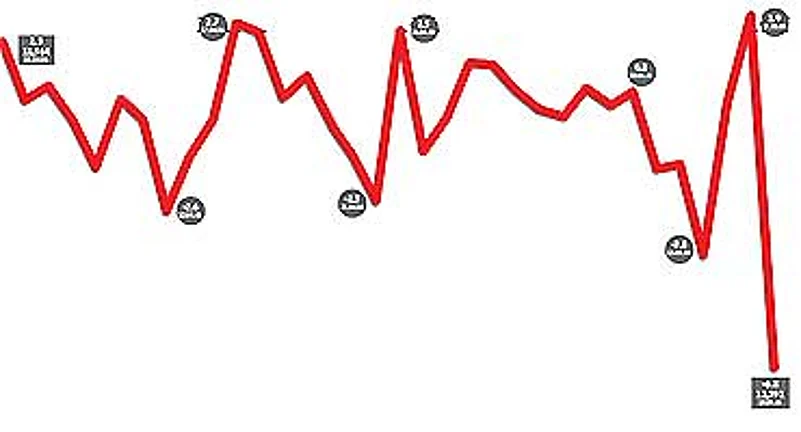

Mercifully, it was a Saturday and the markets were closed. But on Monday (May 15), a typical herd mentality gripped the traders and the speculators. "The most important cue for retail investors is to see what the FIIs are doing. When they saw that the FIIs had got out of the market so quickly, there was panic," says one investor. Adds a bemused sub-broker: "When a large FII sells, others see it happening and doubt their own long position. They sell too. This results in a domino effect. The result was evident on Monday."

Explains Agrawal: "The market was sitting on a tip. And when news came in on Monday of FIIs selling and the global meltdown in metal prices, including a rumour that the London Metal Exchange (LME) had halted futures trading, everyone started selling the Nifty futures. That drove the spot prices downwards." The drop in metal prices the same day acted like a catalyst. On LME that day, zinc crashed by a whopping 10 per cent while copper and aluminium too fell considerably—by seven per cent. Even gold futures lost five per cent. "India is a price-taker and not a price-maker in the metals space," says Sinha, adding "so the impact of the LME crash was bound to be felt here."

As market pundits calmed down the investors, saying that Black Monday was entirely due to the fall in metal prices, the Sensex recovered on Tuesday and, what's more, zoomed the next day. It was strong buying by the domestic mutual funds that helped. "Domestic funds showed this time that they were big enough to support the market," says Amitabha Chakraborty, head of the private client group, BRICS Securities. But the sentiments changed.

On Thursday, the traders realised that the FIIs had continued to sell heavily on the previous two days—net sales of Rs 728 crore and Rs 533 crore respectively. An additional factor was a huge slide of two per cent in the Dow Jones Industrial Average on Wednesday night (India time) and a drop in the Nikkei by 1.35 per cent. The newly released figures for US consumer prices showed an upward rise of 0.6 per cent.

The higher US inflation data, coupled with a 25 basis points hike in interest rate by the US Fed Reserve a few days ago, prompted Dow's sharpest single-day drop in three years. Partly because of this, the dollar too fell to a historic low against the yen the same day. By Thursday noon, there was palpable panic on Dalal Street. The Sensex went into a tailspin as investors cashed out of an uncertain market. "We did know that a correction was in the offing. Global events on Wednesday were an indication," says a leading broker.

Hedge funds were among the larger FIIs which sold that day. A Mumbai-based broker explains why they walked out: "They borrow in dollars and yens to invest in India and other emerging markets. With the dollar-yen exchange rate falling, such a strategy clearly becomes an expensive proposition for the borrowers. And because of the higher US interest rate, it makes more sense for them to invest in the US market. It is common knowledge that FIIs will reduce their exposure in the emerging markets and increase it in the US if the Fed keeps hiking the interest rates."

Market rumours contributed to Thursday's fall. The previous day, the media had speculated that the finance ministry was planning changes in tax regime for traders who were going scot-free and paying low or nil taxes on their earnings. This was quickly interpreted by the harbingers of bad news as a huge blow for the FIIs. The interpretation was that the foreign investors will be deemed as traders and, therefore, end up paying a high 40 per cent tax on their bumper profits from the Indian markets. It was only after the end of the Thursday's trading session, at 4.15 pm, that FM P. Chidambaram clarified that no FIIs operating in India had been assessed as traders. He added that they were investors because they have no permanent offices in India.

But the damage had been done by then. During the 826-point collapse, every stock in the BSE's 30-stock Sensex and the NSE's 50-stock Nifty fell. Other indices (like mid-cap and the sector-specific ones) on the two exchanges crashed by 4-8 per cent. Of the nearly 2,500 stocks regularly traded on the BSE, 2,250 registered medium to heavy declines. Only the remaining few registered small gains or hung on to their previous day's levels. Most stocks that rose were of lesser known low-cap firms. These included trn Textiles, Weizman, Nucent Finance and Keynote Corporate Services.

Kotak Securities' Sinha says he has been warning investors against a possible correction, but notes that people do not think of getting out when the markets are doing well. Although the fundamentals were strong, a drop like this was expected as valuations were stretched and they are likely to come down to more attractive levels, he adds. Andrain Mowat of JP Morgan agrees that the Sensex will look attractive again if it corrects by 4-5 per cent and goes below 11,000. The implication being that the buying frenzy will restart at the lower levels. Nimesh Kampani of JP Morgan Stanley categorically states that the India story still looks good on a long-term horizon of 3-4 years.

Global investment gurus like Jim Rogers remain bullish and discount the correction in the commodities market too. In a TV interview with CNBC, he said "all markets have reactions and consolidation.... In the 1970s, gold went up by 600 per cent, then it went down 50 per cent over a two-year period, only to turn around and go up another 800 per cent." He adds that commodities normally have a 15-20 year bullish cycle and this is only the sixth year of the current run. Rogers was proved partially right when commodities did rebound on Wednesday, after the huge drop two days before.

Other analysts aren't sure. They contend that the interest rate in the US are likely to go up again, after an uninterrupted 25 basis points at regular intervals for the past 21 months. The future of the dollar can be quite choppy, and that can make the US markets more attractive than the emerging ones. Moreover, most global markets are getting overheated and may witness a severe correction. In the case of India, current valuations now match corporate earnings. So, future earnings will have to improve dramatically for valuations to go up. Finally, the Indian government is expected to substantially raise oil prices.

Geopolitical considerations may also come into play if and when the US, having already invaded and occupied Iraq, attacks Iran's nuclear facilities. Some experts think that the Washington is ready to launch an attack on Tehran. Points out a Mumbai-based analyst, "Given the enormous liquidity (availability of funds) globally, the investors in emerging markets have been too busy making money to bother about geopolitics." At least until now.

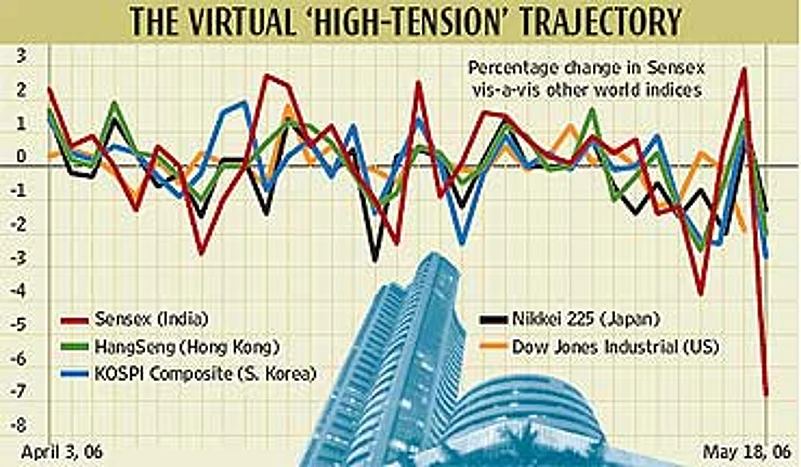

Kampani says there is a possibility that, in the short run, it may turn out to be yet another classic case of "what goes up fast comes down fast too". And the recent rise in the Sensex has been really astonishing. In fact, if one compares the Sensex movements with the indices in other markets like Japan, Korea and Hong Kong, one notices that the Sensex rises by a much higher per cent on days when almost all the markets go up. Little wonder then that when the crash (or the correction) comes, the pain is more intense too.