On most days one spots news items that report deaths of debt-trapped farmers in different parts of the country. In fact, recently a farmer invited people for a funeral service before committing suicide. In comparison, few similar cases get reported about the well-off, most of whom continue to flaunt lavish lifestyles a la Vijay Mallya of the beleaguered Kingfisher Airline fame. Mallya’s bad loans run into Rs 7,500 crore (a loan becomes substandard and then a non-performing asset, or NPA, if the borrower fails to meet his obligation to service it for 90 days). But despite the SBI-led consortium’s decision to sell Kingfisher House in Mumbai, or Mallya resigning as chairman of United Spirits, he has gotten away lightly, without being declared a wilful defaulter.

Both Hands In Pockets, Wilfully

Banks, groaning under a burden of lakhs of crores of rupees worth of NPAs, scramble to clean up their books

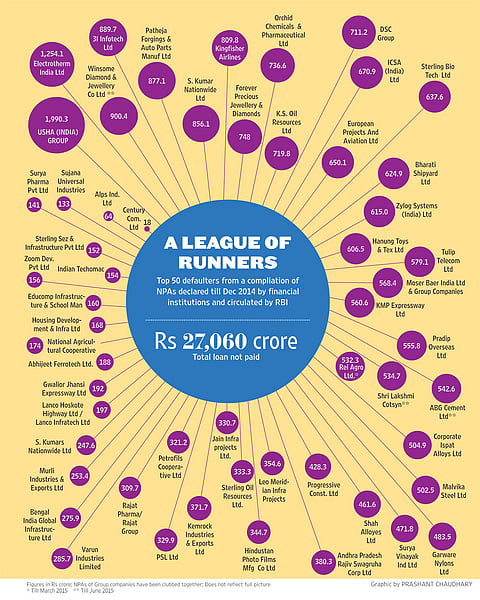

Political and corporate nexus with top bankers is often the talk in party circuits. Bankers point to the fact that while many corporates get off scot-free, escaping the ignominy of ‘naming and shaming’ as in Vijay Mallya’s case, small borrowers of even a few thousand rupees are not so fortunate, as banks are known to (literally) take drums to the defaulters’ offices or residences to publicly shame them into clearing dues. In Mallya’s case, till December 2014, only Bank of Baroda had classified his loans in the NPA category, according to a master list of over 4,000 defaulters circulated last year by the RBI to warn banks about the credit history of risky borrowers (Outlook sourced this list and has printed the top 50 defaulters on page 57).

All this seems to be changing. The deluge of reports in recent weeks about non-performing assets running into lakhs of crores has reached most drawing rooms. The estimates of the NPAs and corporate debt restructuring cases last year were around Rs 6 lakh-crore and are expected to cross Rs 10 lakh-crore when official numbers are released this year by the RBI, says C.H. Venkatachalam, general secretary of bank employee body AIBEA.

There’s no doubt it’s a deep crisis. “The situation in public sector banks is very bad, about 9.5 per cent points worse than in private banks. About half of this is probably due to inefficient lending and half due to political pressures at the time when loans were first approved,” admits Arvind Virmani, chairman of Policy Foundation and former India representative to the International Monetary Fund. Of course, many of these loans were handed out during the UPA tenure. Congress leader Manish Tiwari admits as much, adding: “Once the losses of the power distribution companies get factored in and they are qualified as NPAs, the shit will hit the fan and you are going to have a run on your banks.”

That is a drastic statement—public sector banks are backed by the Indian state and experts rule out any runs on banks. But Manish Tiwari’s statement highlights the importance with which people are now looking at this whole issue. The can of worms started spilling out in real earnest with the Reserve Bank of India—with Governor Raghuram Rajan leading the charge—setting a March 2017 deadline to get banks to clean up their books. The process started in April 2015.

The task is more difficult than one imagines, considering that for years the effort in most cases, including that of the largest public sector State Bank of India, has been to hide NPAs, particularly of big defaulters. The modus operandi has been to lend chosen defaulters fresh amounts, or in some cases refer them for corporate debt restructuring (CDR), which in a way helped banks from not classifying them as bad loans in their accounts.

This evergreening of loans is not something most bankers are comfortable talking about in the open. As a general manager of a public sector bank with one of the highest amount of NPAs put it, “We all face pressure from the political and corporate nexus both to give loans and also not to show them as defaulters. This is the case in almost 50 per cent of the NPAs in our bank.” One of the few banks to break this trend is the Punjab National Bank, which has been publishing the names of wilful defaulters, that is the category of people who have the means to return the borrowed money but opt not to do so. Sheltered by people with clout in most cases, they have persisted in not repaying the debts.

K. Unnikrishnan, deputy chief executive of Indian Banks’ Association, says it is important to clearly distinguish wilful defaulters from those who have been hit by the global economic downturn and its impact on sectors like infrastructure, steel and mining, among others. He does admit that in some cases when opportunity presents itself, companies do tend to overstretch and when there is any delay in project execution or the economy does not grow as expected, they suffer.

A senior retired banker blames the banking policy and the rush to meet loan targets as part of the bigger problem. “There is a staff accountability exam even for small loans. This is conducted up to the level of general manager. But loan amounts of Rs 20 crore plus are approved by the board, in which the CMD and ED are members. Yet, when these loans turn bad, it is the GM who is held accountable. How can a GM write a report against his seniors?”

Vishwas Utagi, vice-president, AIBEA, says it is not enough for the RBI to circulate names of defaulters against whom cases have been filed. “As a depositor, we have the right to know how our money is being used by borrowers as banks are running on the money of depositors,” says Utagi. The composition of deposits as on March 31, 2015, across different states/union territories showed that the household sector accounts for around 60 per cent of deposits, in the case of rural banks it’s over 90 per cent.

In terms of states, the RBI data shows higher concentration of deposits in seven states—Maharashtra, Delhi, Uttar Pradesh, Karnataka, West Bengal, Tamil Nadu, and Gujarat. These states accounted for 66.2 per cent of total deposits and 62.1 per cent of total households’ deposits. Maharashtra alone contributed nearly one-fourth of the total deposits.

The wait is now for the bankruptcy law, which will provide room for corporates to seek legal protection while restructuring their operations, including cutting jobs, while efforts to revive the company are on. This could include seeking an equity partner or outright sale of assets.

Truth be told, the real picture of the NPAs is still evolving and is turning out to be more disturbing than expected, with even the parliamentary panel in its report pointing to the practice of wilful defaulters buying back their stressed assets once the creditor decides to liquidate it. The wait now is to see if the government will step in with adequate funds to help PSU banks recapitalise to provide for bad loans, as required under RBI norms. If so, it will surely come at the cost of much-awaited funds for other social development sectors that are already feeling the pinch.

***

RBI Governor Raghuram Rajan on NPAs

2016

- “Existing loans will have to be written down significantly by banks to tackle NPAs.”

- “The classification of loans as NPAs, is an anaesthetic that allows the bank to perform extensive necessary surgery to set the project back.”

2015

- “You need to do what you need to do. Take the medicine. Pushing up in the future is going to create bigger problem.”

- “Bad loans may not have peaked yet... The RBI increasingly turning towards taking action”

***

Banking Mess

The total corporate loans that have become non-performing assets (NPAs) or gone for corporate debt restructuring (CDR) is over Rs 6 lakh-crore

- Impact Of NPAs On Bank Acknowledging NPAs has deepened losses of many banks. In over a month, listed banks have lost more than Rs 1.8 lakh-crore in market cap.

- Will Clean-Up Of NPAs Help? It will help ease the burden on the banks and get them back to the business of lending. This has currently slowed down due to rising bad loans.

- Recapitalising Of Banks The exchequer is expected to provide for recapitalising PSU banks to provide for bad loans. It will help banks push ahead with financing of projects.

- Who Pays For Clean-UP? Your money is at risk: household deposits account for over 60% of banks funds; to make for losses, deposit rate may dip, lending rate rise.

- No Checks And Balances Despite the RBI putting in place a system for circulation of data on loans listed as losses or doubtful, banks have not paid heed to check the risng NPAs.

***

- Debt-trapped farmer Ashok Rathod and his wife, committed suicide near Nagpur

- A loan of Rs 9 lakh and crop loss led Punjab farmer Surjit Singh to commit suicide

- Mumbai jeweller Harish Soni and family took their own lives, unable to repay Rs 50 lakh

- Burden of home loan led senior editor Srinivasa Raghavan and wife to commit suicide

Tags