Sometimes, the market presents a potential window of opportunity that aligns with certain investment strategies. For investors seeking long-term growth potential and diversification, this may be one such moment, particularly when it comes to small cap funds.

These funds invest in companies ranked 251 and beyond by market capitalization on recognised stock exchanges. These are typically younger, agile businesses that have room for expansion, and may result in higher long-term growth potential than established large cap companies, though this is subject to market and business risks.

The newest entrant in the small cap fund space is the Bajaj Finserv Small Cap Fund. The New Fund Offer period for this scheme began on June 27, 2025, and is open till July 11, 2025.

This article tells you more about the Bajaj Finserv Small Cap Fund to help you find out if it can be a suitable addition to your portfolio.

Recent Corrections have Moderated Valuations

Small cap stocks have seen corrections in FY25 following earlier market gains. As a result of these adjustments, some small cap stocks are trading below their intrinsic value, creating a favourable entry point.

According to a study by Bajaj Finserv AMC, as of April 2025, a significant number of small cap stocks were trading below their 52-week highs, suggesting that the segment may offer opportunities from a valuation perspective.

While the small cap index recorded a modest 4% gain since FY24, profit after tax (PAT) for the segment rose sharply by 38%—from ₹21,669 crore in FY24 to ₹29,941 crore in FY25. This disparity between price movement and earnings growth may point to potential value yet to be reflected in stock prices, however, small caps remain volatile and require careful assessment. Additionally, 74% of the top 250 small cap companies reported double-digit returns on capital employed (ROCE), reflecting operational performance and healthy fundamentals despite recent price corrections.

Source of data: ACE Equity. Data for FY 2024 is as on March 31, 2024, for FY 2025 is as on MAR 31, 2025

The Bajaj Finserv Small Cap Fund seeks to identify such companies – those that are fundamentally sound but trading at an undervalued price. This is part of the fund’s 3 in 1 approach that combines quality, growth and value.

The focus on quality companies and undervalued opportunities can help the fund mitigate some of the risk associated with the highly volatile small cap segment. The emphasis on growth, meanwhile, investors may consider evaluating this opportunity, based on their risk profile and goals.

The Role of Active Management Matters

Typically, large cap companies get more analyst and media coverage than small caps. When publicly available information is limited, professional fund management can help fill some gaps. For investors who do not have the time to research individual companies, an actively managed small cap fund may offer a more convenient way to invest. Active management and strategic stock selection can also mitigate some of the small cap segment’s volatility.

Things to Keep in Mind

Small cap funds may offer higher growth potential over time, but they also come with more ups and downs. This makes them suitable for long-term investors with a very high risk appetite.

One way to mitigate risk while investing in small cap funds is through Systematic Investment Plans or SIPs. These helps you invest small amounts regularly, spreading out your investment over time and potentially reducing the impact of volatility through rupee cost averaging.

If you’re exploring mutual fund options to add variety to your portfolio, small caps may be one element, provided it aligns with your investment goals and comfort with risk.

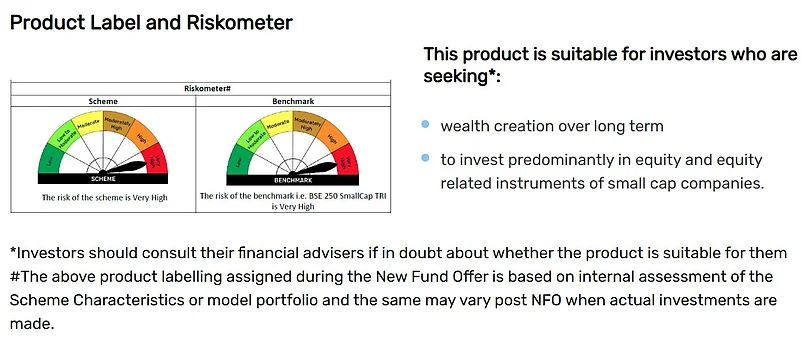

Product Labelling – Bajaj Finserv Small Cap Fund

Riskometer: Very High

This product is suitable for investors who are seeking:

Long term capital appreciation.

Investment predominantly in equity and equity-related instruments of small cap companies.

Benchmark: Nifty Smallcap 250 TRI

Conclusion

With the Bajaj Finserv Small Cap Fund NFO ongoing, investors may consider taking this opportunity to tap into the potential long-term growth of this segment, while managing risk by investing in quality companies and undervalued opportunities. Current market conditions, including economic recovery signals, moderated valuations, and a growing domestic investor base, can create an environment that may be suitable for long-term exposure to this segment.

Consider your investment horizon, risk appetite, and financial goals before investing. Consulting with a financial advisor may help determine whether participation in the Bajaj Finserv Small Cap Fund NFO aligns with your broader strategy.

Investments in the Bajaj Finserv Small Cap Fund start at Rs. 500 for lumpsum and Rs. 500 and above for SIP (with minimum six instalments). To know more about the fund or to invest, visit www.bajajamc.com.

Riskometer and Disclaimers:

This scheme is suitable for investors seeking: Long term capital appreciation; Investment in equity and equity-related instruments of small cap companies. Riskometer: Very High

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This is a sponsored article. The views expressed are for informational purposes only and do not constitute investment advice. Please consult your financial advisor before investing.

Disclaimer: This is a sponsored article. All possible measures have been taken to ensure accuracy, reliability, timeliness and authenticity of the information; however Outlookindia.com does not take any liability for the same. Using of any information provided in the article is solely at the viewers’ discretion.