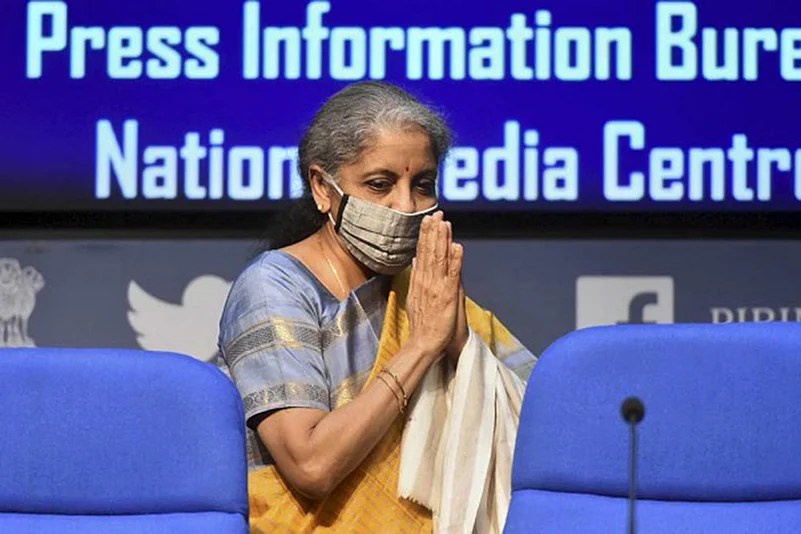

Finance minister Nirmala Sitharaman seems to have presented the Union Budget 2021-22 with an aim to give fillip to the Indian government’s disinvestment agenda. She announced several policy measures, including privatisation of two banks and one general insurance company along with asset monetisation to ensure government has enough money to push for economic growth. Union Budget 2021-22 reaffirms that the Narendra Modi government’s philosophy that “It is not the government’s business to be in business”.

Presenting her third budget today, Sitharaman estimated Rs 1,75,000 crore as disinvestment receipts for 2021-22, which is much lower than last year’s disinvestment budget target of Rs 2.1 lakh crore. Notably, last year’s disinvestment receipts dropped down severely to less than 6.5 times (Rs 32,000 crore). She added that government plans to complete sale of BPCL, Air India, Shipping Corporation of India, Container Corporation of India, IDBI Bank, BEML, Pawan Hans, Neelachal Ispat Nigam limited among others in next fiscal.

Outlining the Modi government’s privatisation policy, Sitharaman said, “Four areas that are strategic where bare minimum CPSEs will be maintained and rest privatized. In the remaining sectors all CPSEs will be privatized.” The government will keep presence through public sector companies only in atomic energy, space and defence; transport and telecommunications; power, petroleum, coal and other minerals and banking, insurance and financial services. Rest all PSUs will be privatised or sold.

The Modi government’s roadmap is now clear. Former finance secretary and economic affairs secretary Subhash Chandra Garg says, privatisation is a kind of disinvestment. Disinvestment can be strategic where you can sale and pass on the management control or disinvestment can be small bit of shares where you retain the management control and ownership with you.

He explained that it is possible to sell bank on strategic basis. “You may decide to sell your entire share holding or you may decide to sell a little less than but pass on the strategic control to the buyer.” There is complete possibility of privatisation of public sector bank but it would require some changes in law as currently the banking regulation acts and nationalisation banking acts don’t permit it. That would require amendment in law.

Garg said which banks are on government’s radar, would reveal the government’s stand. “If you privatise smaller unhealthy banks like Indian Overseas Bank or some other bank, it may not be such a big deal. If you do a better bank like Canara Bank, Bank of Baroda kind of banks then it will be real good privatisation,” he added. Earlier in 2003-04, the government had disinvested strategically BALCO, Hindustan Zinc, and a couple of ITDC hotels.

Sitharaman said, “Idle assets will not contribute to Atmanirbhar Bharat. The non-core assets largely consist of surplus land with government ministries/departments and public sector enterprises. Monetising of land can either be by way of direct sale or concession or by similar means. This requires special abilities and for this purpose, I propose to use a Special Purpose Vehicle in the form of a company that would carry out this activity.”

The National Highways Authority of India (NHAI) undertook the Indian government’s first attempt for asset monetisation. It outsourced ToT (toll-operate-transfer) of nine national highways that fetched the government Rs 9,681 crore as upfront payment. The project was won by Sydney-based Macquarie Group.

That experience came handy as the government now aims to launch a “National Monetization Pipeline” of potential brownfield infrastructure assets along with a dashboard. This will provide visibility to investors. These would include national highways, dedicated freight corridor and next lot of airports.

Notably in 2019, International Monetary Fund (IMF) had stated that the total public sector assets in 38 countries are worth US $ 103 trillion or 216 per cent of GDP. The IMF blog “A Global Picture of Public Wealth” had also these assets consist of public infrastructure such as bridges and roads, financial assets such as bank deposits, as well as natural resource reserves in the ground. The idea behind this was to make governments know more about what you own and owe is to better assess fiscal risks and evaluate government policies. It seems the Indian government has taken a cue from it.

Arvind Sharma, partner, Shardul Amarchand Mangaldas and Company, said, “The government will have to ensure that acquisition of government enterprises should make business sense. Innovative structures will have to be adapted to deal with employee unions and labour matters, lesser continuing or transitioning obligations and incentives which are immediately discontinued after disinvestments. There are some very good assets in the government’s portfolio, and they can be encashed fruitfully and at the same time interests of various stakeholders can be advanced. Since at the end of the day it is sale of a business, so legacies should not be imposed as they do not make commercial sense."

The government will delegate the work of preparing these lists to its think tank Niti Aayog. Niti Aayog’s CEO Amitabh Kant in a TV interview after the Budget disclosed that work for some PSE’s could be started as early as next month. However, he said the two private banks that would be privatised along with insurance company are yet to be finalised.