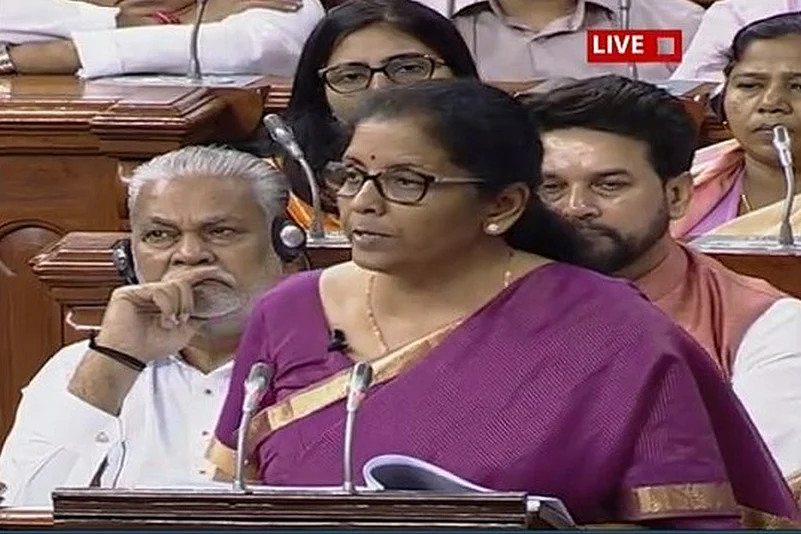

Union Finance Minister Nirmala Sitharaman on Friday presented the first budget of Narendra Modi-led government's second term at the helm of affairs in the country.

Besides levying a TDS of 2% on cash withdrawal from banks of over Rs 1 crore per year, Sitharaman also proposed to increase customs duty on gold and other precious metals from 10% to 12.5%.

Here are other key takeaways from Finance Minister Nirmala Sitharaman's first budget speech:

1) Every single rural family, except those unwilling to take connection, will have an electricity and LPG connection by 2022.

2) To provide further impetus to affordable housing, an additional deduction of 1.5 lakh rupees on interest paid on loans borrowed up to 31 March 2020 for purchase of house up to 45 lakhs.

3) The NRIs will be issued their Aadhar cards immediately upon their arrivals in India without having to wait for 180 days.

4) All companies having an annual turnover of 400 crores will now be taxed 25%. This will cover 99.3% of all the companies.

5) The government also proposed to make Aadhar card and PAN card interchangeable. "I propose to make PAN card and Aadhar card interchangeable and allow those who don't have PAN to file returns by simply quoting Aadhar number and use it wherever they require to use PAN," Sitharaman said.

6) Public sector banks will be provided Rs 70,000 crore to boost capital and improve credit.

7) 9.6 crore toilets have been constructed since October 2, 2014. More than 5.6 lakh villages have become open defecation free.

8) The government proposed relaxation in the FDI norms for sectors such as media, aviation, insurance, and single brand retail with a view to attracting more overseas investment.

Finance Minister Nirmala Sitharaman said that India's FDI inflows in 2018-19 grew by 6 per cent to USD 64.37 billion.

9) Startups taking firm root and therefore growth needs to be encouraged. Funds raised by startups will not require any scrutiny by the tax department, Sitharaman said.

10) Exclusive TV programme exclusively for startups will be started. The channel will be designed and executed by startups themselves.