During April-January '07-08, India had seen inflows of over $26.8 billion from foreign institutional investors. However, the FIIs have pulled out around $3 billion from the country in January. Says Mihir Vohra, head (fund management, equities), HSBC Investments: "The markets continue to be unpredictable as the global cues are not stable even as of now." While domestic mutual fund inflows have picked up, the outlook remains bleak. Says Shankar Sharma, director, First Global Brokerage, "I foresee very steep declines ahead and predict a very treacherous market. India Inc's earnings are disappointing and will continue to be so because we are not delinked from global factors." Manish Sonthalia, VP at Motilal Oswal Securities, partly concurs: "Clearly Asia has not decoupled itself from the US as was widely believed. But one can remain optimistic on the markets going forward, keeping valuations in mind."

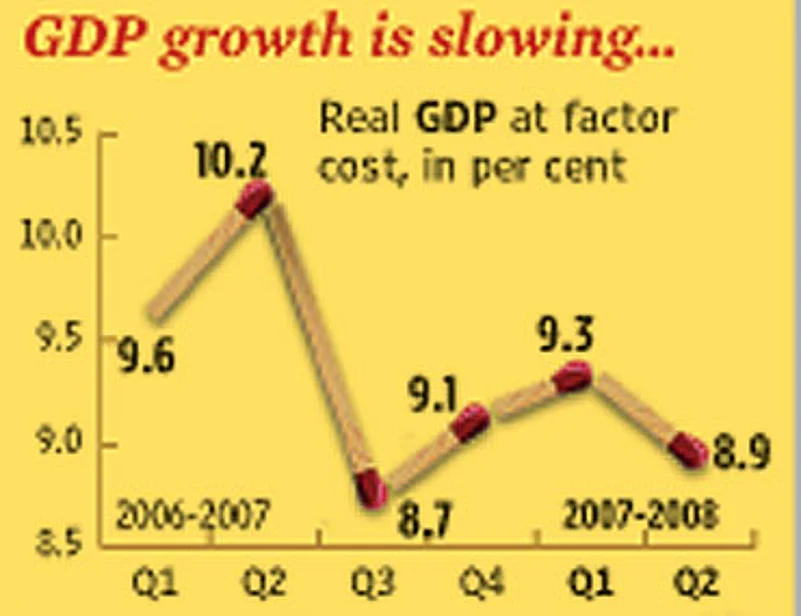

Despite many odds, there continues to be optimism that the Indian economy—which is looking forward to around 8.5 per cent growth in 2007-08—will not be significantly impacted by the bad news from the US. But the foreign funds outflow is taking its toll. Says N.R. Bhanumurthy of the Institute of Economic Growth: "In the past, whenever the rates were cut in the US, funds would generally flow to emerging markets like India. But this time around, we have not seen any such trend. Instead, we are seeing foreign fund outflow. This gives room for RBI not to reduce interest rates. It can now focus on inflation control."

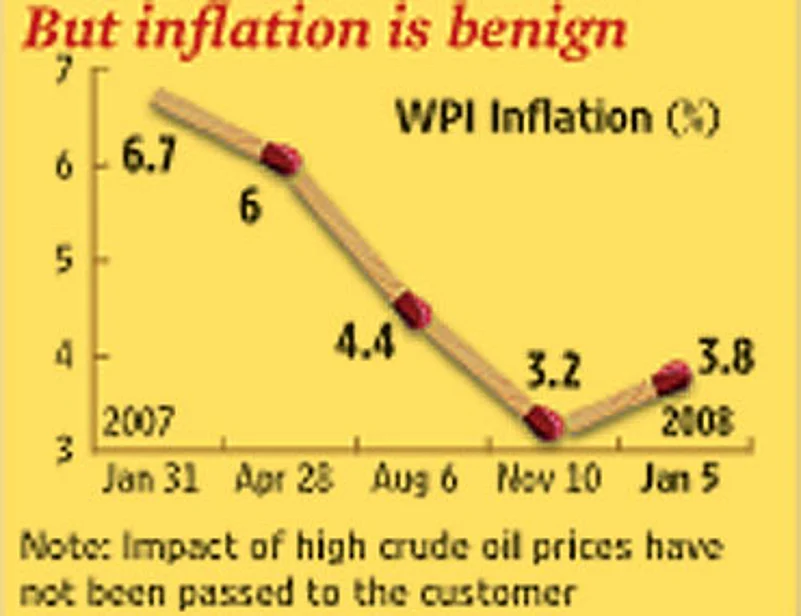

Now, the second cut in US interest rates this month has created a rate differential that could aggravate India's task of controlling liquidity and checking inflation. The central bank has been buying dollars to stem the impact of an appreciating rupee, thereby increasing liquidity in the system. Global financial market players are expected to continue restructuring their positions from high-risk assets and reinvest through the first quarter of 2008. "This will also determine to what extent the fund flows will be allocated to emerging markets such as India and others," says Sanjay Aggarwal, national industry director, financial services, KPMG, who warns of a snowball effect due to the volatility created by the FIIs.

Last year, India responded to a hike in the US interest rate after a time lag of nearly a year. This time around, opinions are divided whether the RBI would go in for a rate cut soon after Budget 2008, instead of waiting for the next review on April 30. The general sentiment is weighed in favour of a cut. Based on his study of global markets, ieg's Bhanumurthy stresses that India needs to hurry with an interest rate cut to be more in line with global trends. "The time lag in domestic monetary policy response to the actions of the US Fed should be brought down compared to the past. That's because the integration of the domestic financial market with the global markets is much stronger now than in the past," he says.

Moreover, fact is, all is not well in parts of the economy. Given the backdrop of a slowdown in industrial growth in November 2007, the focus is now on the third quarter results by companies. Also, the appreciating rupee has slowed export growth and led to lower employment generation. The rising rupee has started impacting services exports. High interest rates since early last year have also resulted in slower credit offtake by institutions and retail consumers, thereby slowing down the industrial growth momentum. Urging lowering interest rates, Anshuman Magazine, MD of real estate consultant CB Richard Ellis, says: "While the government is more concerned about inflation, there is shortage of debt in the market. Normal borrowing from the market is very difficult and expensive."

Though many are disappointed that Reddy did not go in for a rate cut, economists share the optimism that India is well on course to maintain the growth momentum, though lower than 9.6 per cent last year. In fact, NCAER has revised its forecast since October to peg growth in '07-08 at 9.1 per cent. Explains Shashanka Bhide of NCAER: "The actual impact of a global slowdown will be seen in 2008-09. For 2007-08, we are optimistic of 9.1 per cent growth, given that in the current year, large capital inflows have kept the investment climate positive."

And there are many who share the government's view that India's growth surge is largely due to its intrinsic strength led by domestic factors. Says Nagesh Kumar, DG of Research and Information System for Developing Countries: "Earlier, South Asia was highly dependent on the US economy for growth impulses. But of late, with the rise of China and India, the region has become relatively less susceptible to the fluctuations in the US economy. Yet, any slowdown in the US is expected to affect all countries—some like India, relatively less."

Shantayanan Devarajan, chief economist, South Asia region of World Bank Group, agrees. "A recession in the US will have only a mild effect on South Asia because the US's share in the subcontinent's trade has been declining. China has replaced the US as India's largest supplier of imports." On an optimistic note, Devarajan states that in the event of a major recession in the US, the effect on India will be around one percentage point, "which, from a base of 8 per cent growth, is not devastating."

Despite expectations of a limited impact from a US recession, experts warn that South Asian countries will have to be proactive given their domestic macro-economic problems. In Reddy's words, the situation is very complex and there are no easy answers. Given that there's just one year to go for the general elections, containing inflation is on the top of everyone's mind. But there are other factors at play in a fast-changing global market.