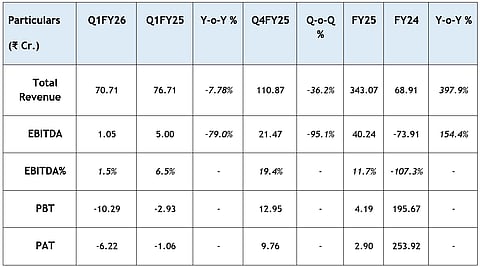

Q1FY26 Total Revenue at ₹70.71 crores with positive EBITDA of ₹1.05 crores

Strong order book growth of 25% with current position at ₹100+ crores

Robust order pipeline visibility of over ₹200 crores providing strong future growth foundation

Material cost optimisation achieved 2.5% reduction through indigenisation initiatives

Three product launches scheduled across port equipment and infrastructure sectors

TIL Limited (NSE: TIL), a cornerstone in India's material handling and infrastructure equipment manufacturing sector, has announced its financial results for the 1st quarter ended June 30th, 2025, reflecting gradual stabilization of operations. TIL Limited has built a healthy orderbook of over ₹100 Crore and a robust pipeline of over ₹200 Cr.

Material cost in Q1FY26 has come down by ~2.5%, compared to 1st quarter of last year indicating indigenisation, import substitution and alternate sourcing solutions. The company continues to capitalise on India's robust infrastructure development cycle while strengthening its market leadership through operational excellence and innovative product development initiatives.

PAT stood at -₹6.22 Crore, while EBITDA stood at ₹ 1.05 Cr in Q1FY26 as compared to ₹ 5.00 Cr in Q1FY25. This is attributable to increased investments in key workforce hires and changes in product mix, which are anticipated to generate returns in the future.

This outcome is in line with management’s expectations and reflects strategic decisions, and market conditions that are expected to position the Company for sustainable long-term growth. The quarter was impacted by temporary market headwinds, including global tariff uncertainties, INR depreciation against the USD, and seasonal demand patterns. Additionally, the broader material handling industry experienced a contraction, with machine sales declining 21% in June 2025 compared to June 2024 (source: ICEMA).