Best Direct Loan Lenders No Credit Check: If you are facing urgent financial distress and have bad credit, do not worry! You can still get a loan from direct loan lenders with no credit check. These lenders offer short-term loans such as payday loans, and we have compiled a list of thetop 7 direct lenders who provide such loans with quick approval.

The best part is that these lenders do not consider your credit score or employment status. Browse through our list of top-rated lenders in 2023 to find the perfect same-day or online payday loan that suits your financial needs.

Advertisement

Top 7 Best Direct Loan Lenders No Credit Check 2023

Here is a detailed table of the best direct payday lenders with no credit check and their loan amount range, annual percentage rate and loan term:

Detailed Overview of the Best Direct Loan Lenders No Credit Check

👉Loans With Fast Approval And Disbursal

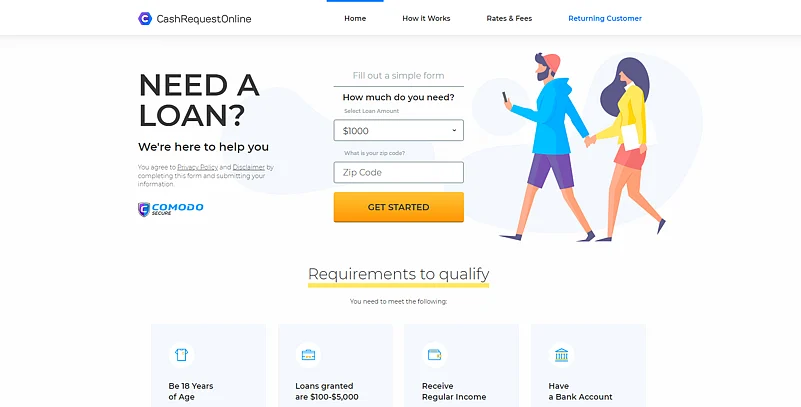

Cash Request Online offers short-term loans of $100 to $5,000 to even bad credit borrowers with flexible terms and Annual Percentage Rates ranging from 5.99% to 35.99%. They are a suitable alternative for borrowers with no or bad credit because they do not necessitate a hard credit pull.

Advertisement

However, borrowers should be aware that Cash Request Online' no-denial payday loans direct lenders only APRs are higher than other types of loans, so they should only be used for emergencies.

👉Highlights

- Hassle-free application procedure

- Quick disbursal of loan application

- No hidden or application charges

👉Loan Amount, Term and Interest Rates

- Loan amount ranging between $100 to $5000

- Annual percentage rate ranging between 5.99% to 35.99%

- Repayment tenure up to 24 months

👉Eligibility Criteria

- The borrower must be 18 years old.

- They also need to have a valid United States identity card.

- The borrower must have a stable source of income.

👉Application Procedure

- Step 1: Visit the official website of CashRequestOnline.com

- Step 2: Select the loan amount you need to borrow

- Step 3: Enter your email address

- Step 4: Enter your personal details and confirm your identity

- Step 5: Submit your request and receive your funds

👉Guaranteed $100 Loan No Credit Check Direct Lender

Lendmill is a direct lender offering reputable no credit check payday loans. They are one of the top lenders in this space, and they are known for their quick and easy approval process, no hard credit pull, variety of loan options, and competitive interest rates.

It is a good option for borrowers with a bad credit history or poor credit who need a personal loan for any reason. To consolidate debt, pay for unexpected expenses, or start a new business, Lendmill.app can help.

👉Highlights

- Personal installment loans approved within a few minutes

- Receive the loan amount directly to your personal bank account

- You can use the loan amount for any purpose you want

Advertisement

👉Loan Amount, Term and Interest Rates

- Repayment tenure up to 48 months

- Annual percentage rate ranging between 5.99% to 35.99%

- Loan amount ranging between $100 to $5000

👉Eligibility Criteria

- It is essential for the borrower to be 18 years old.

- The borrower must earn a minimum of $1000 per month.

- The lenders offer this loan to U.S. permanent residents and citizens.

👉Application Procedure

- Step 1: Visit the website of the loan Lendmill.app

- Step 2: Select the loan amount you need

- Step 3: Select your preferred loan tenure

- Step 4: Enter all the important personal details

- Step 5: Review your application form

- Step 6: Submit the application form and receive the funds

Advertisement

#3. Get Funds Asap

👉Best Overall Direct Loan Lenders No Credit Check

Get Funds Asap is a leading online lender that offers payday and installment loans to individuals with poor credit scores. They have a straightforward loan application process, expedited approval, and no bias against low credit scores.

GetFundsAsap.com works with personal direct loan lenders with no credit check to offer borrowers who may not be able to qualify for a loan from a traditional bank or credit union. This makes them an excellent choice for borrowers who require funds urgently but do not have strong credit.

👉Highlights

- Quick disbursement of the loan amount of $100

- A fair assessment of the annual percentage rate

- Instant approval and no credit check requirement

- Easy and quick application process

- Minimum credit scores are required

- Their great customer support is available 24*7

Advertisement

👉Loan Amount, Term and Interest Rates

- Loan term up to 48 months

- The amount of loan ranges from $100 to $5000

- Annual Percentage Rate: 5.99% to 35.99%

👉Eligibility

- The borrowers should have a stable income source

- They should also be at least 18 years of age

- Borrowers should also have valid ID proof and citizenship of United States

- They must also have a bank account

👉Application Procedure

- Step 1: Visit their website GetFundsAsap.com

- Step 2: Select the loan amount between $500 to $50,000

- Step 3: Select the repayment tenure

- Step 4: Correctly fill up the application form

- Step 5: Verification and approval of the loan application

- Step 6: After verification and approval you will receive the money

Advertisement

#4. Prime Time Advance:

👉Loan Approval Up To $50,000

Prime Time Advance is a streamlined online lending platform that offers an agile borrowing process that is completed in just 5 minutes. All you need is your basic personal information, ID, and Social Security number. Primetimeadvance.com focuses on quick approval, so you can get the money you need fast.

Primetimeadvance.com matches borrowers with lenders, bypassing traditional credit checks and making loans accessible to people with all credit backgrounds. Even with a low credit score, you can still get a quick and easy online loan from Primetimeadvance. It offers direct deposit, so you can get the money you need even faster.

Advertisement

👉Highlights

- Great option for borrowers with bad credit

- Easy online loan request

- Highly likely to be approved for a loan

- Fast approval process and quick funding

- Flexible loan terms and conditions

👉Loan Amount, Term and Interest Rates

- Loan amounts ranging from $100 to $5000

- Loan term up to 48 Months

- Annual Percentage Rate from 5.99% to 35.99%

👉Eligibility

- Loan applicants must be at least 18 years old

- They also must be US citizens and have proof of address

- Loan applicants must provide a valid mobile phone number

👉Application Procedure

- Step 1: Go to the Primetimeadvance.com website.

- Step 2: Choose the loan amount and repayment term you want.

- Step 3: Fill out the application form carefully.

- Step 4: Wait for the verification and approval process.

- Step 5: Once your application is approved, you will receive your funds.

Advertisement

#5. Payzonno:

👉Fast Disbursal Of Loan Amount Within 24 Hours

Payzonno is a mobile app that offers loans of up to $5,000 to borrowers with bad or no credit. Repayment terms are up to 24 months, and payments are made in biweekly installments. Payzonno' annual percentage rates can reach 35.99% in some states, which is significantly higher than other loans such as personal loans or collateral loans.

Payzonno.com reviews applicants' bank account transactions to determine whether they qualify and their loan amount, but the lender doesn't do a hard credit check.

👉Highlights of the Loan

- Loan amounts up to $5,000

- Approval with limited credit history or poor credit score

- Quick approval within one business day

- Easy application process and no hidden fees

- Large network of lenders and alternative options

Advertisement

👉Loan Amount, Term, Interest Rates

- Loan amounts range from $100 to $5,000

- APR ranges from 5.99% to 35.99%

- Flexible repayment terms of up to 24 months

👉Eligibility Criteria

- The borrower must have a stable monthly income of $1000

- They should be at least 18 years old

- They must be a U.S. citizen and have a U.S. bank account

👉Application Procedure

Step 1: Go to the Payzonno.com website.

Step 2: Select the loan amount you want.

Step 3: Use the slider to select the repayment term.

Step 4: Enter your personal details.

Step 5: Review your inputs and click "Submit."

#6. My Credit Advance:

👉Flexible Loan Terms Up To 24 Months

Advertisement

My Credit Advance provide a loan that is easy to obtain, regardless of your credit history. This means that borrowers can easily apply for and receive loans to cover any emergency costs. MyCreditAdvance.com has a large network of lenders who can approve loan requests, but borrowers must meet certain eligibility criteria to qualify.

To apply for a loan from MyCreditAdvance.com, borrowers must first meet the eligibility criteria. Borrowers can receive the loan amount as early as one business day after approval. They can then use the loan funds to cover their educational expenses as needed.

👉Highlights of the Loan

- Loan amounts from $100 to $5,000

- Get connected with a lender you can trust

- Approval decision in a few minutes

- Funds deposited into your account in one business day

- Use the funds for any purpose

Advertisement

👉Loan Amount, Term, Interest Rates

- Loan amounts range from $100 to $5,000

- Flexible repayment terms up to 24 months

- APR ranges from 5.99% to 35.99%

👉Eligibility Criteria

- The borrower must have a regular income from a stable source

- They should also be at least 18 years old and a US resident

- The borrower should also provide verifiable contact information such as email ID and phone number.

👉Application Procedure

- Step 1: Go to the MyCreditAdvance.com website.

- Step 2: Select the loan amount you need.

- Step 3: Enter your personal details.

- Step 4: Review your inputs to minimize errors.

- Step 5: Click "Submit" to complete the application.

#7. Money Aids:

Advertisement

👉Instant Approval Of Loan Within A Few Minutes

This credit platform is completely secure and allows borrowers, including students, to apply for loans. The interest rates on these loans typically start at 5.99%, and the repayment terms can be tailored to your needs.

The loan application process is straightforward and can be completed in just a few easy steps. Once you submit your application, the lender will evaluate your eligibility and either approve or reject your loan request. Additionally, you can contact their support team 24/7 if you encounter any problems.

👉Highlights of the Loan

- Same-day loan approval

- Online application process

- No hidden fees

- Loan approval regardless of your credit score

- Large network of lenders

Advertisement

👉Loan Amount, Term, Interest Rates

- APR ranges from 5.99% to 35.99%

- Loan amounts range from $100 to $5,000

- Flexible repayment terms

👉Eligibility Criteria

- Stable monthly income

- At least 18 years old

- Bank account in a reputable U.S. bank

- U.S. citizen

👉Application Procedure

- Step 1: Navigate to the website of MoneyAids.com

- Step 2: Select your preferred loan amount

- Step 3: Click "Apply Now" on the homepage

- Step 4: Enter your personal details.

- Step 5: Review your inputs for accuracy.

- Step 6: Click "Submit" to complete your request.

| Loan Type | Loan amount range | Annual percentage rate | Loan term |

| CashRequestOnline.com | $100 to $5,000 | 5.99% to 35.99% | Up to 24 months |

| Lendmill.app | $100 to $5,000 Advertisement | 5.99% to 35.99% | Up to 48 months |

| GetFundsAsap.com | $100 to $5000 | 5.99% to 35.99% | Up to 48 months |

| Primetimeadvance.com | $100 to $5000 | 5.99% to 35.99% | Up to 48 months |

| Payzonno.com | $100 to $5,000 | 5.99% to 35.99% | Up to 24 months |

| MyCreditAdvance.com | $100 to $5,000 | 5.99% to 35.99% | Up to 24 months |

| MoneyAids.com | $100 to $5,000 | 5.99% to 35.99% | Up to 12 months |

Tips to Consider while Finding Reliable with No Credit Check Loan with Bad Credit Scores

Here are a few tips for getting the best possible deal from a direct loan lender no credit check:

- Shop Around: Compare the APR and fees of different lenders before choosing one. You can use a loan comparison website to make this process easier.

- Get Pre-approved Loans: This will give you an estimate of how much you can borrow and what your monthly payments will be. It's also a good way to see if you qualify for a loan before you apply.

- Borrow Only What You Need: No credit check loans typically have high-interest rates, so it's important to borrow only what you need.

- Hidden Fees: Some lenders charge hidden fees, such as origination fees and late fees. Be sure to read the fine print before you apply for a loan.

Advertisement

Benefits and Drawbacks of Bad Credit Loans from Direct Lenders

Here are some benefits of direct loan lenders no credit check:

- Easy to qualify: These loans do not require a credit check, so borrowers with bad credit or no credit history can still qualify for a loan.

- Quick approval: The loans typically have a fast and easy approval process. Borrowers can often get approved for a loan within minutes or hours.

- Convenient: Direct loan lenders with no credit check offer a convenient way to get a loan. Borrowers can apply for a loan online or over the phone.

- Flexible Terms: They also offer flexible terms, such as longer repayment periods or lower down payments.

Advertisement

👉Drawbacks of direct loan lenders no credit check:

- High-Interest Rates: These loans typically charge higher interest rates than traditional lenders. This is due to the increased risk they are incurring by lending money to individuals with poor or no credit history.

- Short Repayment Terms: The loans often have short repayment terms. This can make it difficult for borrowers to repay their loans on time, especially if they have a limited income.

- Hidden Fees: Direct loan lenders no credit check may charge hidden fees, such as origination fees and late fees. Be sure to read the fine print before you apply for a loan.

- Predatory Lending Practices: Some of these lenders engage in predatory lending practices, such as targeting vulnerable borrowers with high-interest loans.

Advertisement

Alternative To Guaranteed Approval Payday Loans Online From Direct Loan Lenders

Here is a list of alternatives to payday loans from direct loan lenders:

- Payday Alternative Loans

PALs are small loans (typically up to $1,000) that are available to members of federal credit unions. These loans have capped interest rates (up to 28% APR) and manageable repayment terms (3 to 6 months).

- Secured Personal Loans

Secured personal loans are a good way to get long-term financing, even with bad credit. These loans require you to put up collateral, such as a car, home equity, or stocks when you apply. This makes the loan less risky for the lender, so they are more likely to approve you and offer you better terms.

Advertisement

- Co-Signer Loans

If you have a friend or family member with good credit, you may be able to get a co-signer loan. This means that the co-signer will agree to repay the loan if you default. This can help you get approved for a loan and get better terms, even if your credit is bad.

- Credit Card Cash Advances

If you have a credit card, you can use it to get a cash advance. This can be a quick and easy way to get cash, but it is important to be aware that cash advances typically have high-interest rates and fees.

Advertisement

Best No Credit Check Loans from Direct Lenders Instant Approval - Comparison

Here are the most essential pros and cons of the best direct loan lenders no credit check:

| Loan Type | Pros | Cons |

| CashRequestOnline.com | Easy and quick application process | APR up to 35.99% |

| Lendmill.app | Fast loan amount approval and disbursal | High-interest rates on the credit amount |

| GetFundsAsap.com | Various and alternative options of lenders | High monthly installments and charges |

| Primetimeadvance.com | Loan approval up to $50,000 with easy and simple application process | Interest rates can go as high as 35.99% |

| Payzonno.com | Flexible repayment tenure of up to 24 months | High-interest rates with high monthly installments Advertisement |

| MyCreditAdvance.com | Simple application and quick funding | Interest rates are high |

| MoneyAids.com | Quick approvals and payout with fully online application process | Very high APRs |

States Where Online Loan from Direct Lenders are Available without Hard Credit Check

Here is a list of some of the states where direct loan lenders are available:

- New York

- California

- Florida

- Texas

- Illinois

- Pennsylvania

- New Jersey

- Virginia

- Massachusetts

- Indiana

- Washington

- Arizona

- Kentucky

- Louisiana

- Alabama

- Mississippi

- South Carolina

- Arkansas

- Idaho

- Utah

- Wyoming

- New Hampshire

- Rhode Island

- Maine

- New York

- Connecticut

- Pennsylvania

- Maryland

- West Virginia

- New Jersey

- Virginia

- Delaware

- Texas

Conclusion

Overall, direct loan lenders with no credit check can be a good option for students who need financial assistance to cover their educational expenses and do not have a good credit history. However, it is critical to analyze the many possibilities and be aware of the hazards before deciding on one.

Advertisement

FAQs

- What is the typical repayment term for a loan from a direct loan lender with no credit check?

The typical repayment term for a loan from a direct loan lender with no credit check ranges from 24 to 48 months. Some lenders, however, may provide longer or shorter payback schedules. - How do I apply for a loan from a direct loan lender with no credit check?

To apply for a loan from a direct loan lender with no credit check, you will typically need to provide the lender with your personal information, income information, and employment information. The lender will also need to verify your identity. - What should I do if I am unable to repay my loan from a direct loan lender no credit check?

If you are unable to repay your loan from a direct loan lender with no credit check, it is important to contact the lender as soon as possible. Together, you and the lender will design a manageable repayment schedule.