Pretty soon you can forget about carrying a wallet, as your mobile phone will help you make payments at the malls, help book cinema and railway tickets, as well as a host of sundry other payments.

From the advent of plastic money and operating your bank account through mobile internet, now, in another major leap, the mobile itself will carry the cash, or host your virtual bank account.

The Reserve Bank of India has recently authorised several companies to issue pre-paid payment instruments with which Indian citizens can settle transactions at merchant establishments. Many of these firms will use the mobile phone as their medium of payment—a move that could give a huge boost to m-commerce in India.

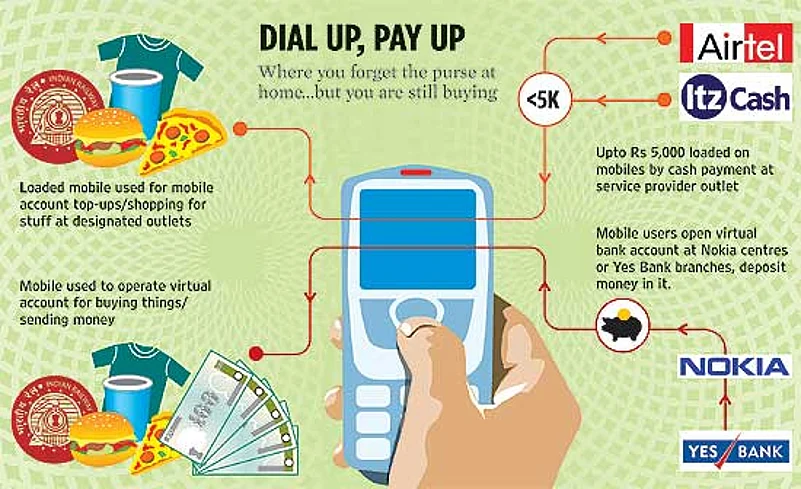

How will the system work? A mobile wallet allows a person to exchange physical cash for virtual money, which is stored on the network and is accessed through mobile phones. This virtual money can then be used to purchase or pay for various goods and services at specific merchants who accept this form of virtual mobile money.

While the exact mode of operation is yet to be fixed by service providers and merchant organisations, available technologies enable such transactions to happen through SMS, bluetooth, through a built-in bar code reader application in phones or even through direct communication between the phone and a card reader at the merchant organisation.

At the user end, the operation will be pretty simple. All that a mobile user would need to do is pay cash to the mobile wallet provider to load his/her phone with credit and then use the virtual money for mobile phone top-up, bill payments, buying things at shops that accept mobile payments or even to buy tickets. What should cheer millions of Indian mobile owners is the fact that the system does not necessarily require high-end smart phones.

Naveen Surya, MD, Itz Cash Card Ltd, one of the several RBI-authorised companies for this service, says, “This will be revolutionary. Only 10 per cent of India’s population uses credit or debit cards. Mobile phone usage is far bigger and now anyone with a mobile phone can use the handset as a payment instrument.”

While RBI has currently set Rs 5,000 as the maximum limit for uploading cash on the m-wallet, looking at India’s 700 million mobile users, this could be big business. Companies like Airtel, the first telecom company to be authorised to offer mobile wallet services, are extremely optimistic and feel this will create mobile money and payments as a specific category in our country.

The only catch—whether supportive infrastructure will keep pace with the demand. Says Romal Shetty, telecom analyst with kpmg, “A mobile wallet will work just like a debit card, so it is essential that an ecosystem of merchant organisations which accept such payments builds up here.”

Of course, all this would come for a price, but that is something the service providers will determine only after rolling out their offerings. A major determining factor would be how many players come into the system and what kind of infrastructure they set up, stresses Surya of Itz Cash Cards, which is gearing up to roll out services in the coming months. A part of the Subhash Chandra-controlled Essel Group, Itz Cash Cards already has its consumer infrastructure in place (being in the business of cash cards).

And just like mobile phones, a proliferation of players and services would boost the acceptance of this new mode of payment. Says Atul Bindal, president, mobile services, Bharti Airtel, “Mobile wallets, like any other form of payment system, would require wide acceptance and availability in order to be successful. It will require what can be called a ‘network effect’—more customers will attract more places to accept these payments, and vice-versa.”

Among the big players, Bharti is the first to have entered the fray. Others too are expected to come into the ring soon with their offerings. With more players and more services, it is possible that the RBI ceiling of Rs 5,000 may be raised, enabling other high-end purchases, like booking of air tickets, through the mobile phone.

Meanwhile, mobile hardware manufacturer Nokia is promising to take the mobile phone to a higher level in banking and payments for financial inclusion. In collaboration with Yes Bank and mobile payment enabler Obopay, Nokia is helping mobile users to open virtual bank accounts on their phone and use the handset not just to make payments but also to transfer money. The Nokia Money Service, which started as a pilot in Pune and Chandigarh, has moved on to a commercial rollout.

Suresh Vedula, director, new business, Nokia India, says, “Banks do not go deep into the rural areas as they do not find it commercially viable to maintain a branch or accounts. That is where this service can be useful as you do not need to have a bank account.” Under this scheme, anyone can walk into a Nokia money centre or Yes Bank branch and deposit money into a virtual mobile phone account which can then be used for transactions.

Obviously, one of the primary concerns is of security, looking at the vulnerability of monetary transactions over the Internet and credit cards in many countries. Airtel’s Bindal isn’t worried though, “Mobile money and mobile wallets have been around for a while across other markets. Recent technology developments make mobile money transactions completely secure...so customers can use the service with complete peace of mind.”

What happens if the mobile phone is lost or stolen (something common in India)? Will the money loaded on it also be gone? Companies assure that since all such mobile transactions would require several layers of encryption and passwords, money in a mobile wallet would be safer than its physical equivalent—it can be easily transferred through the service provider to another handset after the wallet owner’s identity is established. And since these instruments do not permit cash withdrawal even by the holder, except in the Nokia-Yes Bank service, the question of losing money does not arise.

So will India take to mobile wallets? India has been slow in the adoption of credit cards as an alternate mode of payment but mobile phones are a different ball game—they have redefined the many daily functions for Indians. The mobile wallet could be the next big change that is coming.