In today’s digital and regulatory-driven landscape, businesses across industries face the dual challenge of meeting complex compliance requirements while striving for operational efficiency and innovation. The intersection of technology and regulatory compliance has emerged as a critical field where even minor oversights can result in significant penalties, while effective solutions can save companies millions in costs and countless hours of work.

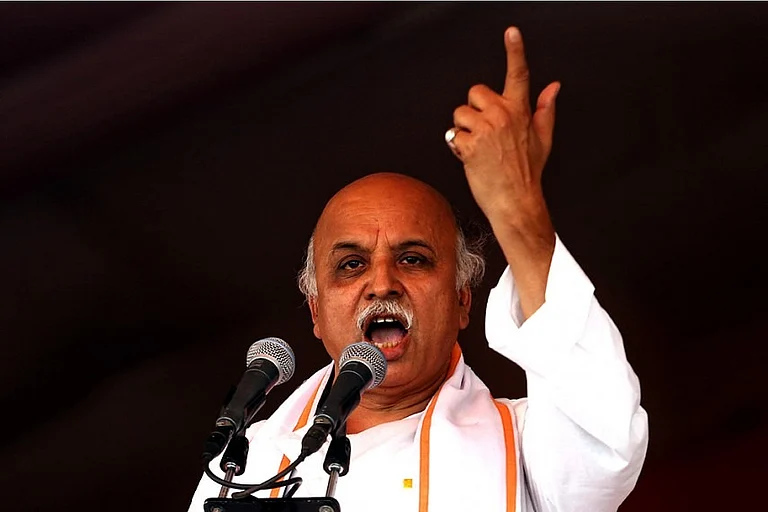

With a dual focus on technology and regulation, Praveen Kumar Koppanati has successfully delivered innovative projects in several industries earning efficiency, precision and adherence to rules for clients in worldwide commercial insurance, retail, and more. His rich experience incorporates a wide array of engagements including creating advanced automation structures, and interfacing with demanding regulators, all of which illustrate his ability to conceive and execute solutions that produce results for organizations that operate in very careful markets.

Praveen made a groundbreaking contribution to the insurance industry by being the first to develop an advanced OFAC Compliance module within the Commercial Insurance Suite, an essential tool for many U.S. companies. Such an effort is crucial for companies that deal with highly sensitive information about their clients since the risks are high because the penalties for breaching compliance requirements can be devastating. Functioning both as a builder and a designer of the OFAC module, Praveen devised an ingenious mechanism that is capable of scanning multi-layered databases, and identifying contacts required OFAC checks in a matter of minutes. The system currently processes up to 300,000 records daily. Additionally, the solution efficiently compiles the minimum appraisal data required by the U.S. Treasury's investigative section, allowing the client to rest easy that its operation is both compliant and correct.

Playing a crucial role in developing an automation framework for one of the biggest insurance clients from scratch, he used JavaScript and later incorporated it into a larger project. “The work was done within the CI/CD pipelines where the testing stages were enhanced and the post-build scripts were simplified”, he informs. This automation helped to reduce the apparent end-to-end script execution time from 10-12 minutes to about 1-2 minutes which is a significant efficiency improvement that decreased testing phase durations and enhanced the development team’s workflow. More than that, the framework also allowed for speeding up the product release due to the need in this industry to be able to quickly adjust to the changes in the law and regulations.

In addition, he has also worked on the active development of middleware solutions and this has played a meaningful part in the transition from a more traditional and rigid single-tier monolithic design models to more flexible micro-service-based model approaches. This was achieved by replacing the current systems with new ones concentrating on scalability and flexibility, thus helping the insurance client to be more proactive in dealing with the shifting market and the regulatory changes that come into force. Micro-services architecture has lessened the client’s reliance on the existing legacy systems thereby facilitating a system where modernization, modification, and incorporation of new elements can be done across different functional areas of the client’s operations without friction. This architectural evolution ensures that clients’ systems are well-equipped to thrive in today’s fast-paced and ever-changing technological landscape.

Praveen remarks, “I firmly believe that through extensive QA, fatal data discrepancies can be addressed. In addition, orchestrating an issue-free launch becomes seamless by coordination with business analysts and developers”.

Further than insurance, he was also required to modify the testing procedures to accommodate seasonal color launches where he created a strong QA test plan to make sure the complex station applications utilized for drinkware customization worked well. These applications were 'turned on' in the process of using engravers and barcode readers which presented complications as it dealt with the blending of physical and digital technologies.

The approach to automation extended to retail customization, particularly in building regression suites and conducting functional tests that reduced the need for repetitive checks, thereby conserving valuable testing hours. Additionally, his role in developing a JavaScript-based automation framework from scratch positioned the retail project to better handle frequent and extensive updates, enabling faster product iterations and improved customer satisfaction.

At the driver information systems, his architectural insights proved essential. He designed a system that would support data on driver tenure for an insurance client, ensuring accurate record-keeping. This system, which continues to operate without production errors even years after its launch, showcases its commitment to creating reliable, long-term solutions.

Across projects, Praveen Kumar Koppanati’s adaptability and attention to detail have positioned him as a key figure in bridging the technical requirements of complex architectures with the stringent demands of regulatory compliance.

The contributions underscore a broader shift toward efficiency-driven solutions in tech-driven industries, and his work highlights the growing importance of adaptable, automation-led systems that can keep pace with the rapidly evolving standards of compliance and customer demands. Through his dedication, he has set new standards for quality, efficiency, and reliability, enabling clients to achieve compliance while also innovating technological capabilities.