Bank employees dub it as the big corporate fraud. Economists and some political leaders blame it on the downturn since 2008. Many of the corporates themselves prefer to switch the conversation to massive loan bailouts to farmers. But Reserve Bank of India deputy governor K.C. Chakraborty was clear as day during his presentation before a bankers’ conclave last month. “The existing levels of non-performing assets (NPAs) are manageable, but if corrective actions to arrest NPAs are not initiated, the stability of the financial system will be at great risk.”

Chakraborty’s presentation revealed that medium and large enterprises account for nearly 50 per cent of the NPAs or bad loans of public sector banks (PSBs). These companies’ share of bank credit has increased from around 40 per cent in 2009 to over 48 per cent in 2013. “If you tackle the top 500 to 1,000 defaulting companies, then you’d have taken care of the bulk of the NPAs,” says Mahesh Vyas of the Centre for Monitoring Indian Economy. “Farm loan defaults are but a small part compared to corporate NPAs.”

As a percentage of total bank credit, gross bank NPAs constituted 3.3 per cent in March this year, rising to 3.7 per cent by end-June. This figure could reach 4.4 per cent by March 2014, turning almost Rs 1 trillion worth of bank credit as NPAs within such a short span, rating agency crisil stated in its report last month. That’s why the government is increasingly being put under pressure to act and put the spotlight on corporate delinquency or what some call wilful fraud.

Offices of Sterling Bio Tech

The numbers are huge. According to the All-India Bank Employees’ Association (AIBEA), bad loans have gone up from Rs 40,000 crore in 2008 to Rs 1,90,000 crore in 2013. “In addition to the official bad loans data, there is Rs 3,25,000 crore of hidden bad loans in the name of restructured loans (often dubbed CDRs, or corporate debt restructuring) that are being passed off as good loans,” says C.H. Venkatachalam, general secretary, AIBEA.

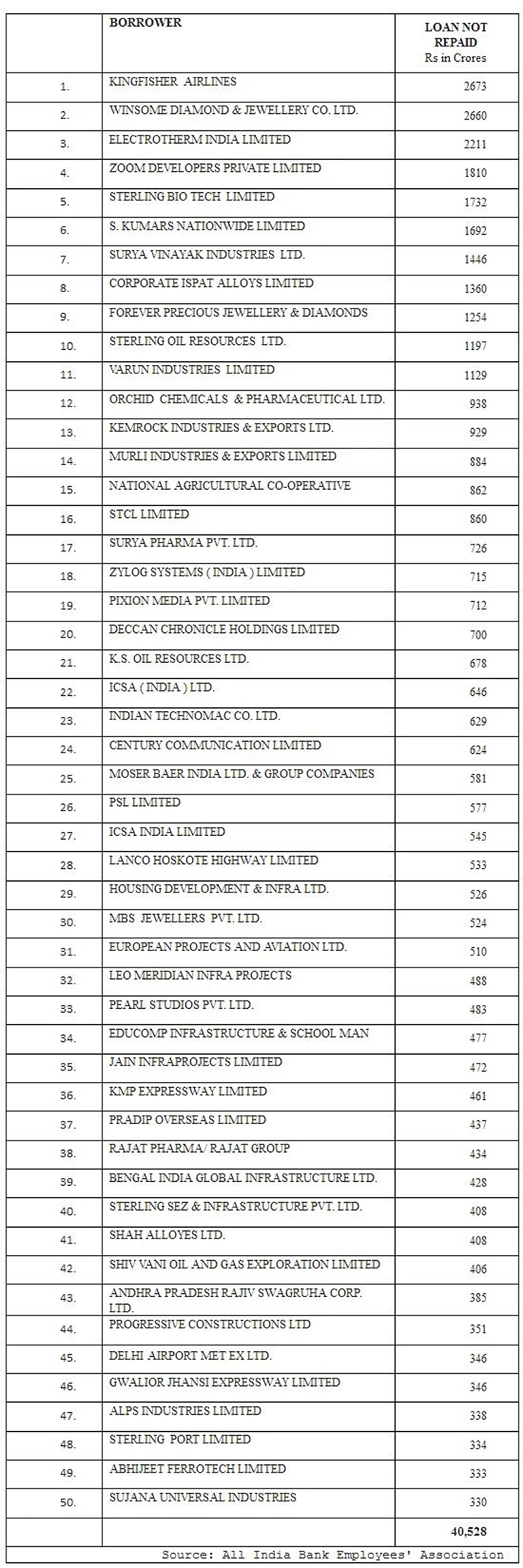

Voicing fears that PSBs—which have a larger share of bad loans on their books as compared to the private sector or foreign banks in the country—are being “killed” by the burden of bad loans, AIBEA has decided to go ahead and make public an initial list of 50 big wilful defaulters, who account for over Rs 40,000 crore of NPAs. “If NPA data is made public, then the market could react and make companies more careful in their dealings with firms that have been defaulting on their bank payments. In fact, the market will perform the role of regulator,” says Vyas.

Currently, the list of NPAs is not made public and, as in the case of the credit bureau, the information is shared between banks. That is not to say it stops banks from offering more loans to defaulting companies. The past track record has been dismal. Other than threatening to blacklist habitual offenders, the banks tend to write off the bad debts from their books while trying with little success to recover their dues. RBI data indicates that banks recover less than 10 per cent of the written-off loans.

Forever jewellery showroom

In many instances, as in the case of Vijay Mallya’s Kingfisher Airlines, banks continue to bail out corporates in a bid to salvage their credit. Therein lies a catch, as Chakraborty points out, that banks are increasingly using restructuring as a tool for NPA management. “Gross NPA in itself (is) not a problem but in conjunction with restructured advances, they have emerged as a major issue,” says the RBI deputy governor. Debt restructuring has, in fact, emerged as a means of evergreening debts, admits a retired senior banker.

Many blame the rise in NPAs and firms seeking debt restructuring to the slowdown in the economy. As economist Ila Patnaik puts it, “It is not a name-and-shame game as it is basically a downturn story and the banks need to provision properly.” The RBI report, however, points out that the rise in NPAs started not after the 2008 financial crisis but at least two years prior to that. Many of the defaulters are big corporations who have the capacity to repay but are unwilling.

S. Kumars Reid & Taylor outlet in Mumbai

The problem is there is no unanimity on the severity of the problem. A senior banker, who declines to be identified, says that while “NPAs are certainly a priority area that need to be addressed”, the situation is not alarming as “we have passed through such phases in the past and have corrected course”. The finance ministry too views the problem from a dimension different from the rbi’s. “We are concerned and have given instructions to give early warning signals, but at the same time, the problem is not so huge as to lose sleep,” says a senior finance ministry official.

Though Union finance minister P. Chidambaram has been speaking on the issue of corporate defaulters and the need for better monitoring of the top 30 defaulters in every bank, there has been little forward movement to ensure its implementation, say bankers. Some, in fact, allege that instead of being taken to task, many of the big corporate defaulters were being provided incentives in the form of concessions to repay the loans.

“In many of the cases of restructuring of loans, it works well with no loss, but in many other cases there is some sacrifice on the part of the bank,” says K. Muraleedharan Pillai, vice-president of the All-Kerala Bank Employees’ Federation, an associate of the AIBEA. He cites the case of Ascent Telecom, which went in for corporate debt restructuring in 2012-13 for an outstanding of Rs 678 crore. The consortium of banks led by Canara Bank took a hit of Rs 103 crore in the process.

In the last six years, bad loans to the tune of Rs 1,41,295 crore have been written off. Venkatachalam’s plea is that wilful default should be made a criminal offence and all defaults over Rs 1 crore should be made public. In addition, there must be a probe of any possible nexus. As we approach another major election, hopefully the government will take a more proactive view on the ever-growing debts of a few moneybags.

***

The Naming and Shaming Game

.jpg?w=801&auto=format%2Ccompress&fit=max&format=webp&dpr=1.0)

Source: All India Bank Employees’ Association; (in Rs crore)

Top 50 Loan Defaulters: