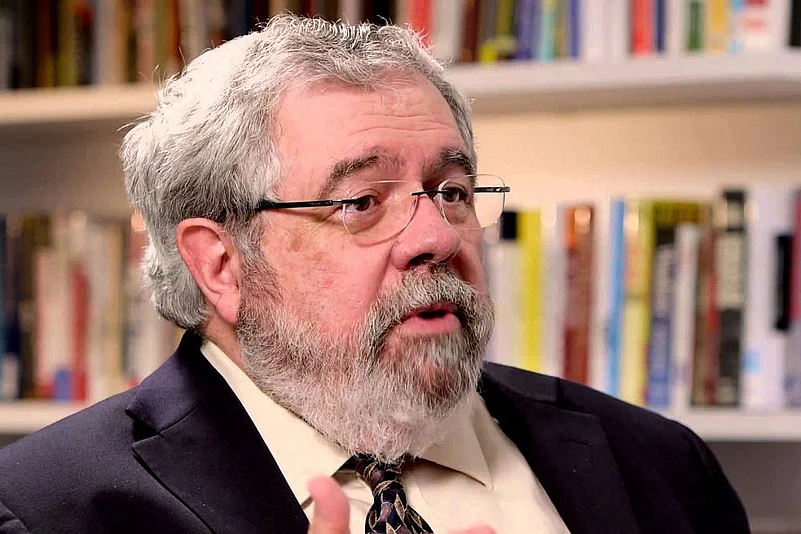

David Cay Johnston is a Pulitzer prize-winning investigative journalist, visiting lecturer at the Syracuse University College of Law. and author of books on tax and economic policies such as Free Lunch and the award-winning Perfectly Legal. In an interview with Ushinor Majumdar, Johnston says countries should not compete to offer lower tax rates to boost business and errant tax advisers should be prosecuted.

What is your view on lowering of corporate taxes?

Nobel Prize-winning economist Professor Peter Diamond of MIT has shown that a 60 per cent tax on profits might be a lot better than lower rates. It actually means that 60 per cent of a company's re-investment expenses are being picked up by the government. High tax rates encourage the creation of jobs and wealth building and low tax rates only encourage owners to withdraw money from the company. When Ronald Reagan pushed lower tax rates, he advocated for owners of companies who were not personally able to enjoy all of the fruits of their work. That's because the tax system encouraged owners to reinvest into the companies which created more jobs instead of withdrawals by owners.

What about emerging economies such as India which has also planned a drastic cut in corporate taxes to offer growth and expansion?

If countries compete on the basis of a lower tax rate, all you will get is competition to go to zero. If everyone followed India to the new 25 per cent rate, then Pakistan or Italy would compete with 23 per cent or lower rates to invite investors. Taxes should be based on a set of principles, such as: firstly, the ability to pay. If you tax the poor, you raise the cost of labour for everybody. You should tax surplus incomes and profits above the base. If the normal profit margin is 5 per cent, you should tax all the companies earning 10 per cent and 20 per cent profits. Secondly, tax dollars are fed back into the economy. Spending on subsidies for certain companies is just a redistribution scheme and it is being done increasingly all over the world. It should be spent on building infrastructure and social infrastructure. Instead, countries are diverting tax dollars to personal wealth – that's what my book ‘Free Lunch' is about.

There is a global economic crisis. What do you think of expanding growth through policies such as India's ‘Make in India' policy to attract companies to set up manufacturing units?

India has enormous intellectual and natural resources and I anticipate it will be a wealthy country in the future. The biggest hurdle in its way is Indian legal structures hobble business. They are impenetrable – like Dickens' novel Bleak House. I socialize with a number of Indians and they complain about the legal problems with their businesses in India. India not only needs to address its tax law but its legal structures and its mechanisms that enable you to build new things.

What do you feel is the difference between tax ‘avoidance' and ‘evasion'?

It is a spectrum. If it's legal, you can do it and if it shouldn't be legal, we should change the law. Then there's flat out criminal behavior. In between those two, there is a wide grey area. There is a whole industry of tax lawyers who find some way to manipulate the law, which they know the government will eventually shut it down but the first people in on it will get to use it. There should be a bright line distinguishing the two. The way you control tax evasion is to prosecute not just the tax evader but also his advisers; at a minimum, we should go after their licenses. General Motors sold a car called Cobalt. If you hung keys with a lot of weight on it, the ignition switch would fail and 124 people died as a result. GM is just paying a fine but no one is being prosecuted or even being identified. In ancient Athens, accountability was very strict. If you were the Chancellor of the Exchequer or the finance secretary and money went missing, they killed you. It was a very effective system.

Do you think trickle-down economics helps an economy?

This term was coined by American Democrats to criticise Ronald Reagan. In Free Lunch, I have said it's not trickle down but Amazon Up. Trickle down is all sorts of mechanisms to take from the many and give to the few. In America, the subsidies to Warren Buffet are an example. In the U.S., one form of utility, the pipeline, is exempt from corporate income tax, which I have estimated at $3.4 billion a year. That's three cents a day per American. Customers are forced to pay the tax since this utility is a monopoly and the company is then exempt from paying corporate income tax. That's just upward redistribution. But, we always talk of redistribution as being downward. You want to have rules that encourage work, savings, investment and that reward people who work very hard. But, also do not force people down below to give involuntarily to people up above.

What are your chief observations about round-tripping of FDI such as those enabled by the India-Mauritius tax treaty?

Round-tripping goes on all over the world in countries where owners are not confident about their position or sometimes for other reasons such as tax avoidance. In Russia, the oligarchs move their money on paper to Cyprus and then invest them in Cyprus. Their theory is that it's harder for the predatory government to take away their money. This March, I reported about ghost apartments in cities across the world where people park their money for tax breaks. And if you have to flee the country, you have a place to live and if you invest in some stocks in those countries, you won't be broke. People should feel secure in the country where you live. In Pakistan, people with capital do not trust the conditions there and the whole country suffers for it. People shouldn't have to worry about nationalism and riots, but should feel that their wealth is secure.

Why did you devise a new tax code?

America makes two value-added products – numbers and molecules. Numbers are algorithms used in software, molecules are drugs, materials used in the jet engines and so on. The ownership of those patents, manufacturing processes and other intangibles which are easy to move can't be taxed easily because they can be moved to a low-tax regime or tax haven. The existing US tax code is 6,500 pages, my version will be less than 100 pages. The proposals are based on the existing law and system, I have just re-purposed them.

How will corporate income tax work in the code that you are devising?

Under the tax code that I am drafting – the prosperity tax – there is no corporate income tax. Instead, what I suggest is that any money that leaves the company and goes to another company to buy goods and services, you have some rules to ensure that they are not playing games. That's not a taxable event but if you are the owner and you withdraw money or an employee is paid, all that is taxed. There is a limit on how much liquid assets you can have, which is already there in the law and if you cross the limit, you have to pay it out. So, we don't have to use the tax system the way we do to build the economy – there are other ways. Our goal should be to create the maximum wealth not for an individual but for society as a whole, create as much employment as possible and income from wealth.

What about checks and balances?

Under my system there is a fiduciary at every company and every entity. If there are three incidents in a year, the fiduciary can go to jail and lose everything. That means that the fiduciary has to have very strong powers to stop the transaction or undo it at a later stage if he finds wrongdoing. A company with weak cash flows can delay tax payment to enable taxation without destroying the business. For any withdrawals, the fiduciary will be bound to publish a public report on all transactions. I originally called it the integrity tax which is what tax systems need and only integrity allows lower tax rates, simplicity and smaller law enforcement agencies.

The interview was conducted following a presentation titled Global Tax Dodging by David Cay Johnston at the Global Investigative Journalism Conference 2015 in Norway