Slipping On Oil And Gas

Why India’s Oil PSUs Will Be Losers

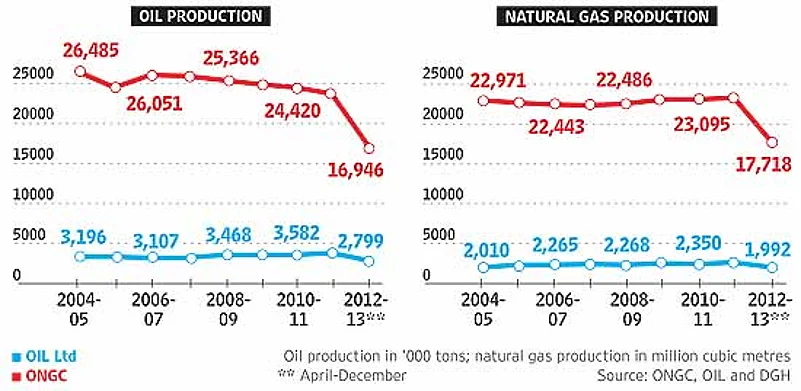

- Over the last decade, OIL’s production has improved slightly, while ONGC’s has remained stagnant or dipped at times

- Both PSUs have been asking for better returns on their oil and gas production, priced lower than private sector products

- The PSUs have to shell out handsomely to help government meet its petro-subsidy bill

- Severe criticism from CAG on ONGC’s lack of operational autonomy, failure to become more efficient and ensure accountability

- Stepmotherly treatment of PSUs; ONGC often forced to rescue wasteful private investments, eg Reliance’s K-G basin rigs

***

Rajya Sabha MP Mani Shankar Aiyar recalls how tough it was to get the late Subir Raha, who was ONGC chairman when Aiyar was petroleum minister from 2004-06, to accept that Reliance Industries’ drilling performance, particularly offshore, was far superior to ONGC’s. Also, he wouldn’t admit to any deficiency that, as a PSU, ONGC needed to plug to improve India’s self-reliance in hydrocarbons. “He was adamant this wasn’t the right way of looking at ONGC’s performance and entered a huge bureaucratic battle on its targets,” says Aiyar.

| Outlook’s July 15 cover story was on how the gas price increase would mainly favour one player—Reliance. |

The government would have everyone believe that the public sector ONGC and Oil India Ltd (OIL)—and not Reliance Industries—will be the major gainers from its controversial decision to double the price of natural gas from April 2014. The idea is that a higher gas price will encourage exploration and reduce the fuel shortfall. It contends that, though the private sector will benefit, the two PSU explorers will also gain as much as Rs 8,000 crore in revenue. But experts Outlook spoke to disagree.

The reality, they say, is different. The heavy subsidy burden they help the government meet leaves the two PSUs struggling to get a cost-plus price for their produce. Both profits and production figures are slipping (see graphic). Over a decade, ONGC’s oil production has dipped from 26 million tonnes in 2004-05 to 23.7 million tonnes. Gas production has only risen marginally. oil, much smaller that ONGC, has seen oil production rise to 3.8 million tonnes and gas to 2.6 billion cubic metres.

“Ultimately, it’s the nation which is the loser, as the ONGC, one of the best companies and a big employer, is being damaged,” says a former top bureaucrat. Earlier this month, both PSUs had approached the petroleum ministry to seek a review of the non-transparent subsidy policy, which ensures that much of their revenues go towards paying for the under-recoveries of oil marketing companies that supply subsidised diesel, kerosene and cooking gas. Such opacity has seen the worth of the ONGC and OIL (both are listed) considerably eroded. “They are blue-chip companies, but their shares are getting impacted,” says S.P. Tulsian, an investment advisor. He adds that the net realisation value of ONGC, in particular, is constantly falling in dollar terms, though in rupee terms they remain constant.

Consider ONGC’s subsidy outgo. A.K. Banerjee, ONGC’s director (finance), says that from fiscal 2003-04 to 2012-13, it footed Rs 2,14,000 crore in subsidy payment to the government. Last year itself, paid out Rs 49,466 crore. This ensured that, in the first quarter of 2012-13, instead of getting the market price of some $100 per barrel, ONGC ended up getting $45 per barrel. During the corresponding quarter this fiscal, this has slipped to $40 per barrel. But for the depreciation of the rupee, ONGC would have seen its revenues hit further. Continuing subsidy burden will definitely impact cash generation. “ONGC and OIL will be hit if our share of the subsidy compensation is tweaked,” Sudhir Vasudeva, ONGC’s CMD, said at a recent seminar.

Planning Commission member B.K. Chaturvedi agrees that the heavy subsidy outgo poses a problem for the PSUs, especially with the cost of exploration going up. On possible gains from the gas price hike, he says there are too many loose ends. “We don’t know what the increase in cost of fertiliser will be. We don’t know how the oil prices will behave. If oil prices come down, the subsidy burden will be less, but if it goes up, we will definitely have a huge subsidy bill, Given the investment requirements, it does create problems,” he says.

Apart from subsidies, the PSUs have to pay cess and royalty, which does not impact private companies, as they are able to recover it from the government as part of their expenses, according to the terms of their production-sharing contracts. This pro-private sector tilt has much to answer for the fact that state-run exploration companies have been slack in monetising many of the discoveries made over the last few years. “When it comes to ONGC, government support is just not there. The terms of its production-sharing contract are not properly implemented. But then, it’s not just ONGC, all PSUs get stepmotherly treatment,” says E.A.S. Sarma, former revenue and petroleum secretary.

Whether it was because of pressure, malpractice or lack of planning, ONGC came through poorly in the cag’s performance audit last year. This year too, it has been questioned on imprudent hiring of a rig—which wasn’t used—from Reliance. “There are management issues, besides the ONGC and OIL being treated like cash cows. They need to get into the field to find more reserves and monetise them—which they are working on,” says Santanu Saikia, editor of Indiapetro.com.

For more than a decade, ONGC has been relying on redevelopment of old fields and better technology to maintain its production, while OIL has been more persistent in exploration, particularly in the Northeast. The dismal production record of ONGC and OIL are due to “poor technical expertise and, more importantly, poor technical leadership. E&P is multi-disciplinary, and there is little cohesion between disciplines, mainly due to poor leadership,” says T.N.R. Rao, former petroleum secretary.

While private firms were brought in to improve investment and technology flow to boost production, somewhere the need for technology transfer to strengthen the PSUs was forgotten. Rao cites the case of private sector consultancies for oil fields in Panna-Mukta- Tapti, Ravva and Kharsang, where technology transfer to ONGC and OIL was a must. “This has never been enforced. No review, including that by CAG, has highlighted this lacuna,” says Rao.

Until the Barmer block of Cairn Energy came to production, the only increase in domestic oil and gas production came from these three joint venture fields (only five per cent of our producing fields). This was due entirely to application of new technology. But there’s no evidence of technology absorption and application by ONGC and OIL. Dr Avinash Chandra, former director-general of hydrocarbons, is anguished that exploration companies are being “used to run a subsidy scheme. There is no alternative but to strengthen your national oil companies, just as there is need to strengthen other PSUs, including Coal India.”

If everyone knows what the problems are, then who is to blame? Former petroleum secretary S.C. Tripathi is blunt: “ONGC suffers from poor management, and tedious and slow decision-making. The lack of leadership from within ONGC and from the ministry which is anchoring it is to blame for the present state of affairs.” And an important question: Who gains from this?