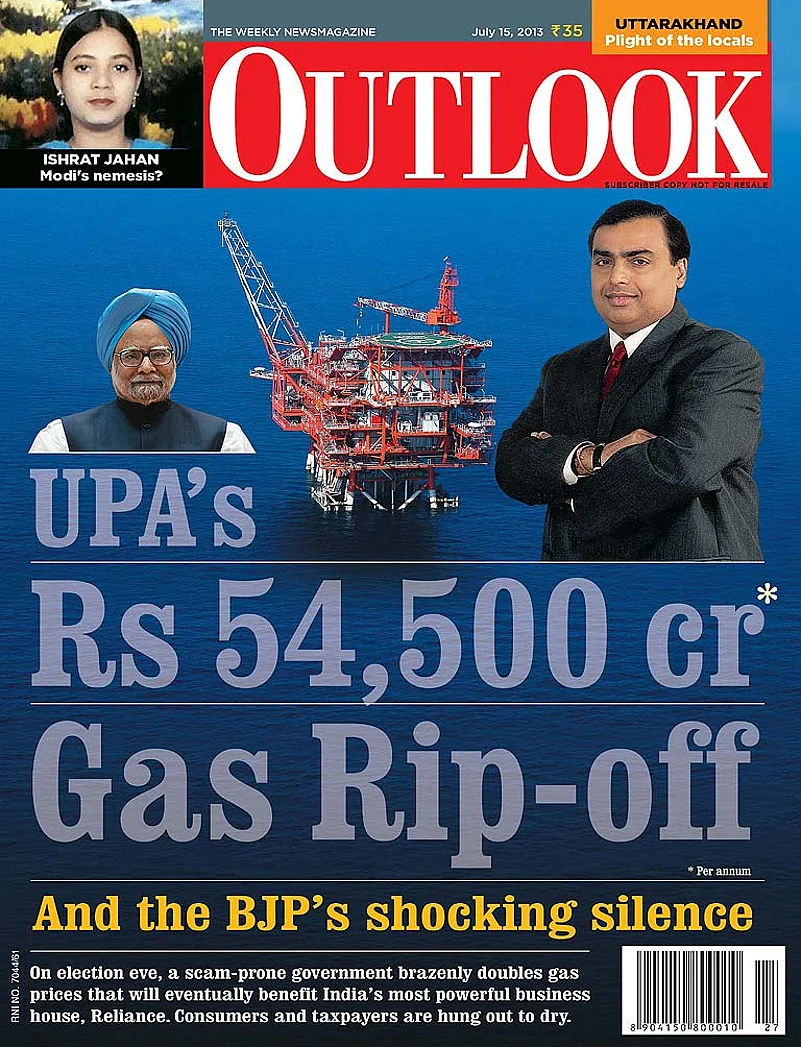

After the great gas rip-off, here comes the cover-up. It’s a beauty wrapped up in riddles about pricing formulas and helped along by contradictory signals from the government’s arms. The end result, predictably, is confusion about the gas price increase—which the government stresses, is here to stay. Make no mistake; this smokescreen deflects attention from the fact that Reliance, the country’s largest private sector gas producer, will be a major beneficiary from the UPA’s decision to increase gas prices for five years, starting April 2014, ahead of the next general elections.

Given the silence by most political parties on the gas price policy, the UPA has sought to use a smoke-and-mirror strategy to sidestep the considerable criticism of its move in the media. Most political parties Outlook spoke to refused to comment on the gas pricing issue. There were a few exceptions. “Gas pricing is not an issue in Orissa because we are a thermal power state,” explains Pinaki Mishra, a BJD MP. “For us, this is a non-issue and hence we are silent. Having said that, it is common knowledge that gas pricing has been done to keep Reliance happy,” he adds.

The latest salvo is an out-of-the-blue office memorandum from the finance ministry (with the approval of P. Chidambaram) to the petroleum ministry drawing attention to various “issues” expressed in newspaper editorials. Bureaucratic sources described the letter as “something the petroleum ministry should have done in the first instance—examine over-cost recovery, penalties for not meeting contracted output levels and technical parameters related to production” in the case of Reliance Industries Ltd. But when asked whether the missive to the petroleum ministry was expected to yield a positive result, a senior bureaucrat with direct knowledge of the matter bluntly stated: “Don’t expect anything.”

Finmin memo by OutlookMagazine

Not surprisingly, petroleum secretary Vivek Rae stated that the finance ministry missive—which included a suggestion that Reliance be paid the current price of $4.2/MMBTU (million metric British thermal unit) till it had delivered on the committed gas—cannot be described as a “directive”. Observers see the note as a damage control attempt to “save their skin” should the mandarins be so directed by a future government (it’s quite obvious that only a third-front alternative could raise the issue).

There’s an obvious political angle too, as the Chennai-headquartered newspaper The Hindu was the main fodder in the finance ministry letter (an editorial from The Economic Times had a token mention). That’s because the AIADMK’s Jayalalitha was one of the strongest in her criticism of the UPA government move. Therefore, with the note making a show of addressing these concerns, Chidambaram sought to target Tamil Nadu politics (and tackle a bitter foe).

It goes without saying that this runs contrary to the stance taken by the finance ministry thus far. In fact, one has to be thankful that the UPA went by the Rangarajan formula and not the proposals mooted by the finance ministry and the Montek Singh Ahluwalia-headed Planning Commission as both would have seen domestic gas prices rise above $11. Their proposals sought to usher in market-determined prices after three years (the government finally went with a five-year formula). “In the CCEA, Chidambaram was the most vocal in the demand for the increase in the price of gas to international levels,” says Gurudas Dasgupta, CPI Lok Sabha member.

In fact, Chidambaram’s stance that a higher price would incentivise investments and check the drop in oil and gas production was reportedly questioned by former petroleum minister S. Jaipal Reddy (now science and technology minister). He pointed out that the sharp dip in India’s gas production was only from one source—Reliance’s D6 block in the Krishna Godavari basin. Instead of the promised 80 million metric standard cubic meters per day (MMSCMD) production from D6, it is currently less than 15 MMSCMD.

Apart from Reddy, power minister Jyotiraditya Scindia, fertiliser minister Srikanta Kumar Jena and rural development minister Jairam Ramesh also voiced their objections. The rest of the cabinet and the Congress party obviously thought otherwise. According to a Mumbai-based energy analyst who declined to be identified, the market is expecting a ramp-up in Reliance production post the gas price announcement. “I have seen guesstimates by some analysts ranging from 30 to 60 MMSCMD over the next 2-3 years, up from the current number of below 15 MMSCMD,” he says.

On another front, after having pushed through a price formula that would double the domestic gas price, the government is suddenly fighting shy, explaining how the number $8.4/mmbtu came to be floated—the new number is the $6.8/MMBTU (at current prices), cited by Moily just a few days earlier. So, is this a climbdown, as some have been claiming? While clarifying that the $8.4 number came from projections in the Rangarajan panel report, the petroleum secretary goes on to say: “The price (in April 2014) may be $8.4/MMBTU, assuming that Qatar price changes and everything else remains unchanged.”

Next year, Qatar gas prices are expected to rise over $13/MMBTU—if so, the domestic gas price may well be $8.4/MMBTU. On the other hand, if India were able to renegotiate the price of imported LNG through long-term contracts (state-run GAIL is pushing for it), there could be lower domestic prices. Given that experts don’t know what the gas price will be 10 months from now, it’s difficult to say with finality. Tapan K. Sen, CPI(M) RS member, cautions that the Rangarajan panel formula could “yield more than $8.4/MMBTU for domestic producers if the variable factors are taken into account”.

Despite public sector ONGC and OIL also being beneficiaries from the gas price hike, the focus remains on Reliance. Ex-expenditure secretary E.A.S. Sarma is however happy that the department of expenditure has played its part of an “evil force” and questioned the government proposal—that the company must get only $4.20/MMBTU till the cumulative shortfall is made up. “To allow RIL to claim the revised price for gas from these fields at $8.40/MMBTU is to allow them huge windfall gains against all norms of financial propriety,” says Sarma.

The debate, unfortunately, is being shifted away from the real losers in the gas price increase: the common man, taxpayer and industry that can no longer reap the benefit from natural gas, touted to be a cheap and green fuel. “There are no immediate benefits of the gas price hike for the people. Especially in an environment of high inflation, any increase in the cost of essential goods and services will only add to the pain of the consumer,” says Vandana Hari, a Singapore-based oil sector analyst.

Just like most opposition parties (barring the Left) who maintained a stoic silence over the issue, Outlook’s attempts to get a response from leading industrialists were in vain, as e-mails and questionnaires went unanswered. Other top industry leaders excused themselves. It’s almost as if the state promise of subsidised fuel supply for the power and fertiliser sector has lulled the industry into complacency. As expected, apex industrial chambers FICC and CII gave measured, myopic reactions without delving into the larger impact. Interestingly, the CII, which came out with a quick reaction praising the government decision on June 28, issued another statement on July 5 as the previous one has comments from ONGC CMD Sudhir Vasudeva, and P.M.S. Prasad, member, executive director and board member, RIL, as both the companies are direct beneficiaries of the government decision. The second statement did not have any names.

Says Satish Chander, director-general, Fertiliser Association of India, “Under the current circumstances, the increased gas price would push up cost of production by about 50-60 per cent.” The FAI has estimated that the fertiliser subsidy could rise by another Rs 10,000 crore if the domestic gas price doubles to $8.4/MMBTU. Chander is also among those who are optimistic that a higher domestic gas price would lead to a quantum jump in production and replace the need for expensive imported LNG.

But people like him may have to wait at least three years for Reliance to deliver on its higher production commitments, by which time domestic gas prices may become even more costly unless the global scenario changes. One thing that is sorely missing in India is a cooperative of gas users (like the white revolution of Amul or the farmers revolution in the guise of IFFCo and Kribhco), feels former CMD of Petronet LNG, Prosad Dasgupta. A stronger users’ lobby would not have allowed such a terrible travesty in the name of development.

By Lola Nayar and Arindam Mukherjee