead for the Rs 10,000 crore of IPOs slated to hit the markets till February-end; experts feel the IPO market could dry up for some time. India's largest public sector bank sbi is, however, going ahead with its offer. Says Ranjan Sundaram Srinivas, chief general manager (financial control), sbi: "Markets have partially corrected but I don't know how sustained it will be. The retail investor may take some time to come but institutional investors may use this opportunity." Other big players like Emaar mgf are also expected to go ahead with their IPO plans.

With the market still playing out, no one is suggesting that there's any change in the India story. The economic fundamentals and corporate performance remain attractive, particularly in a troubled global economy. Says Lahiri: "Fortunately, the Indian growth story is largely domestic consumption and investment driven. Despite a re-pricing of risks worldwide, lower global interest rates will continue to maintain India as a favoured investment destination." Sure, the Indian markets will grow but not as fast as they have done in the past. That's the new market reality.