Bubble Economics?

Add This To Cart?

Hyper e-commerce site valuations, another bubble on the make?

- Online companies getting huge valuations, many times gross merchandise value

- Experts and some players fear a bubble-like situation is being created

- “Eyeballs” and “hits” game over, investors seeking successful e-commerce ventures

- The pluses: Banking on mobile internet, a dramatic rise in Net population

***

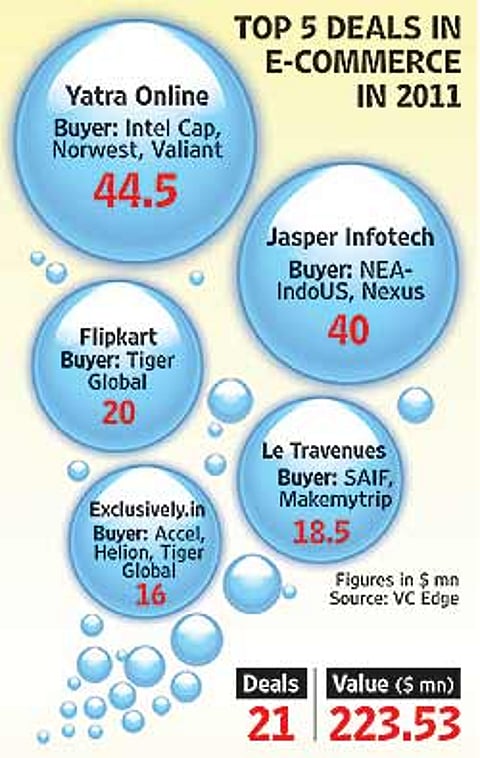

But then, suddenly, we are being told that e-commerce in India has reached an “inflection point” (and some are also saying that a commodity-fuelled Brazil has finally arrived, but that’s a different story). In the past few weeks, around 10 e-commerce companies have attracted investments of between $5-10 million. Online bookseller and retailer Flipkart—the present poster boy of e-commerce in India—is set to raise a mammoth $150 million. Others in this space—infibeam.com, naaptol.com, Magic Rooms, snapdeal.com, myntra, fashionandyou.com, exclusively.in and letsbuy.com—have also raised cash.

Fuelling this rush is some heady buzz: the world’s largest online retailer Amazon is setting up shop in India and will start operations by early next year. Though this could not be confirmed independently, there does appear to be some truth behind the reports.

That was the good news. Many of these domestic e-commerce firms, though, are raising funds at 10-15 times their gross merchandise value (monthly sales calculated on an annual basis). Flipkart, for instance, got a valuation of an unbelievable $1 billion—many times its gross merchandise value. Similarly, Snapdeal (which serves up shopping deals) is said to be valued at around Rs 1,000 crore. Investors are worried and many think this might turn out to be another bubble that may burst anytime.

Recent reports of creative accounting practices followed by dotcoms to look more attractive aren’t helping matters. Says Sanjeev Aggarwal, senior managing director, Helion Venture Partners, which has invested heavily in leading online firms like Makemytrip: “It’s a little insane. These valuations are far ahead of time. At this level, it is difficult for investors to make money.” And since e-commerce companies have a long gestation period and normally take 7-8 years to make profits, the investors’ return on capital could become a distant dream.

K. Vaitheeswaran, CEO, Indiaplaza.in, and one of the pioneers of e-commerce in India, feels the valuations are based on future promise and thus are a gamble. “It has already gone beyond control. I think it’s a bubble. If valuations go the way they are, a bubble burst can come soon and it could be in the next 6-9 months,” he says. Vaitheeswaran also feels that with e-commerce companies in a race to acquire customers at any cost, a concrete revenue model is not being developed, something dangerous for the future of the companies.

Experts feel this surge in valuations is a result of the lack of good successful companies. Ten years ago, almost anything relating to the internet was getting funded as companies sold their potential on the basis on eyeballs and hits. That has now changed—just 20 per cent of the companies are attracting 80 per cent of the finance. Says Santosh Desai, CEO, Future Brands: “The valuations are a little over the top. There is irrationality in the exuberance, a large amount of capital chasing a relatively small amount of successful projects.”

The new online czars, predictably, have a different view, arguing that only companies that show a real team, a good plan and a model that works are getting financed. They feel there is a perceptible change in people’s shopping habits, which is gradually shifting online. Says Kunal Bahl, founder, snapdeal.com: “The core number of Net users has reached a critical mass and enough of them are buying online...these valuations will look extremely paltry in three years’ time.” His own company has 8 million members and does 15,000 transactions a day, he says. This year, it will clock revenues of Rs 150 crore in just 17 months of existence.

“Valuations are driven by market dynamics, not entrepreneurs. So if a company has strength, it will have good valuation,” argues Hitesh Dhingra, founder and CEO, letsbuy.com. He feels the key trigger is that online retailers are discarding third-party suppliers, managing their own supply chain and setting up their own warehouses. “This is why investors are also excited about investing in them,” concludes Dhingra, who is “in line” to raise $30-35 million.

While travel is by far the predominant activity on the internet (two of every 12 airline tickets are bought on the top three travel portals), IRCTC has redefined railway ticket purchases and other sectors like books, apparel, fashion and consumer goods have also become popular verticals. Harish Bahl of Smile Interactive, which invests in new companies, says, “This is different from a few years ago when there wasn’t much to sell. What is real is the fact that online transactions are happening and companies are doing multiples of thousands of transactions a day across sectors.”

As of now, there are 30 million active users of the internet, those who regularly buy online. Companies like Snapdeal and Store 18 regularly offer discounted deals on the internet, lapped up easily by price-sensitive Indian customers. This has taken the number of monetisable searches in India up by 100 times since 1999. But remember, these are often on the back of heavy discounts.

Overall, it does look positive: companies expect India’s internet user numbers to go up dramatically in the next 2-3 years. Says S.V. Divvaakar, executive director, ICOMP, an organisation that monitors the online and e-commerce space: “Mobile phone internet will be a game-changer for e-commerce in India. In the next three years, 30 per cent of the phone base will be smartphones which will actively transact on the internet.”

That said, everyone is still betting on a potential that is somewhere in the future. Going by the current trends, e-commerce definitely looks more viable now—it could even boom a few years down the line. But the fantastic valuations show that some people have not learnt from the previous two flareouts. It’s still prudent to make haste slowly.

Tags