Day Of The Beanstalk

At 9.3%, the growth last quarter reached near-record levels. How long can it go on?

Still, most economists are convinced that the performance in this fiscal (2006-07) will not be that good. D.K. Joshi, senior economist, Crisil, predicts that there will be "some moderation" in GDP growth, "although they'll not come down to 5-6 per cent levels." Crisil's assessment indicates a growth rate of 7.3 per cent this year. Abheek Barua, chief economist, abn Amro, seconds this and feels that "the immediate fear of a slowdown is not there and we're not worried from a demand perspective. But we see GDP growth coming in at about 7.2-7.5 per cent. This is what the consensus seems to be."

But why? What's the reason for this slight pessimism? A major factor that contributed to phenomenal numbers last year was the unexpected performance by the agriculture sector. After a modest 0.7 per cent growth in 2004-05, the sector was actually up 3.8 per cent in 2005-06. This later figure was upgraded from the earlier estimates of 2.3 per cent. Experts say there's nothing unusual about this, as it came on the low base in the previous year. Others point out that it was expected after the government indicated that last year's kharif crop had been good. So, there's no surprise here.

Figures in quarterly % growth

Past experience shows that after a better year, agriculture invariably takes a dip the next year. Since 1994-95, a year of huge positive growth has been followed by one with a modest or a negative one—and vice versa. Ironically, the growth figures seem slightly disconnected from the monsoons and seem more in sync with what's called the base effect (the lower the growth base in a particular year, the more the chances of a higher growth the next year). For example, agriculture grew by 5.9 per cent in 1998-99, when rainfall in 1998 was 106 per cent of the long-term average. But, in 1999-2000, when rainfall was slightly lower at 96 per cent, the growth dipped sharply to 0.6 per cent. In 2000-01, the growth was still lower at 0.2 per cent, as average rainfall in 2000 fell again to 92 per cent. Surprisingly, the monsoons were at an even lower 91 per cent in 2001, but the agriculture sector grew by an amazing 5.8 per cent in 2001-02. By this logic, the farm sector in the next fiscal may not reap enough.

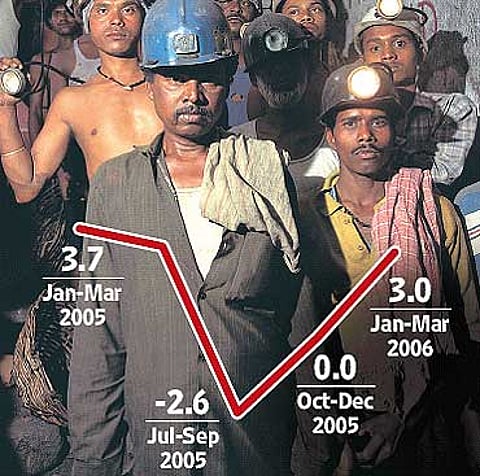

MINING: Figures in quarterly % growth

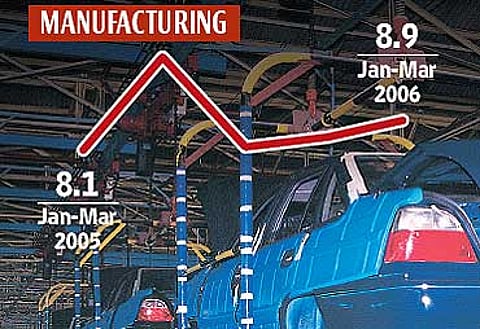

There are other reasons for concern. Although the manufacturing sector has done well in 2005-06, with a yearly growth of 9 per cent, it was lower than the earlier estimates of 9.4 per cent. Industry associations like the cii have expressed concern at this downgrade. Infrastructure segments like electricity and mining have fared quite poorly. In fact, even the FM termed this as "somewhat disappointing". He added that more "structural, legal and administrative reforms" were needed in these sectors to sustain the higher GDP growth rates. But whatever the finance ministry does, it may not have an impact this fiscal. So, if these sectors continue to do badly, it may have an adverse impact on overall growth.

Couple all this with the growing feeling that some of the sectors that boomed last year—like construction—may witness lower growth rates this year. "The growth in construction will largely be a play on housing, which may be affected because the leverage costs are increasing. So far, the industry has absorbed hikes in input costs, but this year, it may pass it on to consumers, which may impact demand," observes Barua. At a macro level, Joshi thinks that higher global crude prices, domestic inputs costs and rising interest rates can dent the growth figures.

Figures in quarterly % growth

What's surprising is that there are a few experts who think that if the GDP grows at around 7.5 per cent this fiscal, it'll indicate a peak in the current business cycle. Thus, things may only go down. Another point is that global experts are slowly talking about similar peaks having reached—or about to reach—in other asset categories like commodities, metals and bullion. So, if they too go down in the next few months, it'll have a drag effect on several developing economies, including India. That will be bad news for die-hard optimists, who feel the India growth story has just begun.

Tags