She's Got An Inner Life

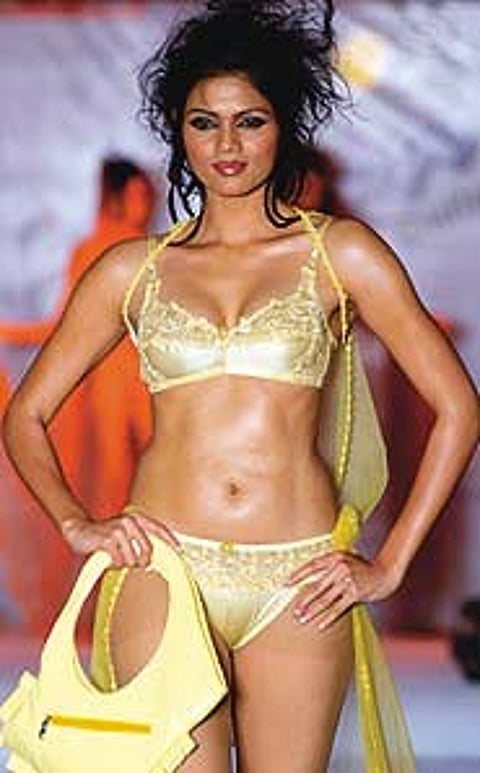

The itsy bitsy makes space, big brands vie for the Indian woman

Farzana Nurali, proprietor of French boutique Passion d'Elle, felt the same way when she spent New Year's Eve in the city three years ago, hunting in vain for the right bra for her new dress. "In India, buying lingerie is a necessity," says Nurali. "It's not like you fall in love with it and buy it...except at wedding time."

There's plenty to fall in love with at Passion d'Elle though, from everyday Daniel Hechter to Lise Sharmel, "the Christian Dior of lingerie". The latter comes for anywhere from Rs 900-5,000 for a bra and Rs 400-4,000 a panty.

"Initially, we always got remarks like, 'This much...for underwear?'" says Nurali, ruing the Indian customer's reluctance to spend on something most people won't get to see. But even that didn't deter sales from growing by 60 per cent the first year. She even admits that price is slowly becoming less of an issue as customers realise what they're getting in return—great shopping ambience, a well-designed product, and most needed of all, fitting advice.

"It was a huge challenge getting our customers into the changing room to be measured," says Bains. "Nine out of 10 Indian women wear the wrong bra."

Nurali was also appalled by how female customers economised, teaming up "a great bra with Bridget Jones panties... only men buying lingerie as gifts took the whole set," she says. "The wives would come in and take only the bra."

Typically, lingerie stores nowadays get female customers of all age groups, buying for themselves. Men constitute, at most, 30 per cent of store clientele (no surprises here, Indian men are still a shy lot). Bains wants that to change too. Her store is having a 'Men's Only' shopping evening in the run-up to Valentine's Day. There's also a V-Day 'wishlist', where female clients can pre-select favourite pieces before sending in husbands or boyfriends to make the final choice.

For lingerie stores, making the shopping experience more comfortable for everyone is easier than contending with, say, the acute shortage of quality retail space. "There are so many colours, sizes, designs...a lingerie store needs a lot of display space," explains Sunil Pathare, MD, Maxwell Industries.

There are peculiarities too with the Indian market. Spanish lingerie major Women's Secret discovered that beachwear wasn't a huge seller here, and that its bold, feisty colours didn't have ready buyers. As brand manager Simmi Sharma quipped, "Where are the beaches for it?" The quirks apply to advertising too: after the local Shiv Sena lodged protests, hoardings had to be taken down.

Advertising lingerie has always been a tricky job in India, says Sanjay Manocha, editor of the country's first lingerie magazine, Lace-n-Lingerie. Manocha, who started out in advertising, says many lingerie manufacturer clients used to complain about the difficulty in finding magazines willing to carry ads or even get models to pose for them. "The lingerie segment needed its own trade magazine, its own trade fair," says Manocha, who also launched India's first lingerie trade fair in 2000. "Earlier, they were being dismissed as bra-and-panty people."

Not anymore. Besides La Perla (at stratospheric prices of up to Rs 10,000 for a single bra or panty), the Murjani Group, a luxury retail platform, will also launch Calvin Klein early this year. Passion d'Elle is planning outlets in Delhi and Bangalore. Boudoir London has even bigger ambitions: going countrywide, as well as opening a men's underwear store. Besides considering a multi-branded one-stop shop, Maxwell Industries is finalising plans to bring in two more European lingerie labels and open 120 Lovable outlets across the country.

But is the market big enough for all this? "Women's lingerie reaches only about 40 per cent of the country now," says Manocha, who has organised three designer lingerie contests so far (tying up with Maxwell Industries) to showcase local talent. "You'll find a Coke vendor in every village, but not a bra shop."

For the branded lingerie segment though, the urban market is temptation enough, for now. As Nurali puts it: "Only one per cent of the population might be able to afford our stuff, but in India, that's still a huge number."

Tags