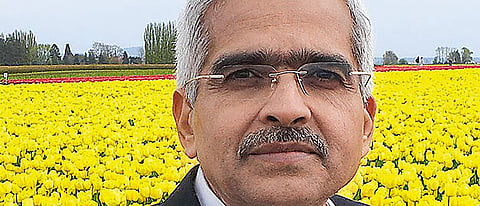

The main mover in the protracted negotiations to plug the loopholes in the double taxation avoidance treaties with Mauritius and Singapore has been the finance ministry’s revenue department, first led by Shaktikanta Das, currently economic affairs secretary, and since September by Hasmukh Adhia. Given that 50 per cent of FDI inflows come from these destinations, this is a big move by the BJP. Of course, there were corporate pulls and pressures to retain ‘flow facilitation mechanism’ that allowed them to launder black money in the guise of FDI.

Overestimation of gas reserves in KG-22 block by the Gujarat State Petroleum Corporation (GSPC), announced in 2006 with great fanfare by Narendra Modi, then chief minister of Gujarat, was no different than the hype created earlier by Reliance Industries in the case of D6 block in the same Krishna Godavari basin. In both cases, studies by experts led to drastic downsizing of original estimates. Both played around with investor sentiment, but was GSPC also guilty of wasteful expenditure? That is open to debate. Exploration by its very nature is an expensive gamble, made more risky by unwise business moves.