Airwave Sandwich

Bharti Telecom and Africa's MTN can unite to be a global behemoth

- A Bharti-MTN merger through an SPV likely with both having equal stake

- Outright acquisition unlikely, could put a debt burden of $25 b on Bharti

- Bharti has to structure deal keeping FDI under 74% to avoid regulatory issues

- Aggressive bidding could raise stakes, negate synergistic benefits for Bharti

- MTN keeping its options open, may be talking to other players as well

***

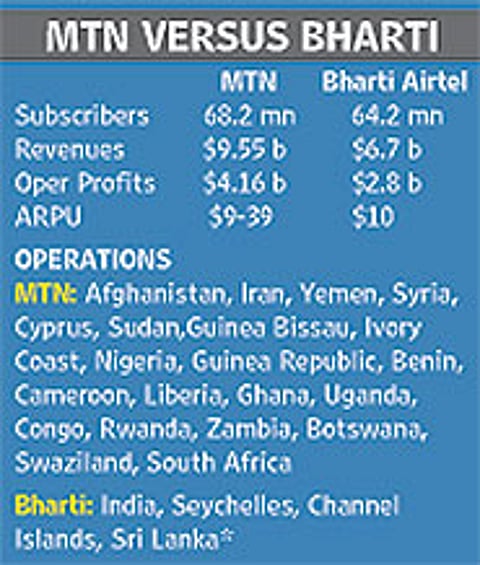

ARPU: Average Revenue per user *Has license, but operations yet to begin |

There could be regulatory issues as well. Chandrashekhar says: "While it doesn't pose a regulatory challenge vis-a-vis competition, there could be issues on equity refinancing (capital for the acquisition). Issues of domestic and foreign equity would have to be sorted out before anything is finalised." As India doesn't allow foreign direct investment (FDI) above 74 per cent in telecom companies, Bharti (with 68 per cent FDI) would either have to seek an exemption—or structure the deal in a way that it doesn't upset the regulatory applecart. What helps is that rbi recently doubled the overseas investment limit for an Indian firm to 400 per cent of its net worth.

Moreover, some European companies have reportedly shown interest in MTN. This could pose problems for Bharti. "Fear of competitive bidding is the single-largest concern. Aggressive bidding could ultimately lead to higher cost of acquisition and eat away the economic benefits of synergies," warns Purohit.

As things stand, some signal is expected now that Mittal and MTN CEO Phuthuma Nhleko have been locked in talks since March. But Bharti would also have to play it safe, as MTN is known to be a smooth operator. Says telecom expert Mahesh Uppal: "MTN tends to be a naughty player. It is quite routine for it to be involved in these talks and the deal not coming through."

In fact, sources say MTN's M&A team was in India as recently as April, looking for acquisitions and held talks with new licencees. Both companies know they represent the future growth of telecom—and, so, expect long-drawn-out negotiations. Hopefully, this saga, with such epic possibilities, will have a happy ending. Sunil Mittal has earned a reputation of pulling things through. His shareholders and 64 million subscribers are now betting that he can take a global call.

Tags