Key recommendations made by intelligence agencies with the Financial Intelligence Unit (FIU) are:

Blood Money Flow

Militants are using the regular banking route to get funds

Key recommendations made by intelligence agencies with the Financial Intelligence Unit (FIU) are:

- Post revenue intelligence officials to embassies/high commissions of sensitive countries like Pakistan, UAE, US, UK, Nepal and Afghanistan.

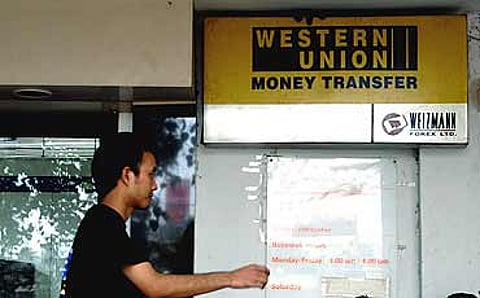

- Amend Prevention of Money-Laundering Act (PMLA), 2002, and bring international payment gateways like Visa, Mastercard and money transfer agencies like Western Union under the surveillance and monitoring network.

- Make it mandatory for lawyers, accountants, real estate agents, foreign exchange dealers and jewellers to report all cash transactions over Rs 10 lakh and any suspicious financial transfers to the FIU.

***

- In October, the security forces arrested two Kashmiri militants belonging to Al-Badr, Mohammad Ali Hussain and Mohammad Fahad, in faraway Mysore. The duo had received about Rs 6 lakh over a period of four months. The money was transferred through Western Union. Fahad received an additional three lakh in his ICICI account in Mysore.

- In March 2006, Lashkar-e-Toiba militant Sami Ahmad Shah was arrested from Gulbarga, Karnataka. He received Rs 3.5 lakh, over two years, through Western Union again. Each payment was an innocuous Rs 10,000.

- In September 2006, ISI agent Laraib was arrested in Lucknow. He had been using a debit card to withdraw money from various ATMs.

- Make it mandatory for international credit card companies like Visa and Mastercard to report to the FIU any cash transaction over Rs 10 lakh. International money transfer agencies like Western Union must come under the purview of the surveillance network.

- Lawyers, accountants, foreign exchange dealers, real estate agents, jewellers and gem dealers should report transactions above Rs 10 lakh.

- The Unlawful Activity Prevention Act (UAPA), 2005, should be included in the schedule of PMLA. The UAPA is the law that replaced the Prevention of Terrorist Activity Act (POTA). This will make terror funding a punishable offence under provisions of the anti-money-laundering law.

- Suspicious transactions should be defined comprehensively. At present it is left to the discretion of banks and financial institutions to report what they feel are questionable transactions.

Indian efforts at combating terror financing have been found inadequate by international standards. Says an intelligence official: "This is one reason why our banks like ICICI are finding it difficult to open branches in other countries. They are always refused permission on the ground that the anti-money-laundering laws in our country are not good enough, and that they cannot take chances. Most countries have become very stringent post 9/11. Funding of terrorist activities has become a major issue. India has to improve its standards."

However, this is easier said than done. Since global finance gateways like Visa and Mastercard are based overseas, they cannot be controlled by Indian laws. Notes an intelligence official: "It may not be easy to make them answerable to any intelligence agency here. In fact, that is also the problem with an international money transfer company like Western Union. We can only ask them to report transactions voluntarily. It may be difficult to make them comply legally."

Another problem that the intelligence agencies currently face is analysing the huge mass of information that the FIU receives from banks. To tackle this the FIU has signed an agreement with the account and audit firm Ernst & Young. Under the two-year contract, the firm will set up and operate a computerised system which will record and analyse all suspicious financial transactions.

With a functional and effective data processing system in place, theFIO can monitor patterns of money-laundering and terror financing. This, it is hoped, will help the FIU issue timely alerts to enforcement and intelligence agencies to combat militancy.

Tags