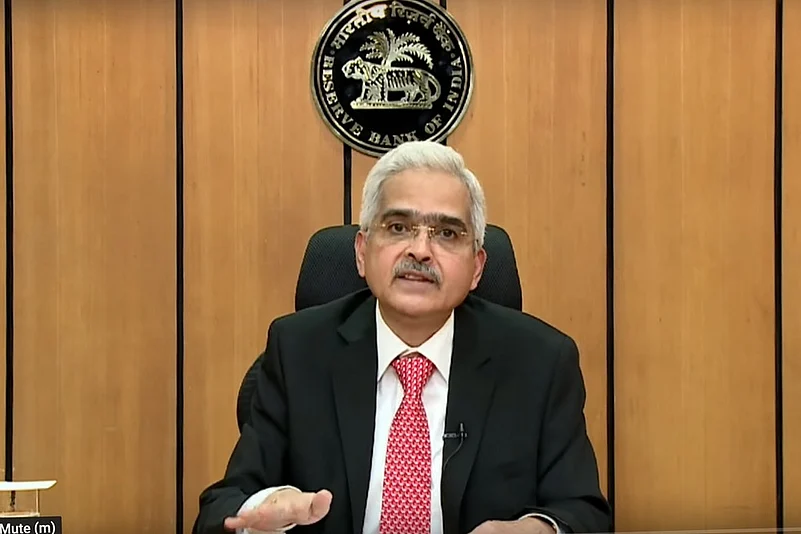

The Monetary Policy Committee (MPC) has decided to maintain status quo and keep the repo rate unchanged at 4%. Reserve Bank of India (RBI) Governor Shaktikanta Das said the policy stance continues to be “accommodative”. The central bank was widely expected to keep the interest rates steady. The MPC statement comes amid easing inflation and recovery in economic.

Here are key points:

- The MPC voted 5-1 to retain the accommodative stance as long as necessary to sustain growth on a durable basis, while ensuring that inflation remains within the target.

- India in a much better place today than at the time of the last MPC meeting. Growth impulses are strengthening, inflation trajectory more favourable than expected, says RBI Governor Shaktikanta Das.

- India in a much better place today than at the time of the last MPC meeting. Growth impulses are strengthening, inflation trajectory more favourable than expected, says RBI Governor Shaktikanta Das.

- Governor Das says RBI took over 100 measures since onset of COVID-19 pandemic. Inflation trajectory turning more favourable than anticipated; economic activity slowly picking up. Core inflation remains sticky.

- RBI retains GDP growth target at 9.5 pc in FY22, IMPS limit to be increased from Rs 2 lakh to Rs 5 lakh: Governor Das.

- Capacity utilisation in the manufacturing sector recovered in Q2, further improvements expected in ensuing quarters.

- Food inflation is expected to remain muted in the coming month on the back of record production of foodgrains.

- RBI projects retail inflation for fiscal ending March 2022 at 5.3 per cent.

- CPI inflation seen at 5.3 per cent for this fiscal. In Q2, it is seen at 5.1 per cent, 4.5 per cent in Q3 and 5.8 per cent in Q4, with risks broadly balanced.

- Pent-up demand, festival season should boost urban demand. Recovery in demand gathered pace in Aug-Sep. Pick-up in import of cap goods point to some recovery in activity: Governor Das.

- Let there be no concern about the adequacy of liquidity; RBI will ensure adequate liquidity to support growth: Governor Das.

- RBI proposes to introduce framework for retail digital payment in offline mode across India. Set to introduce internal Ombudsman Scheme to address grievances of large NBFC customers.

- The Central Bank will stop bond buys under G-SAP. Das said that given the liquidity overhang and the absence of fresh government borrowing for GST compensation means that these bond purchases are not needed. The RBI will, however, continue to conduct open market operations as needed.