Green card holders who have met the standards for naturalization must be wondering if obtaining U.S. citizenship is the best decision for them. If your intention is to establish permanent residence in the United States, the quick and straightforward answer is yes. The following are very essential considerations that every lawful permanent resident should think about right now.

1. The Right to Vote

All federal elections are open to all US citizens over the age of 18. Your voice will be heard if you become a US citizen and exercise your right to vote!

2. No Deportation - a Benefit of Having a Green Card

Although lawful permanent residents (green card holders) have permanent immigration status, people may be expelled from the United States for a variety of reasons, including committing a major felony. Some people believe that non-citizens and non-citizen immigrants face a more difficult legal system in the United States.

3. Lower Long-Term Costs

The current filing fee for renewing a green card with the Department of Homeland Security is $540, and this cost will climb over time. The current filing fee for applying for naturalization is $725. You will never have to renew your green card again if you become a US citizen, which can save you a lot of money!

4. You Are Allowed to Bring Your Family to the United States.

Only US citizens may petition for the entry of their parents, siblings, and married adult children. Furthermore, the petition will benefit not only the US citizen's siblings and married offspring but also their spouses and children under the age of 21. Green card holders, on the other hand, can only petition for their wives and unmarried children.

5. You Earn the Right to Carry a US Passport.

With a US passport, you can visit more than 180 countries without a visa. This will not only save you time and money while traveling internationally but will also allow you to re-enter the United States without limits. As an added bonus, US passport holders receive help from US Embassies and Consulates when traveling outside the US, whereas green card holders are not accorded the same priority as US citizens.

6. You Earn the Right to Travel Outside the United States for Extended Periods of Time.

The United States Department of Homeland Security may consider a green card holder to have "abandoned" their permanent residence in the United States if the individual is absent from the country for more than six months (180 days). If you are a US citizen, you are free to leave the nation for as long as you choose with no legal consequences.

7. You Earn the Right to Receive Additional Federal Benefits.

Many federal employment opportunities, grants, scholarships, and other government perks are unavailable to green card holders. As a U.S. citizen, you are eligible to apply for all federal benefits, including jobs at federal agencies and federal college funding, which are exclusively accessible to U.S. citizens.

8. You Will Have a More Convenient Re-entry into the United States.

No more waiting in long lines at customs while returning to the United States from a foreign trip. As a US citizen, you will be able to re-enter the country more quickly and easily. If you have US citizenship, you will also have simpler entry and exit into other international countries.

9. Children Automatically Become Citizens of the United States.

As an American citizen, your children will automatically become citizens of the United States. This is true even if they were born elsewhere. According to the US State Department, if your child is born outside of the US, all you need to do is notify a US embassy or consulate.

10. Benefits of US Tax Law

You can leave real estate to your spouse if he or she is also an American citizen. That property will pass to your spouse and be exempt from property taxes. This can be a significant saving. Other tax-free exchanges of real estate between married US citizens are also permitted under US tax law.

Benefits of US Citizenship: Why You Should Apply

Citizenship supporters frequently emphasize the patriotic and emotional benefits of naturalization. Let's explore the advantages of being a naturalized US citizen.

Published At:

A table with a visa application form

A table with a visa application form

- Previous Story

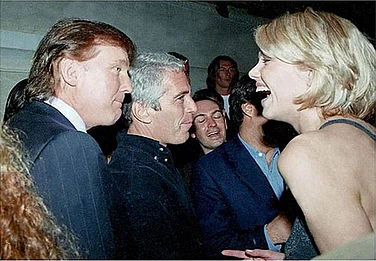

The Epstein Files: A Network of Criminal Socialites in a Rotten System Called Capitalism

The Epstein Files: A Network of Criminal Socialites in a Rotten System Called Capitalism - Next Story

WATCH

MORE FROM THE AUTHOR

PHOTOS

×