The big day has come and gone. All the excitement created a fortnight before the budget ended with its presentation. Debates over the budget (good or bad) will continue for some time to come—however, the euphoria is over. Why was there so much excitement? Were we expecting fireworks from the finance minister? Does the budget presentation really matter? It is the Anchoring Effect at work here. We are so anchored to the past that we still go on giving undue importance to the budget, something that actually lost its meaning with the liberalisation of the Indian economy in 1991.

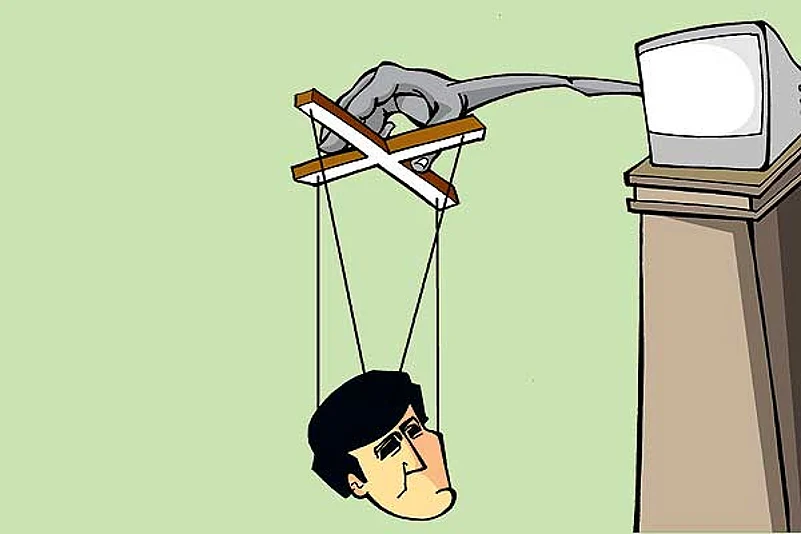

The media created the availability bias. All the channels, business ones in particular, were geared up for Friday, February 26, 2010. You had posters of eminent personalities who would be giving their views on the budget. Then you had the ad by a business newspaper with “BUY, HOLD, SELL” strategies to be passed on by the so-called market experts. Newspapers are meant to give news. However, now they have started providing investment advice. We are seeing an era of convergence of media and finance.

Investors, for a moment, please reflect back and think. Can you make investment decisions based on such advice on the budget day? If you did participate, then you were speculating and not investing. I am sure you are repenting for getting carried away by the noise. Well, you got trapped in the media fight for TRP ratings.

Weeks before the budget, we had been hearing so much debate about what the government should do and what it shouldn’t do. Different experts from different fields gave their take on what the FM should be doing. Did anyone care to understand the stark realities? You have to be in the FM’s shoes to understand that. These advisors were speaking from their point of view with mostly half-baked knowledge.

Finally, budget day arrived. The speech starts and everyone is glued to the TV. The stockmarket fluctuates with the proposals coming in. Can we act on mere proposals without reading the finer print? However, experts were ready on different channels giving their expert views on a certain proposal that will affect industry and this resulted in wide fluctuations in stock prices. There was chaos as every analyst, business head, professional became astrologer trying to predict the effect of the proposals. They gave judgement on what the FM should have done and not done. This chatter ended with the closing bell of the stockmarkets.

Viewers were now more confused: one by the predictions of the astrologers and other by the fluctuations in stock prices. They waited for more gyan from a different set of brilliant experts to comment on the budget in the evening.

Evening shows after the markets were reserved for the politicians from the ruling party and the Opposition, the captains of industry, stockmarket pundits, the bankers and the leading advertisers of the respective medias. Each one had an agenda. The ruling party defended the budget proposals while the Opposition slammed it. The diplomats praised the budget, criticised it and at the same time sympathised with the FM. Others blamed the FM for missing an opportunity. Ultimately, all were talking from their own point of view. This left the viewers more confused and past midnight they went to bed wondering whether the day was well spent and what did they learn? The Sensex fluctuated widely and that made them more confused.

At the end of it all, one has to wonder—was all the noise worth it? What was the outcome? One media company was adjudged winner on TRP ratings. Who made that happen? The viewer in front of the idiot box. The intermediaries did good business. Who made that happen? The viewer, who bought and sold stocks sitting in front of the box. The actors gained publicity. How did that happen? The media made it happen.

Some rational thoughts to round things off:

- The budget had some meaning when we were in a closed environment. However, with liberalisation, it’s lost its meaning. It’s only the media fanning the hype to increase TRPs.

- Making investment decisions based on information flowing on the budget day is akin to gambling. You only make the intermediaries rich.

- Budget proposals need to be studied in detail. This takes time. Experts shooting off their comments on budget day are misleading you. You must avoid any activity on stockmarkets based on such expert comments.

- Life’s simple. Don’t complicate it by joining the chaos.

(The author is chairman, Parag Parikh Financial Advisory Services and author of Stock to Riches)