Cardano is zooming up. Bitcoin has bounced back…what did your fund manager tell you? My neighbour’s into stocks, but he does not touch it; his son in Montreal is in on the game though. How about Ethereum…aren’t they rolling out 2.0? This is an all-time high. Look at El Salvador—they know a thing or two about coups, after all! This one’s a real coup. Almost as good as what the Mayans did back in the eighth century, using chocolate as money. Wait, is this a currency? Or a commodity? A plane or a bird? Does it even exist?

Bitcoin, Altcoin, Blockchain, Mining…The Nuts And Bolts Of Cryptocurrency

Decoding the mechanics behind the befuddling yet exciting world of money that is not quite money

The chatter on the wires is quite breathless, and rising to a crescendo. There’s quite a large, swinging crowd of millennials who have taken to it like ducks to water—in fact, those below 30 form the bulk of the user base of WazirX, the largest crypto exchange in India. Indeed, the platform also saw a surge of users aged over 45 between February and April—a 337 per cent rise, according to The Economic Times. From among both segments, you have the usual lottery winners. Like Richi Sood (32), who betted over 10 lakh on Bitcoin, Dogecoin and Ethereum, and, thanks to her timing, laughed all the way to the bank when Bitcoin hit $50,000 in February. Wait…bank? You must be Jurassic. If there’s money that’s not quite money, can you bank on a bank?

Everyone knows something is going on, but hey…what exactly? Do not be afraid to ask. This is where most people are when it comes to cryptocurrency—a zone of befuddlement—and it’s most natural. Because what we have here is not just a system that’s outside the system, the idea of a non-material currency that’s not backed by an asset is so far out that it shakes up our very circuits of knowledge. So very few can read the present…and even those who can may not hazard a guess about the future. But we do know a few things for sure. Here are some easy clues to crack the cryptic crossword puzzle. At the heart of these digital transactions is blockchain technology—that’s the orbit on which the crypto galaxy moves. But before we get to the underlying technology, let’s look at the basics.

ALSO READ: Ride The Bullish Run Of Cryptocurrency

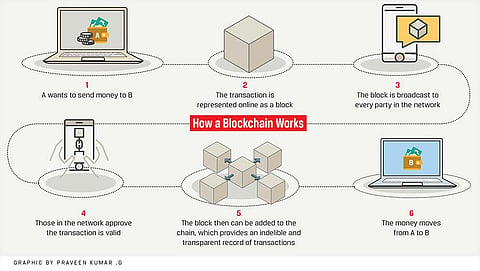

The Alpha and Omega: For the new initiate, think of cryptocurrency as a new form of cash. Except, it doesn’t have a physical existence. These are virtual ‘coins’ that exist only in the sense that they are stored online, in the form of digital files. These files, containing all their transaction records, are stored on a network and shared across multiple computers. The records are stored in the form of ‘blocks’ that are connected via a chain—hence the name ‘blockchain’ for the technology that forms the backbone of most cryptocurrencies, which does the job of recording the transactions. These blockchains are further secured by cryptographic techniques that help you make secure payments online…that is, if the receiver accepts that form of abstract payment. Hence the name ‘crypto (hidden) currency’.

The blockchain data could be public, private, or what’s called ‘permission’ data. While the public blockchain is truly decentralised and independent of any central authority, staying anonymous on these networks can be difficult and the chances of your data being exposed are high. Bitcoin, Ethereum and Litecoin are some examples of cryptocurrencies that use a public blockchain. One can also opt for a private blockchain that allows entry only through verified invitations. In private blockchains, only the owner has the right to make any changes to the entries—thus, it’s the opposite of decentralised. Ripple (XRP) and Hyperledger are some examples of popular private blockchain-based payment systems.

The ‘permissioned’ blockchain is a mix of public and private blockchains that allows anyone to join the network after their identity is completely verified. But on condition that the new entrant performs only those activities that are permitted. Some examples of cryptocurrencies that run on ‘public permissioned’ networks: Stellar and Sovrin. Hyperledger Fabric or R3’s Cordaare are, by contrast, powered by ‘private permissioned’ ledgers.

A transaction record is a series of interconnected ‘blocks’, each of which contains the relevant data and is appended with a unique hash. As one goes along the series, eachsubsequent block is also marked by the previous block’s unique hash—hence forming a chain. A typical blockchain could look something like this:

Block 1 = 100 Bitcoins from Ajay and Reema (data) + 20AB (unique hash)

Block 2 = 50 Bitcoins from Reema to Sohail (data) + 17KL (unique hash) + 20AB (hash from Block 1)

Block 3 = 20 Bitcoins from Sohail to Meena (data) + 23CQ (unique hash) + 17KL (hash Block 2)

And so on...

The blockchain thus records all the data relating to transactions of a given set of cryptocurrency units in a public ledger secured using cryptography. Crypto means ‘hidden’; graphy relates to ‘writing’. This means your blockchain data—transaction + participant details—is secured with hidden writing, metaphorically speaking. Cryptography secures the data with hashing, a mathematical operation that creates a unique marker, one that’s a lot like a fingerprint or signature. The hashing technique helps transform the data (transaction + participant details) into a unique text sequence. For example, when you want to create a new email account, you must provide your desired email address and password. However, the email provider, say Gmail or Yahoo, cannot save your password in the same format. They must encrypt it to keep the data protected even from internal access—that’s where the hashing function typically came in before cryptocurrency harnessed it for its own needs. Now the latter has become one of the major applications of hashing, which makes it impossible for hackers to break into the data and make any changes.

Cryptography thus protects your transactions, manages the currency units, authenticates the transfers of digital assets and tokens, and keeps you from double-spending. Moreover, since blockchain technology is decentralised (not controlled by a single person or group or central authority), it makes the data unalterable. According to MIT Technology Review, “The whole point of using a blockchain is to let people—in particular, people who don’t trust one another—share valuable data in a secure, tamper-proof way.”

NFT digital art supported by cryptocurrency

Digital vs Crypto? Let’s clear one key confusion that’s gaining ground: cryptocurrency is NOT the same as a digital currency. Digital currency is merely what you call the online transaction of physical money between parties—for example, fund transfer from one bank to another, or transactions made through digital wallets. They are, ultimately, backed somewhere by dollars, rupees et al—the trail always leads back to the old physical money. Cryptocurrencies, on the other hand, do not. They are virtual currencies stored in the form of a value online and secured by encryption. The only link individual cryptocurrency units have with physical money is in their valuation, which reflects in the fluctuating stock prices. So don’t be fooled by cryptos being called ‘digital coins’—that’s just a casual nickname.

Another term you’d have come across on the subject of cryptocurrency is ‘mining’. Taken along with the frequently expressed concern that crypto mining is energy-intensive—and that it’s the harbinger of a future environmental catastrophe—the metaphor conjures up images of a physical process, as if an ore is actually extracted from the ground. But we are in a decidedly digital space here, and that’s merely a metaphor. So what exactly is crypto mining?

In short, it’s a way of creating units of cryptocurrency using technology. Well, to be clear, you do not need to be a miner to come to own crypto tokens. Most individuals purchase and trade units of cryptocurrency the old-fashioned way. You can buy tokens of cryptocurrency with fiat currency, trade them on an exchange like Bitstamp with another cryptocurrency (for example, Ethereum or NEO to buy Bitcoin), or earn them by shopping, writing blog posts on platforms that pay users in crypto, or even setting up interest-earning crypto accounts. But it is also possible to ‘mine’ tokens using your computer—this way, you actually bring new ‘coins’ into existence, so to speak. Indeed, the promise of getting paid in cryptocurrency is a major lure for those who play this niche nerd game. For, mining involves solving cryptographic equations with the use of high-power computers. The solving process comprises verifying data blocks and adding transaction records to a blockchain ledger secured by applying complex encryption techniques.

As we said, since cryptocurrencies use a distributed method of storage, they rely on cryptographic algorithms for the transactions and their verification. To get new coins on the ledger involves solving complicated mathematical puzzles that assist in verifying virtual currency transactions and then updating them on the decentralised blockchain ledger. As the outcome of this work, the miners receive pay with cryptocurrency. This method is called mining as it allows new coins into circulation. Even a conservative nation like Iran is betting heavily on crypto mining. That, along with El Salvador’s lead and the fact that Honduras has launched the first cryptocurrency ATM, it’s clear that a global trend is here. Is it just speculative play? Or will it sustain? Fred Ehrsam of cryptocurrency investment firm Paradigm says “everything will be tokenised and connected by a blockchain one day”. Consider the technological leap and ask: can we de-invent the wheel?

***

Crypto Glossary

ALTCOINS: Altcoins are alternative cryptocurrencies that were launched after Bitcoin’s success. They generally project themselves as better replacements for Bitcoin.

MINING: Each time a cryptocurrency transaction is made, a miner is responsible for ensuring the authenticity of information and updating the blockchain with the transaction.

SHILLING: Shilling is creating hype and buzz about a coin to promote and increase its price. In crypto world, someone who promotes a coin so that they can personally benefit are called shills!

WHALE: Whales are individuals or companies who hold large amounts of bitcoins. Their buy/sell activity has the power to move the market. When markets are highly volatile, big players, referred to as whales, are usually considered as the source behind the market volatility.

AIRDROP: An event where coins or tokens are sent to selected users' digital wallets. It is a famous marketing stunt to create a buzz about a new token.

(This appeared in the print edition as "Cryptic Nuts and Bolts")

(With inputs from Harsh Kumar)