Many Perceived Risks, It’s A Gamble

Billion Dollar Question

Political manoeuvring aside, is the Adanis’ coal rush a complete goner?

Q. What’s the fuss about Adani Mining’s project to develop Australia’s Carmichael coalmine?

A. Well, sliding coal prices over the past five years have raised serious doubts over the project’s viability. So, it’s a gamble—there are plenty of coal reserves, but will prices recover to justify SBI’s loan to Adani?

Q. Is that why foreign banks—RBS, Deutsche Bank and HSBC—have shied away from the venture?

A. Yes, there are many perceived risks. Also, reports that India will soon improve its own coal output to reduce imports have raised concerns.

Q. Hasn’t the project got the green nod?

A. Delays in getting clearances have added to costs. In fact, in August, BHP Billiton abandoned its plans in the region, citing carbon and mining taxes, among other reasons. It may well impact Adani’s 2017 timeline.

Q. Finally, is the Adani Group overleveraged?

A. There are concerns, of course, given the Rs 80,000 crore debt. However, Adani Enterprises has thus far not defaulted on loan servicing.

***

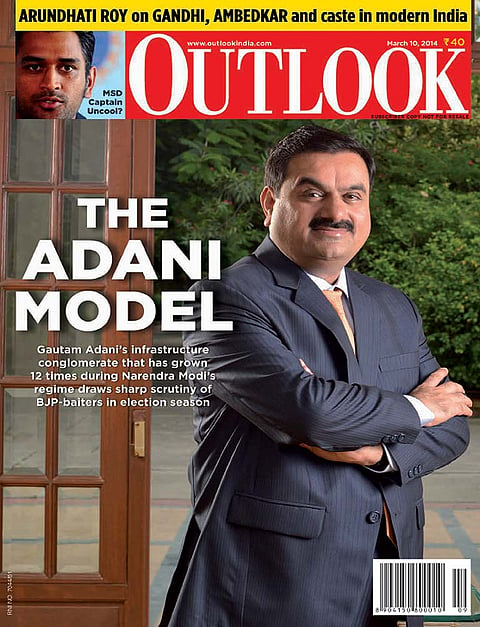

The buzz in Australia is that the long-awaited environment clearance for Adani Mining’s Carmichael coal mining project came through with clear signals emanating from India about group chairman Gautam Adani’s closeness to Prime Minister Narendra Modi. The promise of multi-million dollar investments and creation of hundreds of jobs at a time when mining giants like bhp Billiton and Glencore are recasting and even shelving their new coal mining projects in Queensland was by no means a small inducement. Especially with the state going to polls next year.

The desperation is apparent when one considers how Queensland’s action is contrary to the G20 resolve to cut down on subsidies. Given the “low coal prices and the dubious economics of the project”, Michael West of the Sydney Morning Herald tells Outlook, “I hear the local banks here are not jumping at the opportunity to provide funding to Adani, etc. The project may become viable if coal prices rise significantly.” The trend in the last five years indicates no such northward trend.

Diplomatically, both India and Australia were able to showcase commitment to boost bilateral trade and investment with the signing of the $1 billion loan agreement between the public sector State Bank of India and the Adani Group. What is worrying some market-watchers is the fact that SBI is planning to lend an additional $1 billion to what many consider an over-leveraged company. As on September 30, 2014, the total debt of the company stood at over Rs 72,632 crore (currently it is estimated to be Rs 81,122 crore).

Since the emergence of Modi on the political scene and return of the NDA government, the Adani group’s stocks have been one of the biggest beneficiaries. Analysts point out that Gautam Adani has used the rise in stocks to borrow more and make fresh acquisitions, including a 1,350 MW thermal power plant in Udupi from Lanco for Rs 6,000 crore. “Everybody knows that the Australian show was arranged by Adani and that is why he was able to swing the deal with SBI and get the long-awaited environment clearance from the Queensland government,” says a senior retired bureaucrat and energy expert.

On the defensive, SBI chairman Arundhati Bhattacharya told media on the sidelines of a quarterly review meeting of PSU banks with the finance ministry, “There is no viability issue and the quality of coal is very good. FoB (freight on board) of their coal is $42 per tonne, which is much better than the international prices.” She further clarified, “This is only an MoU. It will go through due diligence based on which the board will take a call.”

But don’t expect any surprises here, given the overall largesse at stake. Beyond the coveted green nod from the Australian government for its $7.5 billion Carmichael coal mine, rail and port project, the Adani Group also got a commitment for funding. The Queensland state government is planning to pick up stakes in the rail and port infrastructure projects, and some funding is expected from South Korea’s export credit agencies. But make no mistake: at a time when several local banks had refused to help fund the project, the SBI funding is the biggest helping hand to Adani.

This comes over and above an earlier $800 million loan by an SBI-led consortium to help Adani acquire the Abbot Point port and Galilee Basin coal deposits in a deal worth up to $3 billion over 20 years. The project has not made much progress due to delay in environment clearances and funding issues. The government may have given the green nod but protests by civil society groups persist; finances too still have to be tied up.

Says Hamish McDonald, Australian journalist and author of Polyester Prince: The Rise of Dhirubhai Ambani, “Adani seems determined to go ahead despite the fall in thermal coal prices. With the SBI loan and the Queensland state government just agreeing to help build the 300-km railway from mine to port, it may be viable. The thing that worries people here most has been the plan to dredge the loading port at Bowen Point and dump the spoil in the Barrier Reef. The coral is already suffering a lot of damage from unusual run-off from the land bringing dirt into the water, plus rising sea temperatures.”

With over 10,000 MW of thermal power generating capacity, Adani has emerged as one of the biggest coal importers in the country. Company sources claim it makes sense to have captive coal supplies from Australia, given that the Carmichael coal mine produce is of better quality than what is available in India; it will give better results. Once in operation, Carmichael would be Australia’s largest coal mine, producing 60 million tonnes of coal per year during its 90-year lifespan. Currently, Adani leases the existing coal terminal at Abbot Point. However, soon expansion plans will be executed there and at the port of Hay Point.

Gautam Adani’s grand vision is to raise the generation capacity to 20,000 MW by 2020 with coal sourced not just from India, but also from Indonesia and Australia. Critics, however, wonder why Adani would in the long run bring coal supplies to India if he can get a better price in the international market? That is still in the future.

Indian experts are by and large positive. Market expert Deven Choksey says, “The over-leveraging concern is misplaced in the case of Adanis as it is the only company in the private sector today to have implemented projects in time and is running them at the highest efficiency level.” Brushing aside concerns on political consideration overriding prudence by banks, he goes on to say, “Today, if you don’t have the capability to deliver, no politician worth his repute would back you.”

Given the size of the Australian project, any company executing it would seem over-leveraged, says investment advisor S.P. Tulsian, who feels the Adani Group, by its performance, has proved it is capable of maintaining its financial repayment schedule given its excellent execution capability whether in port or power sector. “Wonder why we see any political pressure when the banks have their own accountability? I don’t think any bank or bureaucrat in the current situation will be bold or kind enough to sanction any loan which does not fit the financing norms,” says Tulsian.

Of course, if that indeed was the case, one would not see the likes of Kingfisher Airlines getting away with financial mismanagement. “Already the exposure to the top 10 companies is more than Rs 6 lakh-crore or 10 per cent of the entire banking system. It is undesirable to further expose the banks by extending further credit facilities of this magnitude,” says C.H. Venkatachalam, general secretary of the All India Bank Employees Association.

Even as the Adani Group is targeting starting the first coal exports from Australia to India in 2017, much can change in the interim as the greens have not given up their fight, the political scenario in Queensland may change and even the commodity market may spring surprises. Here’s hoping India will at least get assured coal supplies and consumers affordable power for all the political patronage to the Adanis.

Tags