The Comptroller and Auditor General (CAG) will soon begin an audit of various aspects of the demonetization that sucked out 86% of currency value in circulation.

A report in The Hindu quotes CAG Shashi Kant Sharma saying that while the withdrawal of notes of Rs 500 and Rs 1000 was an issue of banking and money supply, the “CAG is well within its rights to seek audit of fiscal impact of demonetisation, largely its impact on tax revenues. That way the issue gets linked with the public exchequer,” he is reported to have said.

There has been widespread disagreement on the tangible benefits of demonetization and its effects on the Indian economy. Though the government has tom-tommed the recent GDP figures to counter the narrative that scrapping of high value currency pulled back the economy, the figures were suspect. Economists like Jean Dreze had said that demonetisation was like shooting at the tyres of a fast-moving car.

Advertisement

The entire exercise was shrouded in secrecy and attempts to dig out facts were stonewalled.The RBI, which spearheaded the move, refused to share details of its recommendations to the government to scrap Rs 500 and Rs 1,000 banknotes. It even refused to say who all were involved in taking the decision. And that they had no details on illegal accounts either.

The newspaper says Sharma pointed out there are other issues concerning the public exchequer that will also be a part of the audit, namely: the expenses on printing of notes. There were allegations that cost of printing notes far outweigh the benfits accruing from demonetisation.

Advertisement

Sharma added that they propose to take up these issues along with the audits in the coming days. Adding more caveats, he told the newspaper that transaction data of banks along with the follow up of the Revenue Department could also be subject to an audit. “Audit can look into various risks, such as errors and omissions in identifying the potential tax evaders, failures to pursue the identified suspects, selective and arbitrary pursuance of leads and consequences thereof,” he reportedly added.

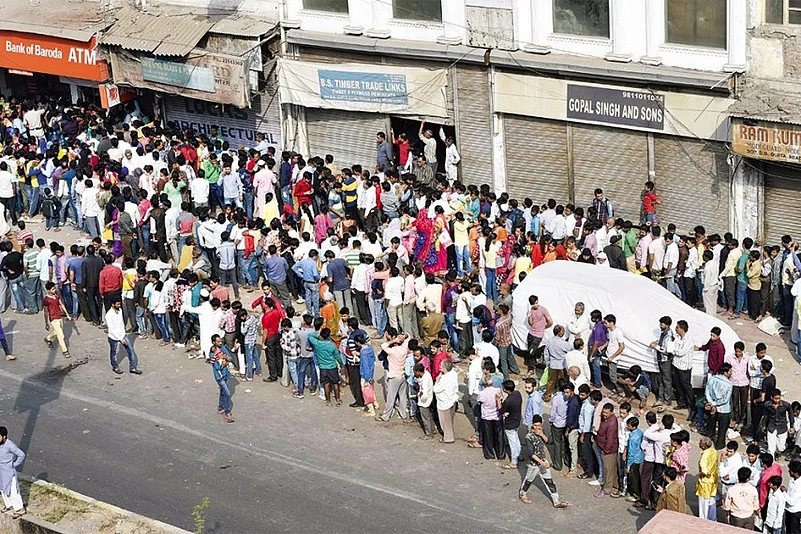

The demonetization move announced by PM Modi ended up withdrawing close to 86 percent of the currency. The fall-out of the move has been seen in serpentine queues across banks and ATMs across the country, leaving out the reported deaths and suicides which have been attributed to the move.

On Monday, the Supreme Court took note of the reversals and revisions in the policies announced by the government and the RBI, asking why old notes could not be exchanged by citizens until March 31 as was promised earlier.