Mehrunissa Mehboob Mullawale

Housemaid, Mumbai

Housemaid, Mumbai

2004-05 | 2008-09 | |

Your spending: In The Kitchen | ||

“But they are better than the previous one in some ways. Like the roads are better, but only slightly so. With prices rising steeply, we wish it would try to make our basic needs affordable. What I do like about the government is that it made sure the new houses under the slum rehabilitation scheme are larger (300 sq ft), allowing a family of four to live in some comfort. It also came to our aid with a relief of Rs 5,000 when we suffered losses in the 2005 floods.”

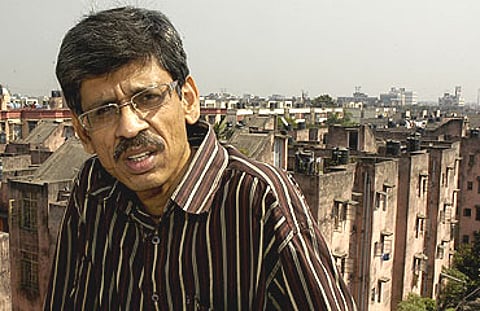

Tapomoy Bandyopadhyay, GM, Ambuja Realty, Calcutta

| ||

Your spending: Entertainment |

Abhijit Shilotri, CEO, Yatra Exhibits, Bangalore

|

Kinkini Chakravarty, Executive, EEPC, Mumbai

| ||

Your spending: Keeping In Touch |

Shahid Ahmad, Hairdresser, Delhi : “I do not expect any dole from the government.”

| ||

Your Resume: Careers |

Surinder Singh, Farmer, Jalandhar: “The UPA government’s policies towards farmers have helped us better our lifestyle.”

|

| ||||

Your Borrowings: Interest Rates | ||||

Tags